Keeping track of your finances is essential for managing your money effectively. One tool that can help you stay organized is a check register. By recording all your transactions, you can monitor your spending, avoid overdrafts, and ensure your account balance is accurate. While many people opt for online banking or mobile apps, some still prefer the traditional method of using a check register. If you’re looking for a free printable check register full page, you’re in luck!

Having a full-page check register allows for more space to write down your transactions, making it easier to keep everything organized. Whether you prefer a physical copy or want to have a backup in case your digital records are unavailable, a printable check register can be a valuable tool in managing your finances.

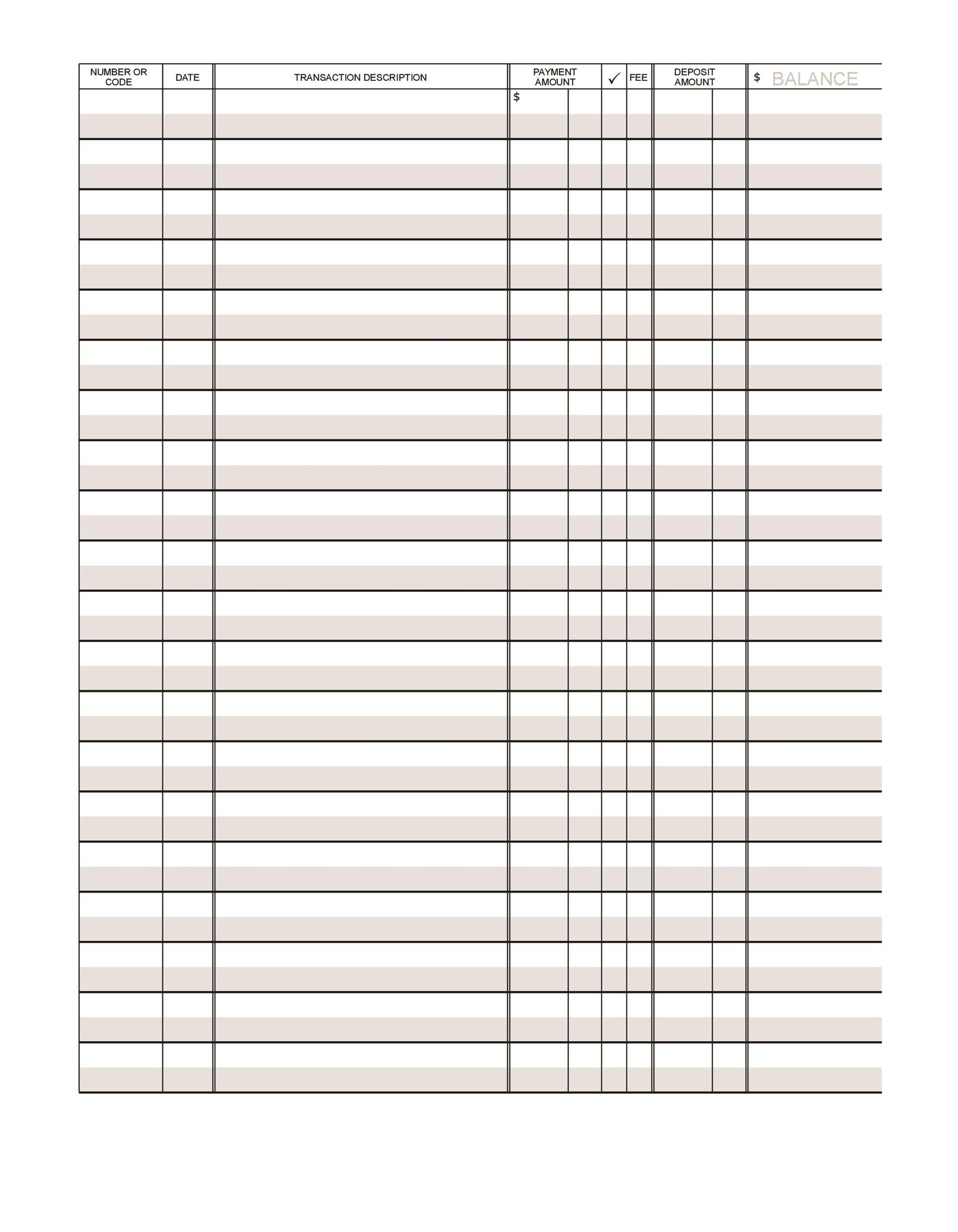

Free Printable Check Register Full Page

Free Printable Check Register Full Page

Quickly Access and Print Free Printable Check Register Full Page

There are various templates available online that you can download and print for free. These templates typically include columns for the date, check number, description of the transaction, debit or credit amount, and running balance. Some templates even have additional columns for categories or notes to further categorize your expenses.

Using a printable check register can also help you identify any discrepancies in your account, such as unauthorized charges or errors. By regularly updating your register and reconciling it with your bank statement, you can catch any mistakes early on and take action to resolve them.

Overall, a free printable check register full page can be a useful tool for managing your finances and staying organized. Whether you prefer the simplicity of pen and paper or want a backup to your digital records, having a physical copy of your transactions can provide peace of mind and help you stay on top of your finances.

So, if you’re looking to take control of your finances and stay organized, consider using a free printable check register full page. It’s a simple yet effective way to track your transactions, monitor your spending, and ensure your account balance is accurate.