Keeping track of your finances is essential for managing your money effectively. One tool that can help with this is a check register. A check register is a document used to record all transactions, including checks written, deposits, and withdrawals. This allows you to keep a running balance and avoid overdrawing your account.

For those who have difficulty reading small print, a printable check register with large print can be a helpful solution. This type of register features larger text and wider spacing, making it easier to read and fill out. It is especially beneficial for individuals with visual impairments or anyone who prefers a more accessible option.

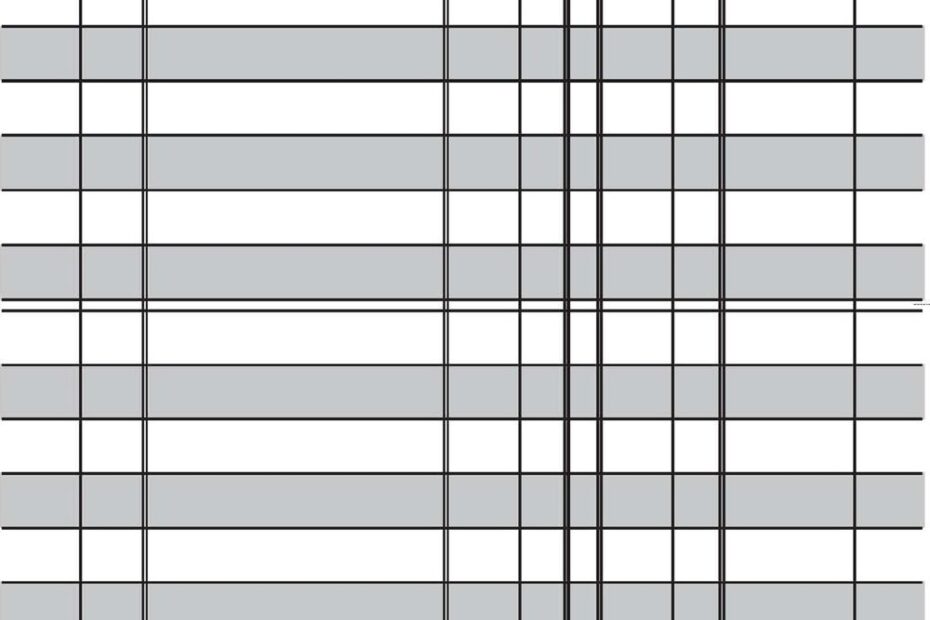

Printable Check Register Large Print

Printable Check Register Large Print

Quickly Access and Print Printable Check Register Large Print

Printable check registers with large print come in various formats, including PDF files that can be printed at home or spiral-bound booklets for added durability. Some also include extra features like columns for tracking specific expenses or categories, making it easier to organize your finances.

Using a printable check register with large print can help you stay organized and on top of your finances. By recording each transaction promptly and accurately, you can avoid costly mistakes and ensure that your account balance is always up to date. It is a simple yet effective tool for maintaining financial stability and peace of mind.

Whether you prefer a digital or physical format, there are options available for everyone. Some online banking platforms also offer digital check registers that can be accessed on your computer or mobile device. Whichever method you choose, the key is to use it consistently and stay proactive in managing your money.

In conclusion, a printable check register with large print is a valuable tool for anyone looking to take control of their finances. With its user-friendly design and customizable features, it can make the process of tracking transactions simple and efficient. By using this tool regularly, you can better understand your spending habits, identify areas for improvement, and ultimately achieve your financial goals.