As tax season approaches, it’s important for California residents to be prepared with the necessary forms to file their state income taxes. One of the most commonly used forms is the California State Income Tax Form 540, which is used by residents to report their annual income and calculate the amount of tax they owe to the state.

Form 540 is available for the tax year 2019 and can be easily downloaded and printed from the California Franchise Tax Board website. This form is used by both residents and nonresidents of California who need to file their state income taxes, and it covers various sources of income including wages, dividends, and rental income.

California State Income Tax Forms 540 Printable For 2019

California State Income Tax Forms 540 Printable For 2019

Easily Download and Print California State Income Tax Forms 540 Printable For 2019

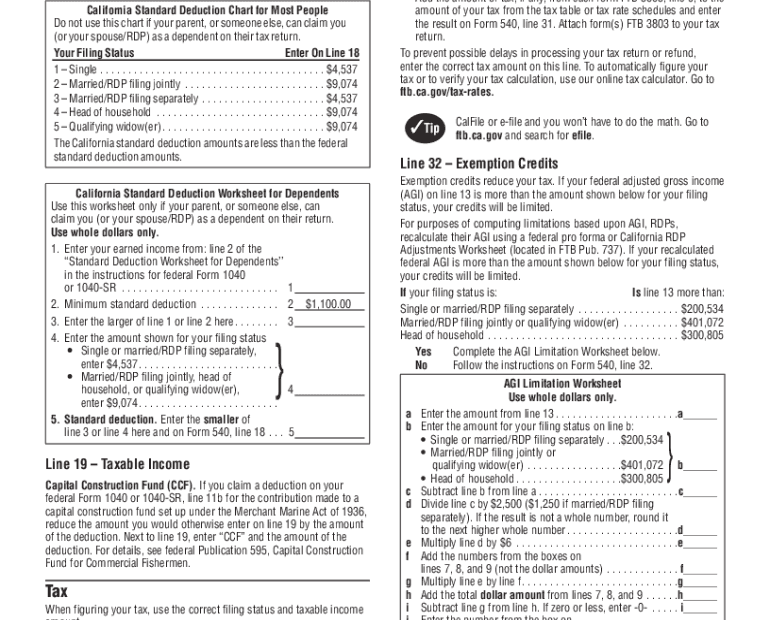

When filling out Form 540, taxpayers will need to provide information such as their name, social security number, and filing status. They will also need to report their income, deductions, and credits to calculate their tax liability. It’s important to double-check all information entered on the form to avoid errors that could delay the processing of your tax return.

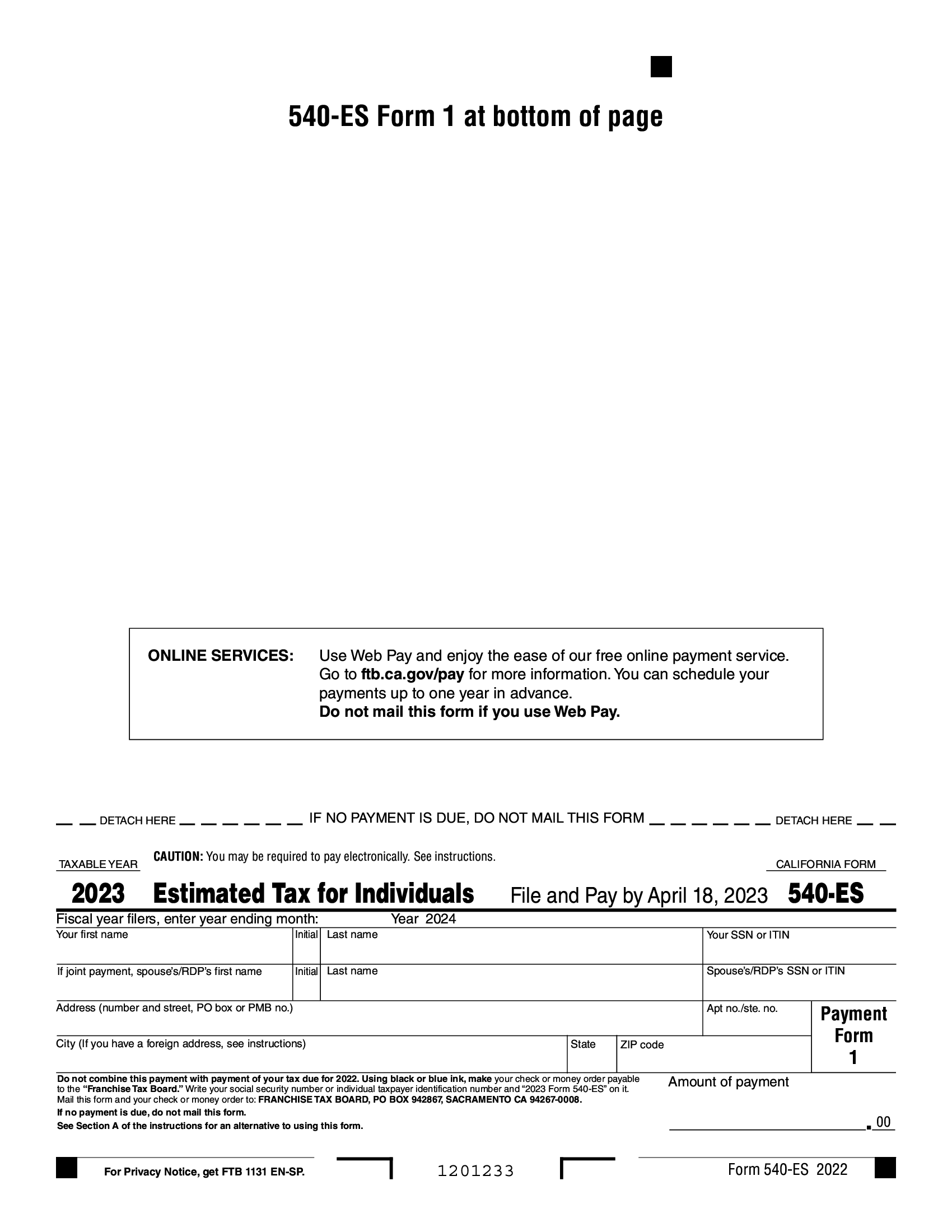

Once the form is completed, taxpayers can either mail it to the California Franchise Tax Board or file it electronically using the CalFile system. Filing electronically is a convenient and secure way to submit your tax return and can help expedite the processing of your refund, if applicable.

It’s important for California residents to file their state income taxes by the deadline, which is typically April 15th of each year. Failing to file on time can result in penalties and interest charges, so it’s best to submit your tax return as early as possible to avoid any issues.

In conclusion, Form 540 is an essential document for California residents who need to file their state income taxes for the tax year 2019. By downloading and printing this form from the California Franchise Tax Board website, taxpayers can ensure they have all the necessary information to accurately report their income and calculate their tax liability.