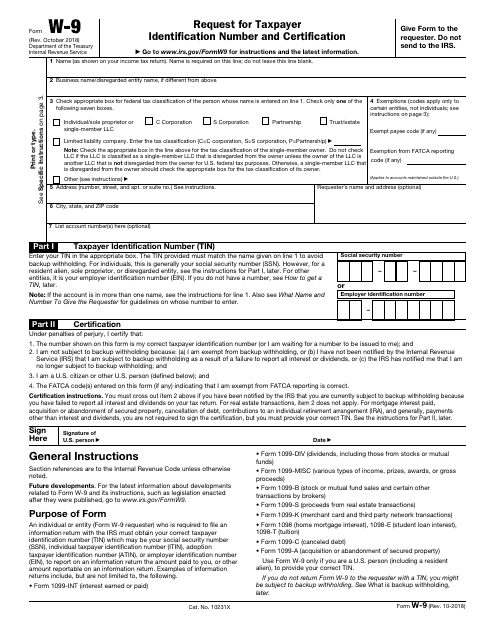

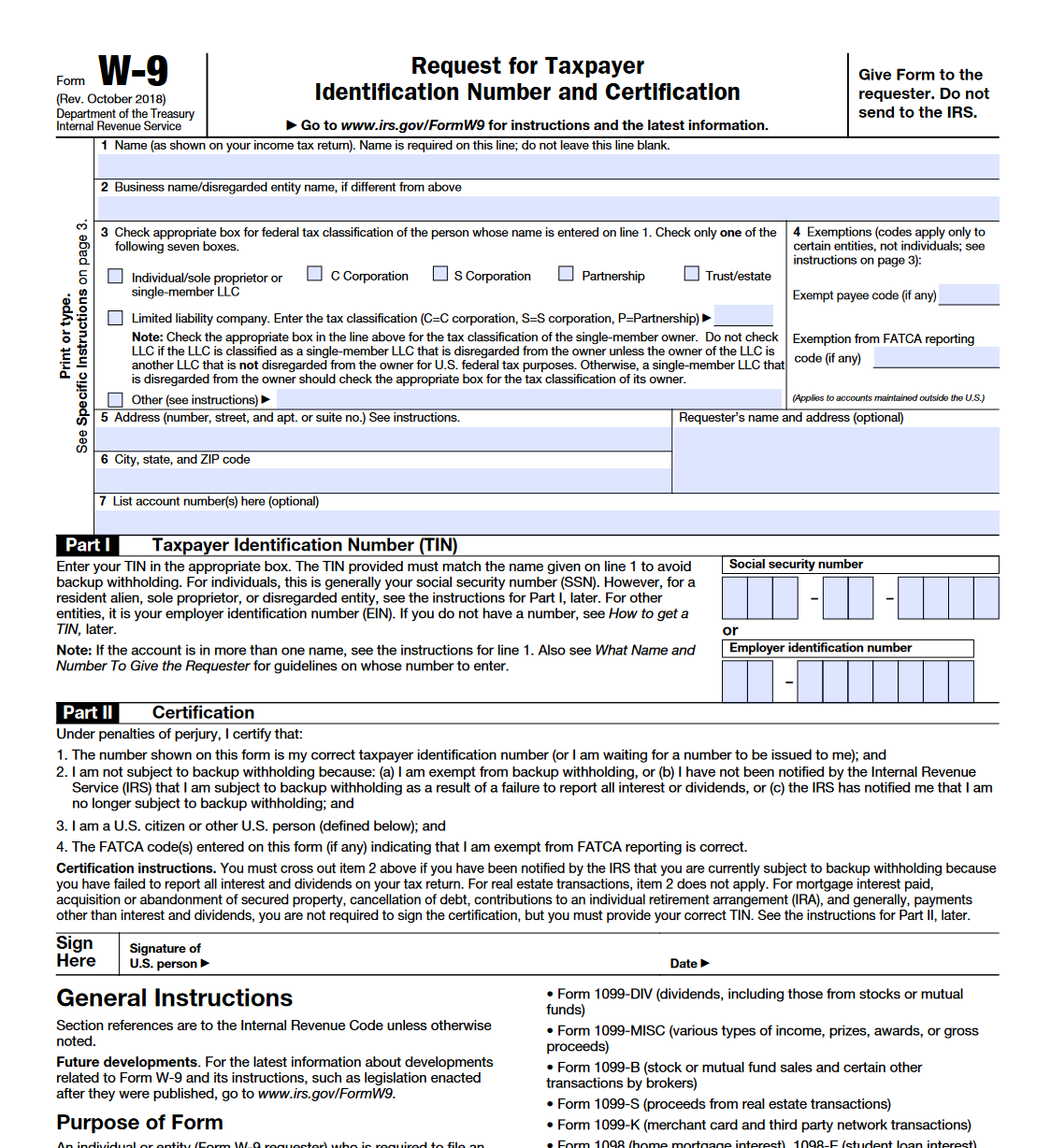

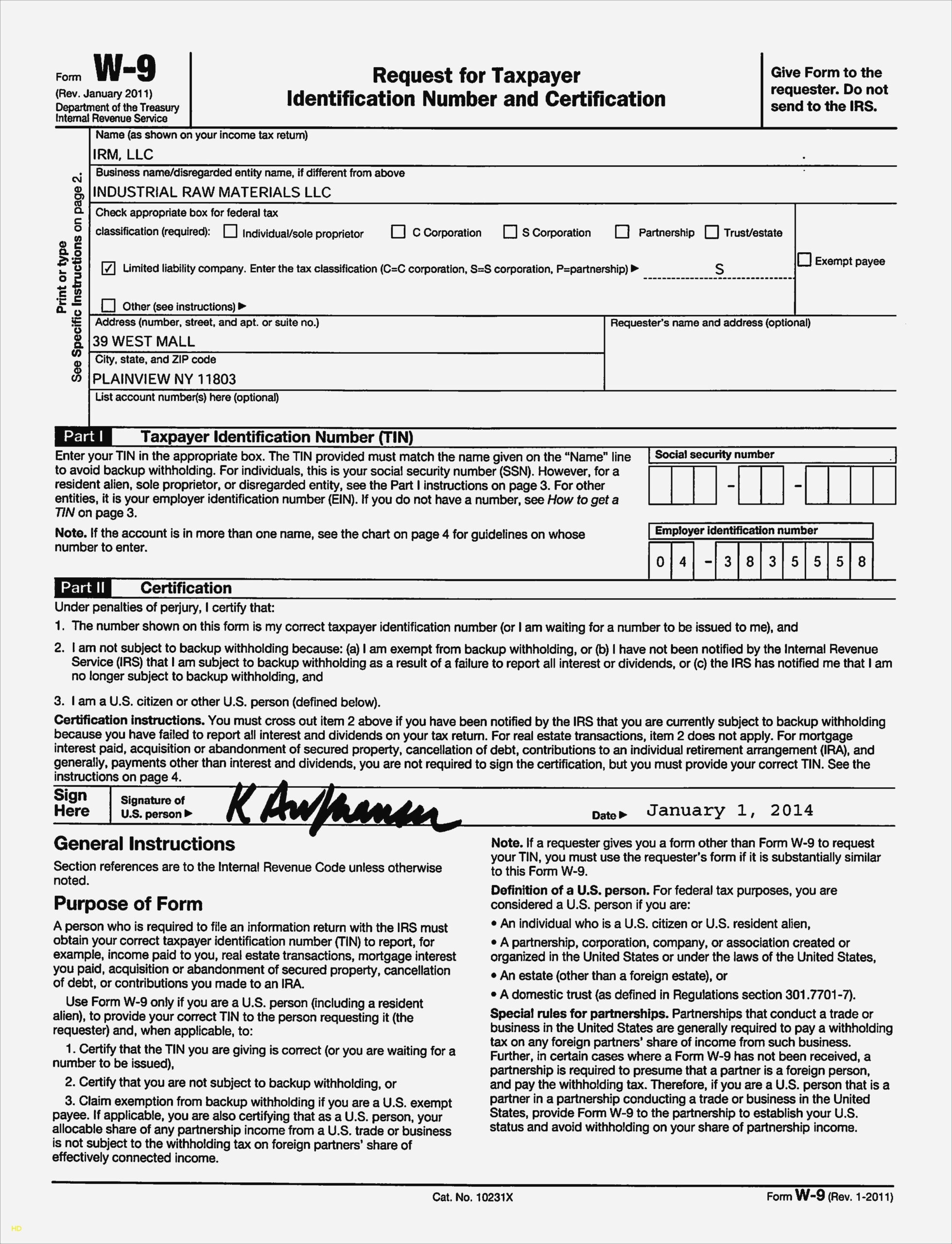

When it comes to tax forms, the W-9 is one of the most common documents you’ll encounter. This form is used by businesses to request taxpayer identification information from individuals and entities they work with. It’s important to understand how to properly fill out and submit a W-9 to ensure accurate reporting to the IRS.

Whether you’re a freelancer, independent contractor, or vendor, you may be asked to provide a W-9 to the businesses you work with. This form collects your name, address, and taxpayer identification number (usually your Social Security number or employer identification number). By completing a W-9, you certify that the information you provide is accurate and that you are not subject to backup withholding.

Get and Print Irs W 9 Form Printable

Irs W 9 Form 2025 Printable Pdf Claire Gottschalk

Irs W 9 Form 2025 Printable Pdf Claire Gottschalk

Before you fill out a W-9, make sure you have the correct form. You can easily find a printable version of the W-9 on the IRS website. Simply download the form, print it out, and fill in the required fields. Be sure to double-check your information before submitting the form to avoid any delays or errors.

It’s important to note that you may be required to provide a W-9 to multiple businesses throughout the year, especially if you work with different clients or companies. Keeping track of when and where you submit your W-9 forms can help you stay organized and ensure you comply with IRS regulations.

Once you’ve completed the W-9 form, you can either mail it to the requesting business or submit it electronically, depending on their preferred method of communication. Make sure to keep a copy of the form for your records in case you need to reference it in the future.

Overall, understanding how to properly fill out and submit an IRS W-9 form printable is essential for anyone who works as a freelancer or independent contractor. By following the instructions carefully and providing accurate information, you can ensure smooth transactions with your clients and avoid any potential issues with the IRS.