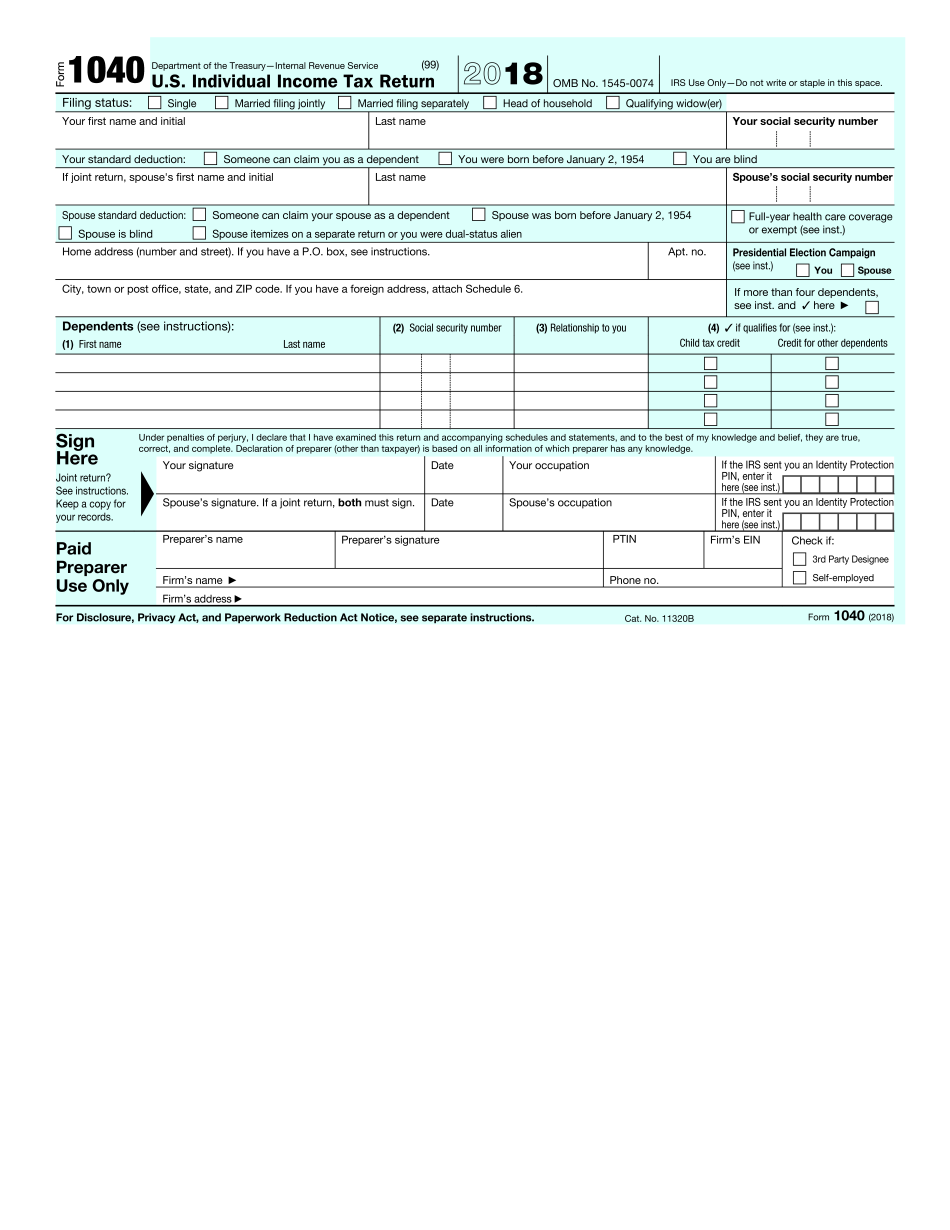

Filing taxes can be a daunting task for many individuals, but having access to printable forms can make the process a bit easier. The IRS Form 1040 is one of the most commonly used forms for individual tax returns, and having a printable version can be convenient for those who prefer to file their taxes by mail.

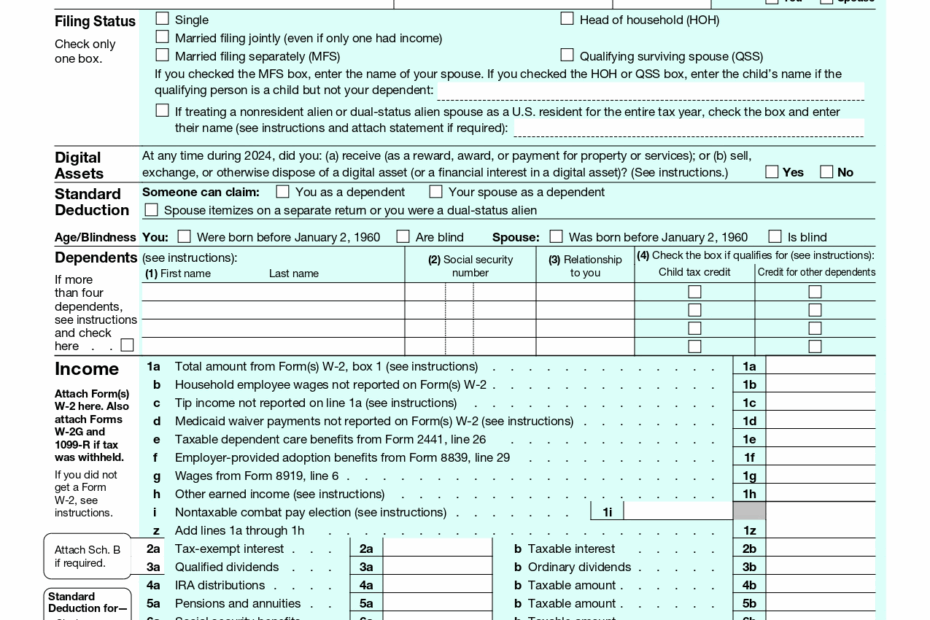

For the year 2024, the IRS has made available the printable version of Form 1040 on their website. This form includes all the necessary fields for reporting income, deductions, credits, and other relevant tax information. Taxpayers can download and print this form for free, making it easy to complete and file their taxes.

Get and Print 2024 Irs Form 1040 Printable

2024 Irs 1040 Tax Forms Veda Gabriellia

2024 Irs 1040 Tax Forms Veda Gabriellia

When filling out the 2024 IRS Form 1040, taxpayers will need to provide information such as their name, Social Security number, filing status, and income details. They will also need to report any deductions and credits they are eligible for, as well as calculate their tax liability or refund amount. Having a printable version of the form can help taxpayers organize their information and ensure they are filling out the form correctly.

It is important for taxpayers to carefully review the instructions provided with the 2024 IRS Form 1040 to ensure they are completing it accurately. Mistakes or omissions on the form can lead to delays in processing or even penalties from the IRS. By using the printable version of the form, taxpayers can take their time to review their information and make sure everything is correct before submitting their tax return.

Overall, having access to the 2024 IRS Form 1040 printable can make the tax-filing process more convenient for individuals who prefer to file their taxes by mail. By downloading and printing the form from the IRS website, taxpayers can easily fill out the necessary information and submit their tax return in a timely manner.

So, if you are getting ready to file your taxes for the year 2024, be sure to check out the printable version of the IRS Form 1040 on the IRS website. It can help make the process smoother and ensure that you are providing accurate information to the IRS.