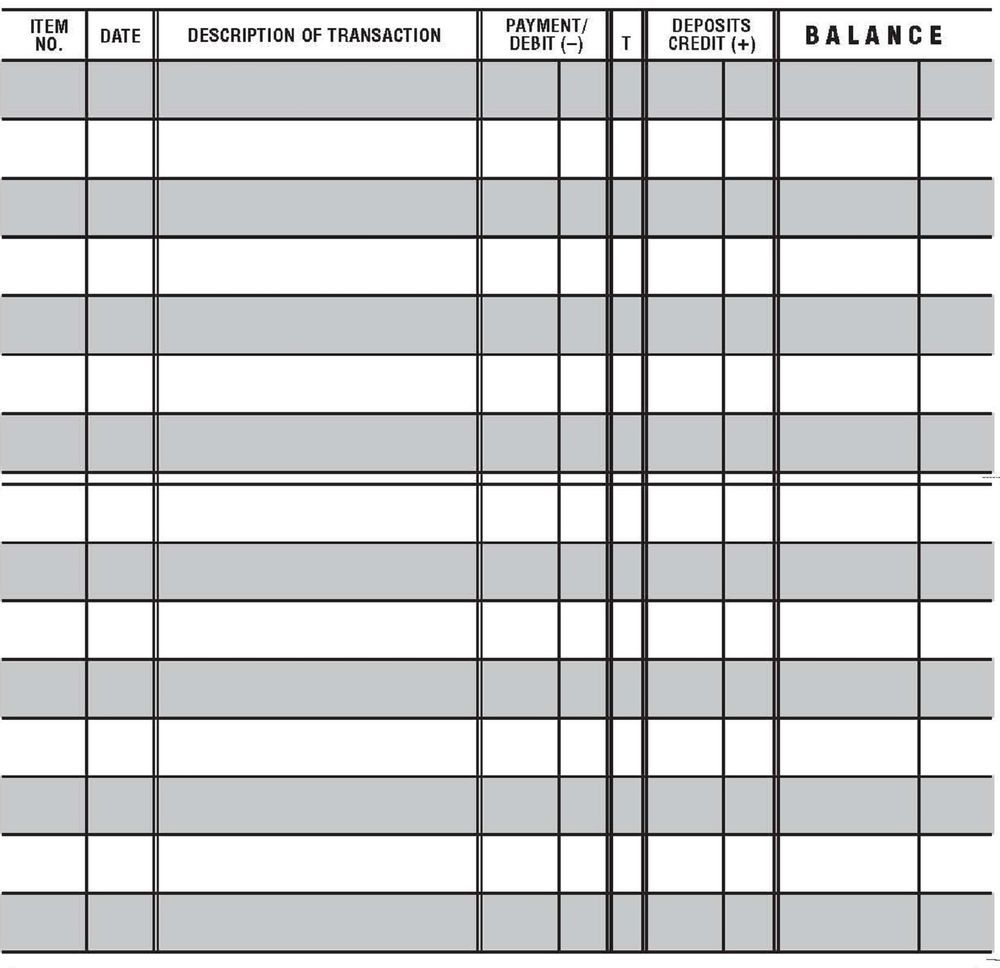

Keeping track of your finances is essential for maintaining financial stability and avoiding overdrafts or missed payments. One tool that can help you stay organized is a printable bank check register. This simple document allows you to record all of your transactions in one place, making it easy to see where your money is going and how much you have left.

With a printable bank check register, you can easily track your deposits, withdrawals, and current balance. This can help you avoid costly overdraft fees by ensuring that you always have enough funds in your account to cover your expenses. Additionally, having all of your financial information in one place makes it easier to create a budget and track your spending habits.

Download and Print Printable Bank Check Register

Printable Bank Check Register

One of the main benefits of using a printable bank check register is that it allows you to see your financial situation at a glance. By recording each transaction as it occurs, you can easily track your account balance and monitor any discrepancies or unauthorized charges. This can help you catch errors early and prevent fraudulent activity on your account.

Another advantage of a printable bank check register is that it provides a tangible record of your financial transactions. In the event of a dispute with a merchant or a discrepancy in your account, having a written record can help you resolve the issue quickly and easily. Additionally, keeping a check register can help you identify any recurring expenses or unnecessary purchases that you can cut back on to save money.

Using a printable bank check register can also help you stay organized and reduce financial stress. By taking a few minutes each day to record your transactions, you can avoid the last-minute scramble to balance your account before a bill is due. This can help you feel more in control of your finances and make better decisions about how to allocate your money.

In conclusion, a printable bank check register is a valuable tool for managing your finances and staying on top of your spending. By recording your transactions in one convenient document, you can easily track your account balance, monitor your expenses, and avoid costly mistakes. Whether you prefer a paper register or an electronic version, using this simple tool can help you achieve your financial goals and maintain peace of mind.