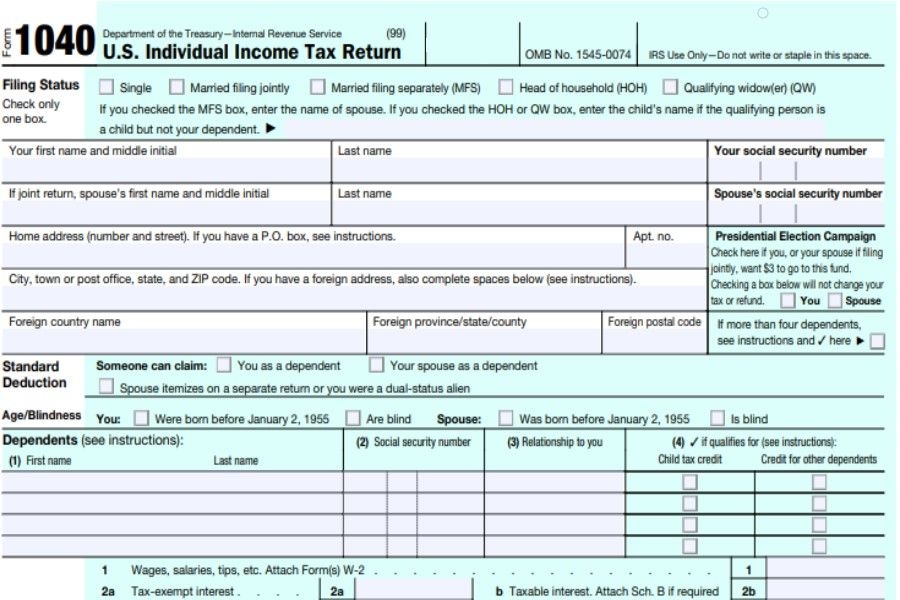

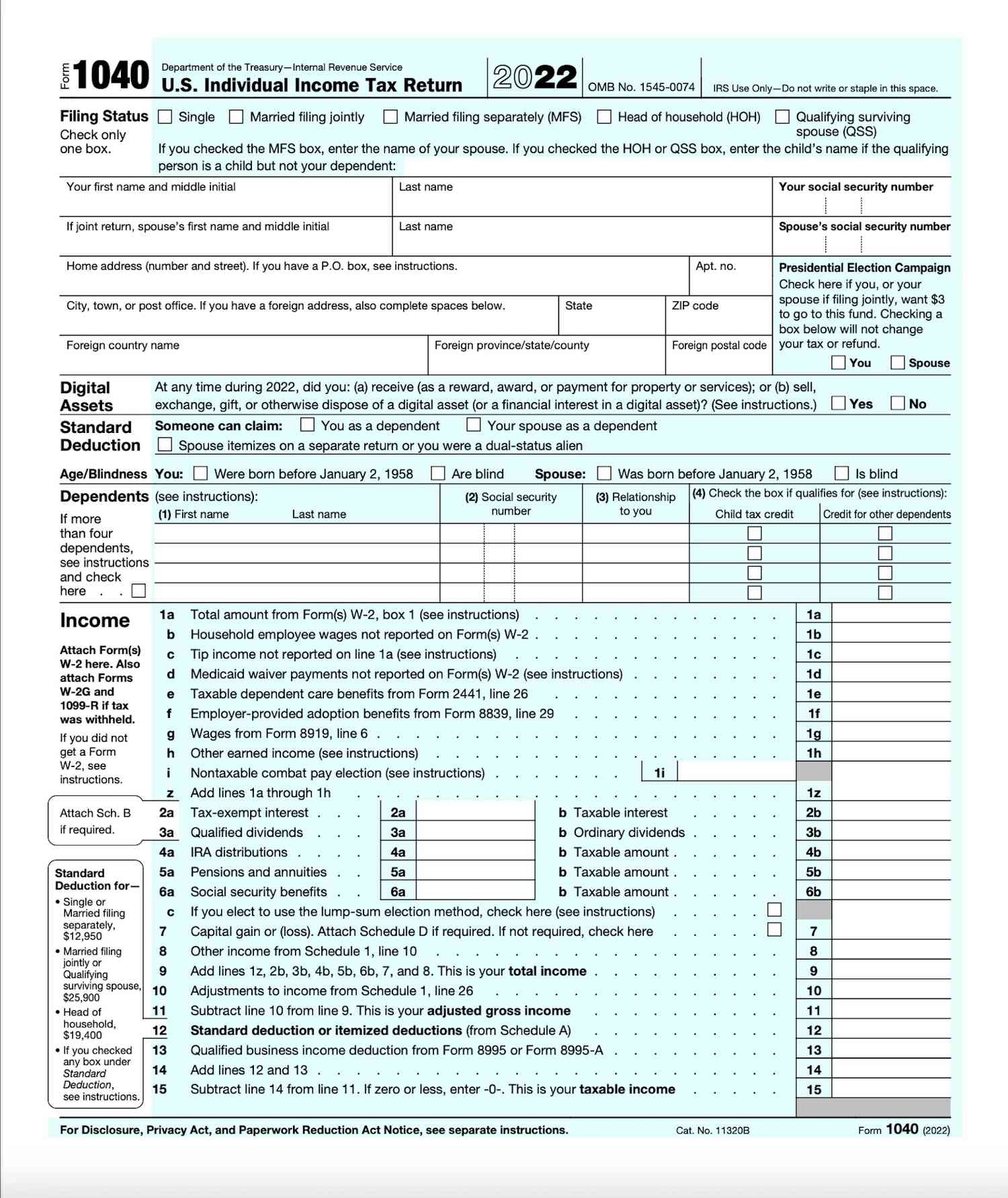

Filing your federal income taxes can be a daunting task, but having the right tools can make the process much easier. The Form 1040 is the standard form used by individuals to file their annual income tax returns with the Internal Revenue Service (IRS). This form is used to report your income, deductions, and credits, and ultimately determine how much tax you owe or are owed as a refund.

Having a printable version of the Form 1040 can be helpful for those who prefer to fill out their taxes by hand or for those who want to review the form before submitting it electronically. It provides a clear layout of the information required and allows you to easily follow the instructions provided by the IRS.

Printable Federal Income Tax Form 1040

Printable Federal Income Tax Form 1040

Get and Print Printable Federal Income Tax Form 1040

When filling out the Form 1040, you will need to gather all relevant financial documents, such as W-2s, 1099s, and any other income or deduction records. You will then need to carefully follow the instructions provided on the form to ensure that you are accurately reporting your income and claiming any eligible deductions or credits.

It is important to note that there are different versions of the Form 1040, depending on your filing status and the complexity of your tax situation. For example, if you have self-employment income or certain other types of income, you may need to use additional schedules or forms in conjunction with the Form 1040.

Once you have completed the Form 1040, you can either submit it by mail or electronically through the IRS e-file system. If you are expecting a refund, filing electronically can often result in a faster refund process. However, if you owe taxes, you may need to make a payment at the time of filing or set up a payment plan with the IRS.

In conclusion, having access to a printable version of the Federal Income Tax Form 1040 can be a valuable resource for individuals looking to file their taxes accurately and efficiently. By following the instructions provided and carefully reporting your income and deductions, you can ensure that you are meeting your tax obligations and potentially maximizing any refunds owed to you.