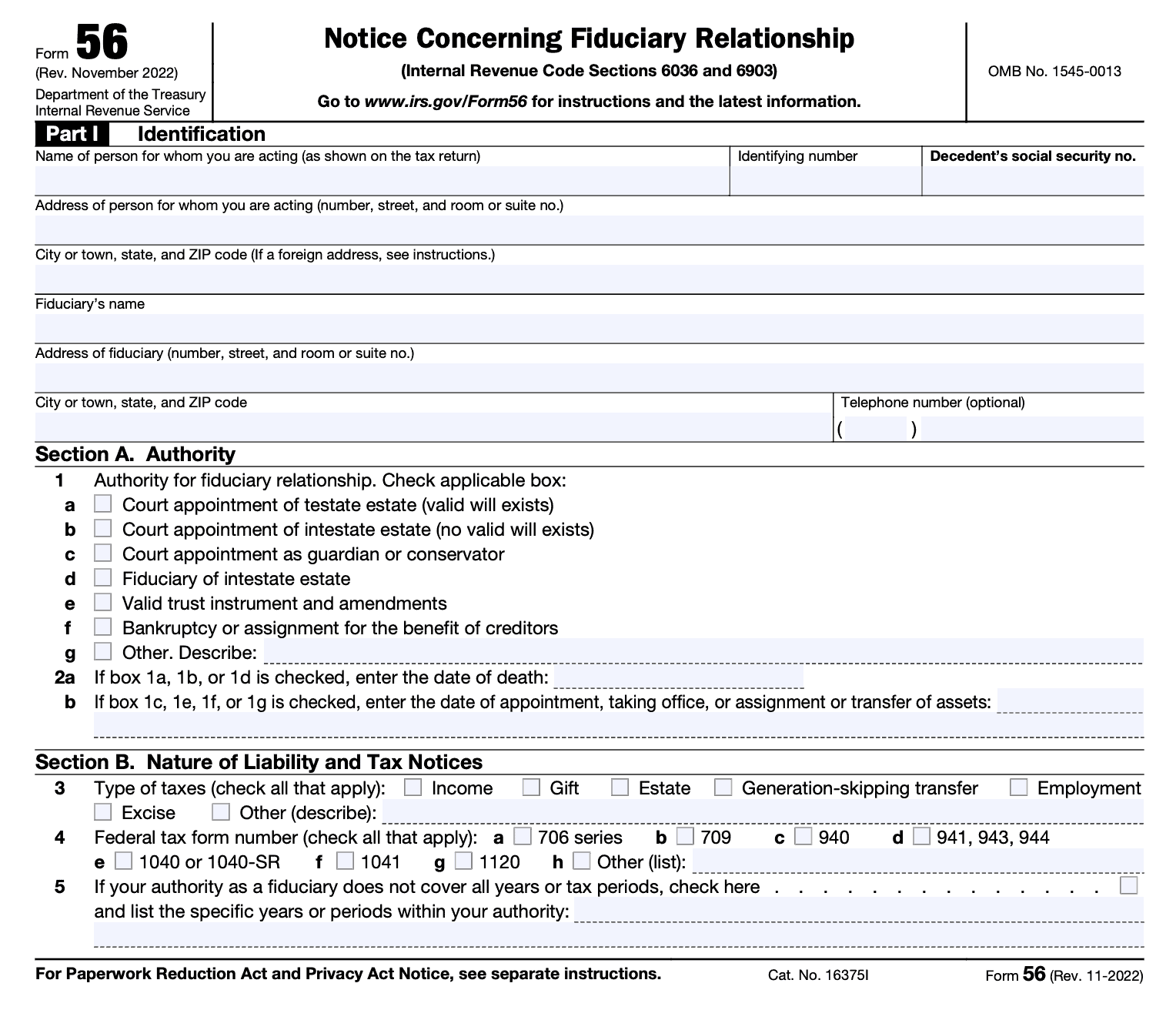

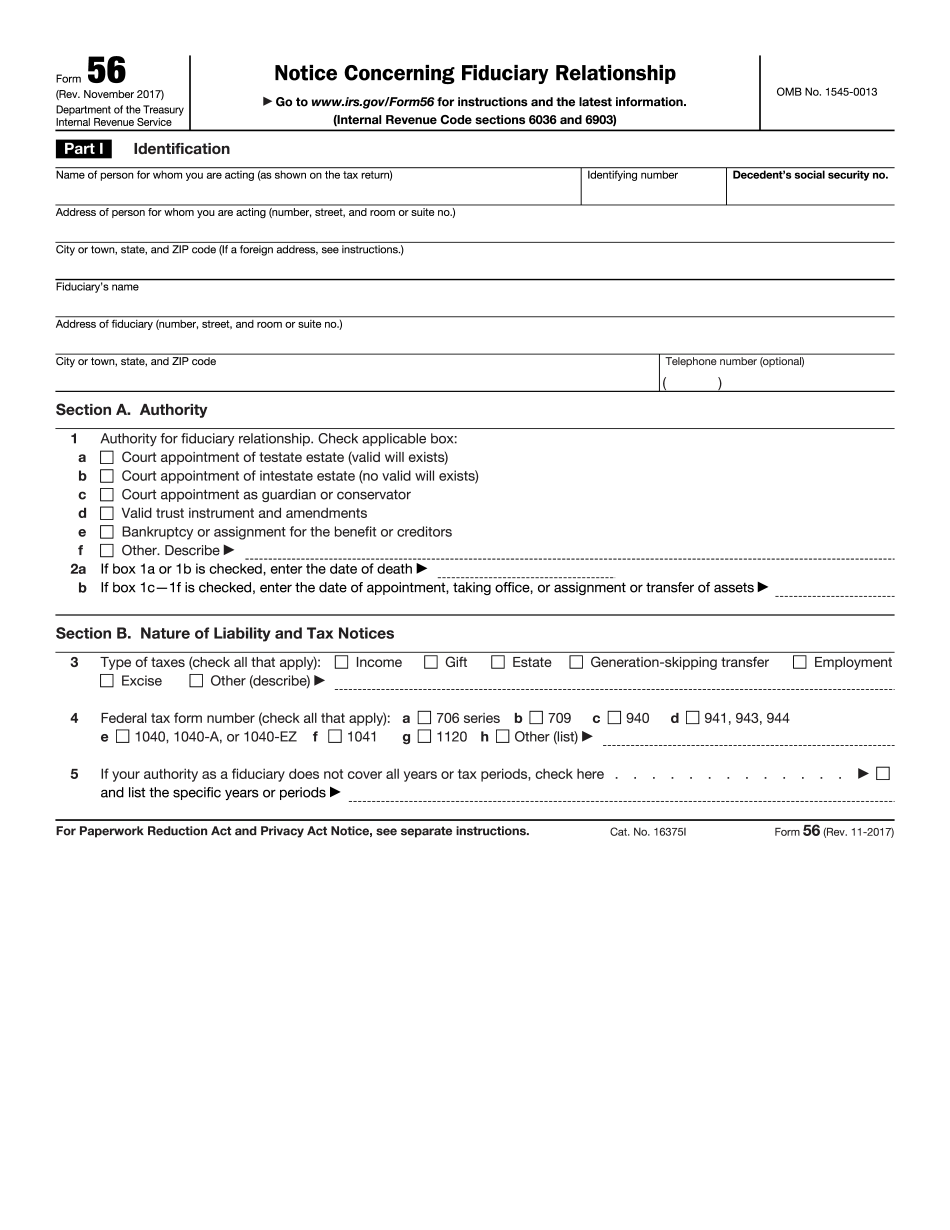

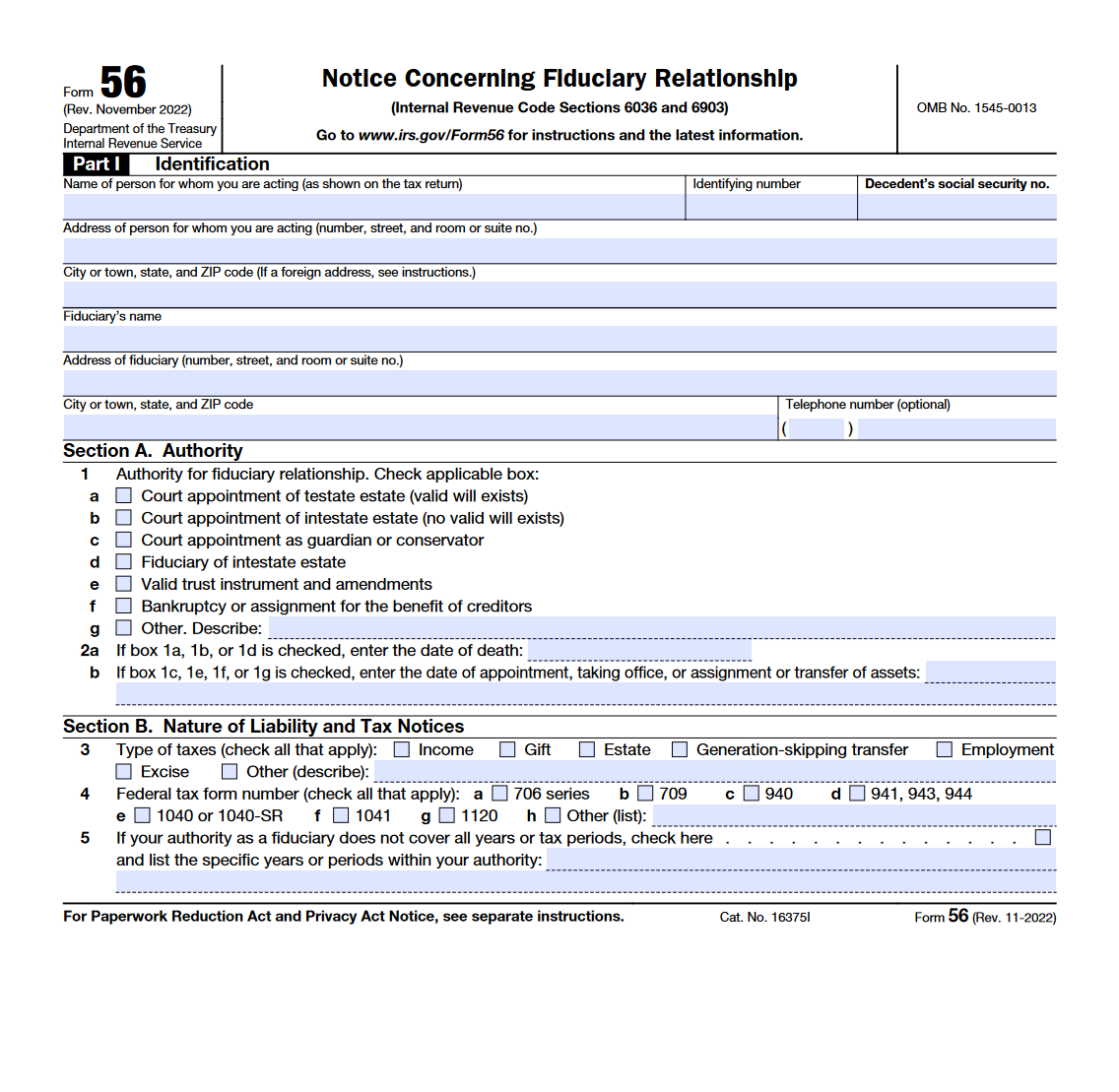

When it comes to managing someone else’s financial affairs, it’s important to have the proper documentation in place. This is where IRS Form 56 comes into play. This form, also known as the Notice Concerning Fiduciary Relationship, is used to notify the IRS of a fiduciary relationship and provide information about the fiduciary responsible for managing another person’s finances.

IRS Form 56 is a crucial document for anyone who has been appointed as a fiduciary, whether it be for an estate, trust, or individual. It outlines the responsibilities of the fiduciary and ensures that the IRS is aware of the individual or entity responsible for handling financial matters on behalf of another party.

