In today’s digital age, it’s important to keep track of your finances and one way to do that is by maintaining a checking account balance sheet. This tool helps you monitor your income, expenses, and overall financial health. By having a printable version of your balance sheet, you can easily reference and update it as needed.

With a checking account balance sheet printable, you can have a clear overview of your financial transactions. This can help you identify any discrepancies, track your spending habits, and make informed decisions about your money management. It provides a snapshot of your current financial situation and allows you to plan for the future accordingly.

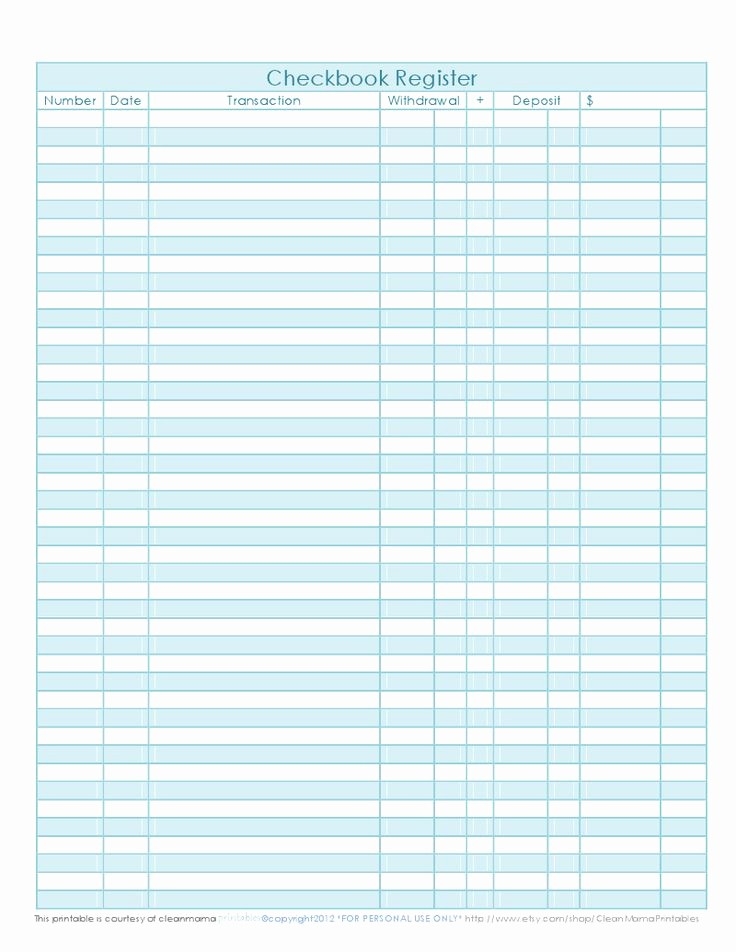

Checking Account Balance Sheet Printable

Checking Account Balance Sheet Printable

Get and Print Checking Account Balance Sheet Printable

Checking Account Balance Sheet Printable

Creating a checking account balance sheet printable is simple. You can use a spreadsheet program like Excel or Google Sheets to input your income and expenses. Make sure to categorize your transactions accurately to get a clear picture of where your money is going. You can also include your current account balance, any outstanding checks, and upcoming bills to have a comprehensive view of your finances.

Having a printable balance sheet is useful for monitoring your financial progress over time. By reviewing it regularly, you can identify any patterns or trends in your spending habits and make adjustments as needed. It can also serve as a reference point when making important financial decisions or setting financial goals.

Another benefit of a checking account balance sheet printable is that it can help you stay organized. By having all your financial information in one place, you can easily access it when needed and ensure that you are staying on track with your budget. It can also be a helpful tool when working with financial advisors or tax professionals.

In conclusion, a checking account balance sheet printable is a valuable tool for managing your finances effectively. By keeping track of your income, expenses, and account balances, you can make informed decisions about your money and plan for the future. Whether you prefer to use a digital spreadsheet or a printed document, having a balance sheet can help you stay on top of your financial goals and achieve financial success.