Managing finances is an important skill for students to learn, and one way to do so is by using a check register. A check register is a simple tool that helps keep track of expenses, deposits, and balances. While many banks offer online options for tracking transactions, having a physical check register can be beneficial for students who prefer a hands-on approach to managing their money.

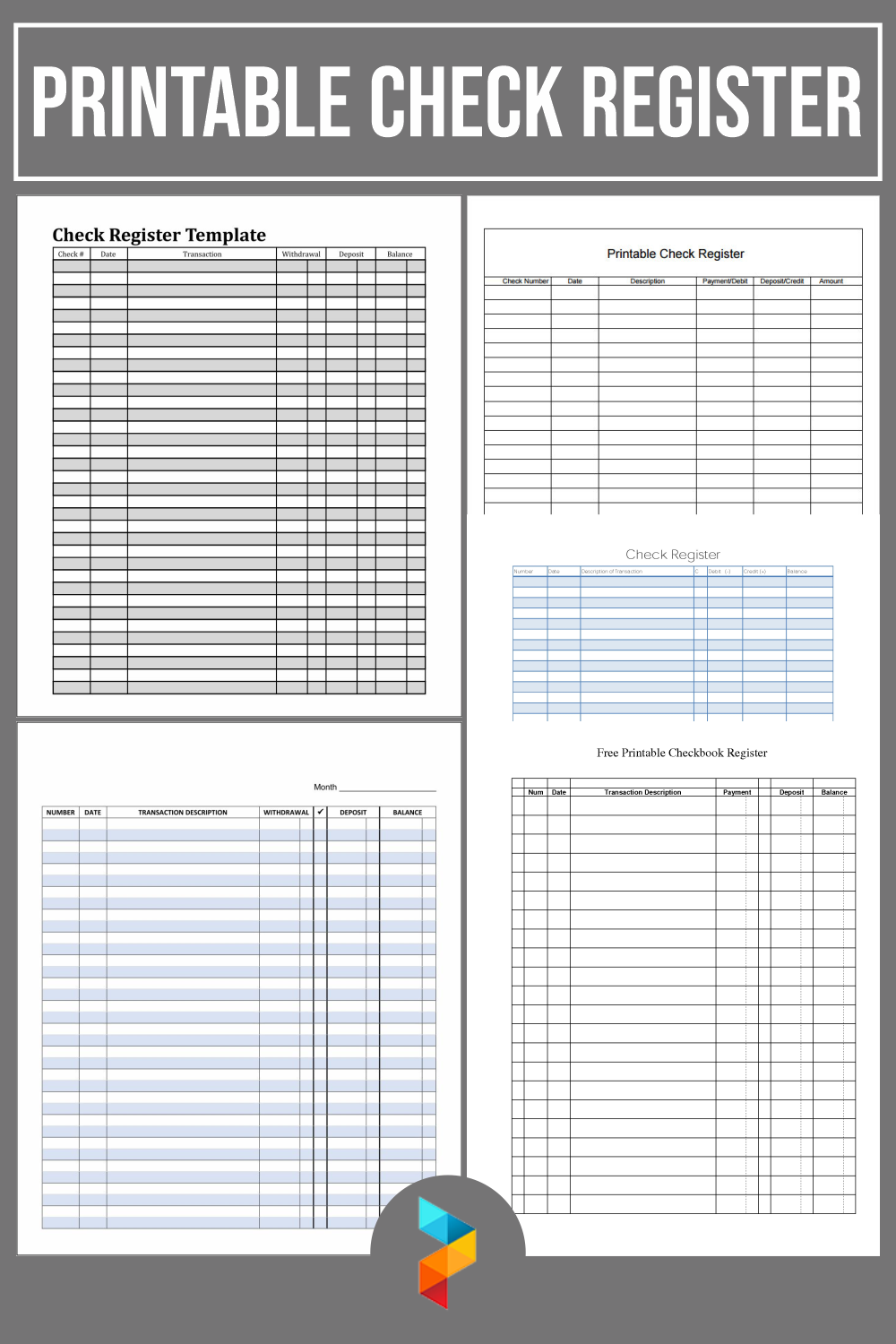

For students looking for a free and easy way to keep track of their finances, printable check registers are a great option. These templates can be easily downloaded and printed, allowing students to fill them out by hand and stay organized with their spending.

Free Printable Check Register For Students

Free Printable Check Register For Students

Easily Download and Print Free Printable Check Register For Students

One advantage of using a printable check register is that it provides a visual representation of where money is being spent. By writing down each transaction, students can see patterns in their spending habits and make adjustments as needed. This can help them develop better budgeting skills and become more aware of their financial decisions.

Additionally, printable check registers can serve as a useful reference tool when reconciling bank statements. Students can compare their handwritten records to their online banking statements to ensure that all transactions are accounted for and to catch any discrepancies that may arise.

Overall, utilizing a free printable check register can be a valuable tool for students to track their expenses, manage their budgets, and develop good financial habits. By taking the time to fill out a check register regularly, students can gain a better understanding of their finances and work towards achieving their financial goals.

In conclusion, students can benefit from using a free printable check register to help them stay organized and in control of their finances. By utilizing this simple tool, students can develop important money management skills that will serve them well in the future. So, why not give it a try and see the difference it can make in your financial journey?