Download and Print Irs Form 56 Printable

What Is Irs Form 56 How To Fill It Out Accounts Confidant

What Is Irs Form 56 How To Fill It Out Accounts Confidant

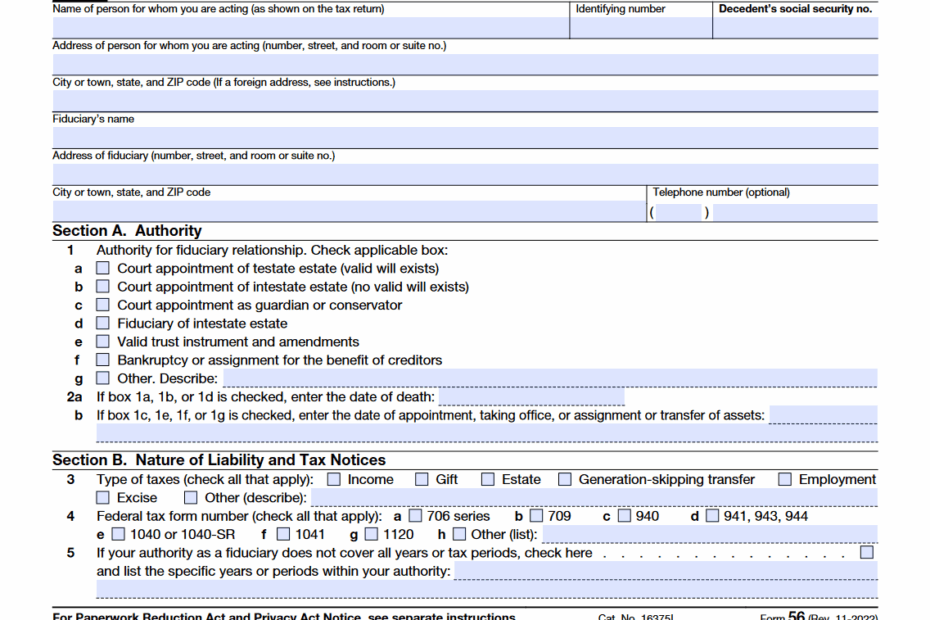

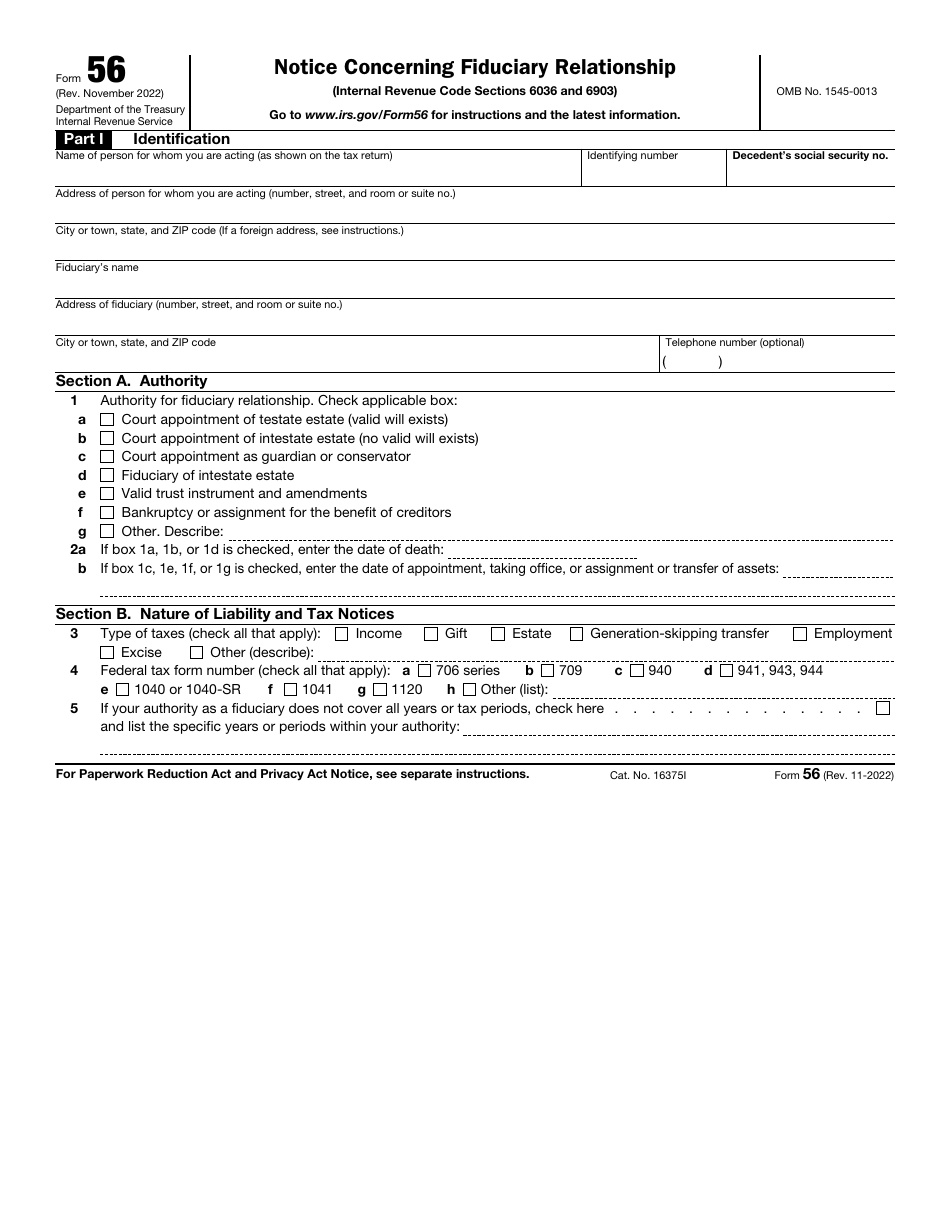

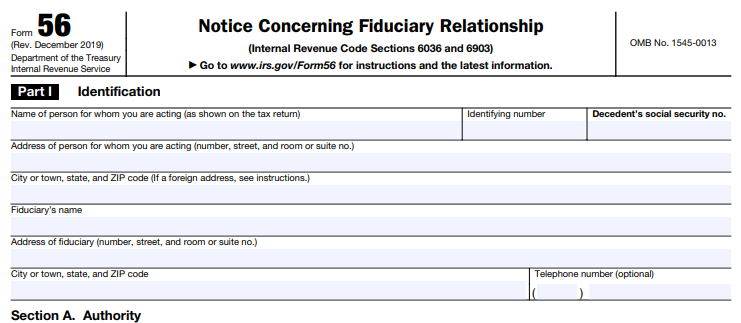

When filling out IRS Form 56, it’s important to provide accurate and detailed information about the fiduciary relationship. This includes identifying information for both the fiduciary and the party for whom financial matters are being managed, as well as details about the type of fiduciary relationship and the specific powers granted to the fiduciary.

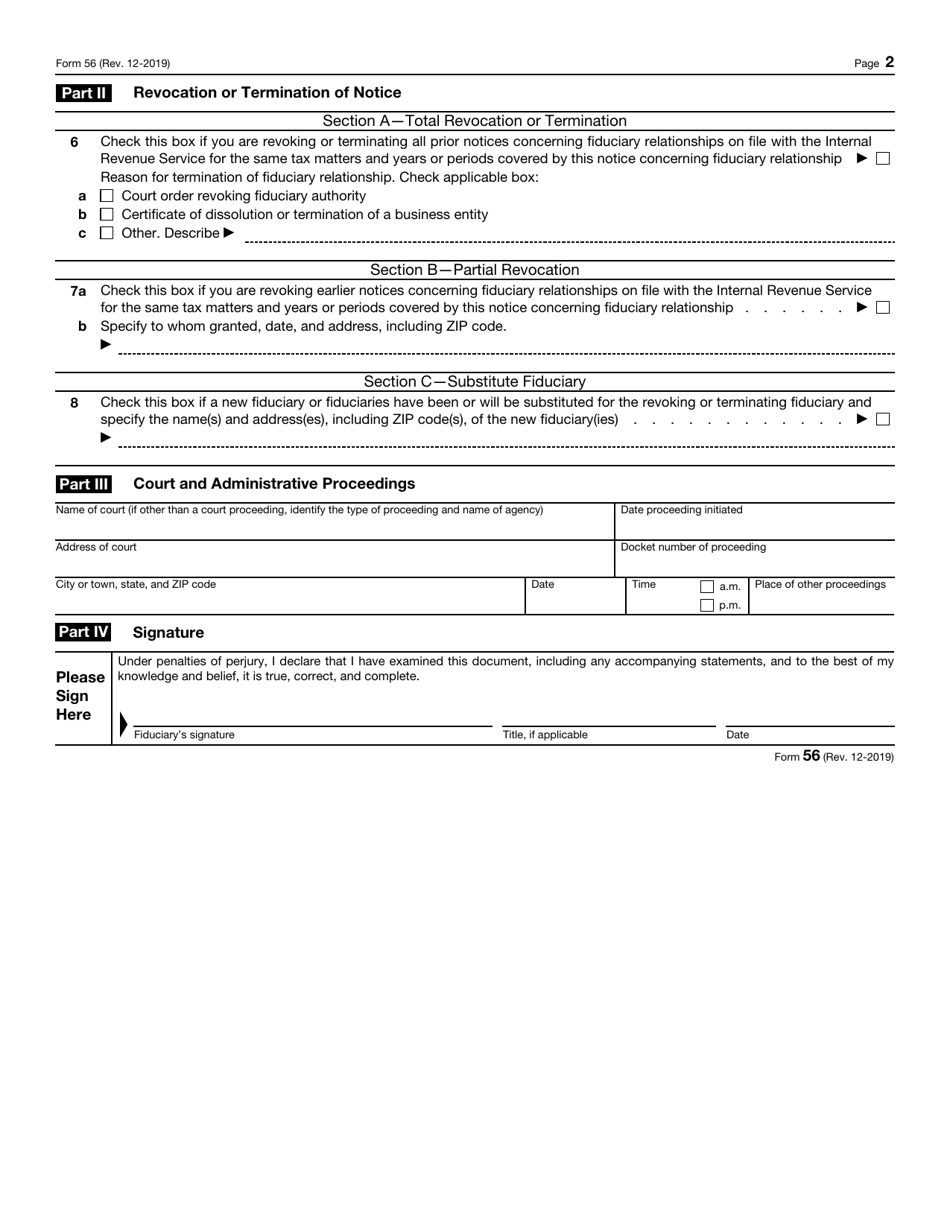

It’s also important to note that IRS Form 56 is not a one-time filing. Fiduciaries are required to file this form whenever there is a change in the fiduciary relationship, such as a change in fiduciaries or a change in the powers granted to the fiduciary. Failure to file this form when required can result in penalties and other consequences.

In order to stay compliant with IRS regulations and ensure that financial matters are being properly managed, it’s essential to understand and utilize IRS Form 56. By completing and filing this form as needed, fiduciaries can fulfill their obligations and provide transparency to the IRS regarding their fiduciary responsibilities.

In conclusion, IRS Form 56 is a critical document for anyone serving as a fiduciary. By accurately completing and filing this form, fiduciaries can ensure that they are meeting their obligations and maintaining transparency with the IRS. It’s important to stay informed about the requirements and deadlines associated with IRS Form 56 to avoid potential penalties and ensure that financial matters are being properly managed.

IRS Form 56 Fill Out Sign Online And Download Fillable PDF

IRS Form 56 Fill Out Sign Online And Download Fillable PDF

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Instructions Fill Online Printable Fillab Vrogue Co

Irs Form 56 Instructions Fill Online Printable Fillab Vrogue Co

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Fillable Pdf Printable Forms Free Online

Searching for a hassle-free method to handle your money matters? Our free printable checks offer a simple, reliable, and editable option right from home. Be it for personal use, home businesses, or keeping track of expenses, printable checks help you save both time and cash without sacrificing professionalism. Compatible with most accounting software and easy to print, they’re a smart alternative to bank-ordered checks. Print your own today and take full control of your check issuing—no delays, zero charges. Explore our ready-to-use templates and choose the one that suits your style. With our beginner-friendly features, handling your money has never been this streamlined. Access your free printable checks and streamline your check-writing process with ease!.