Filing taxes can be a daunting task, but it doesn’t have to be. One of the forms that many taxpayers use is the IRS Schedule A, which is used to itemize deductions. By using this form, taxpayers can potentially lower their taxable income and save money on their taxes.

Many taxpayers prefer to fill out the IRS Schedule A form by hand, rather than using tax software or hiring a professional. This can be a cost-effective and efficient way to ensure accuracy in your tax return.

Get and Print Irs Schedule A Printable Form

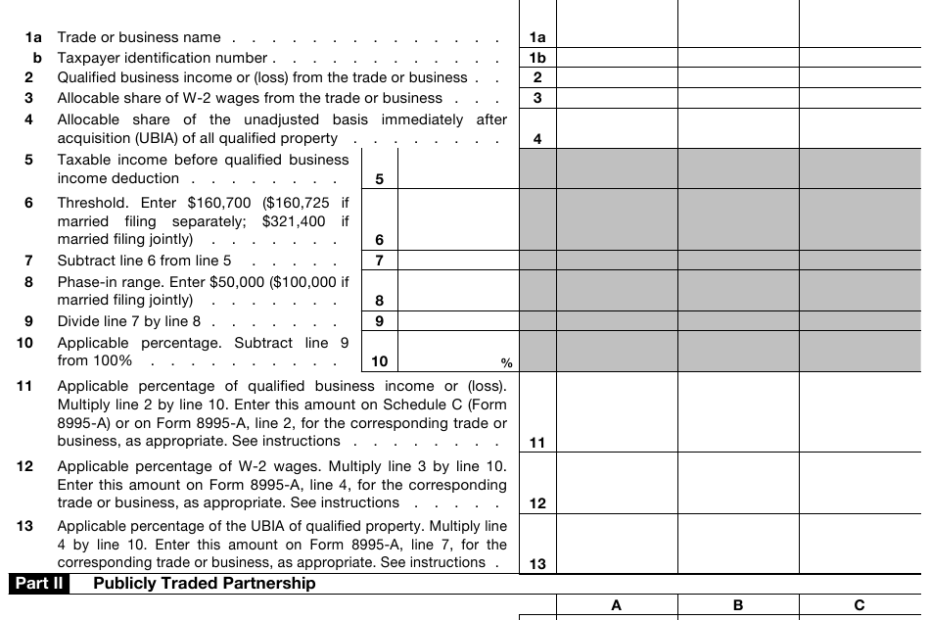

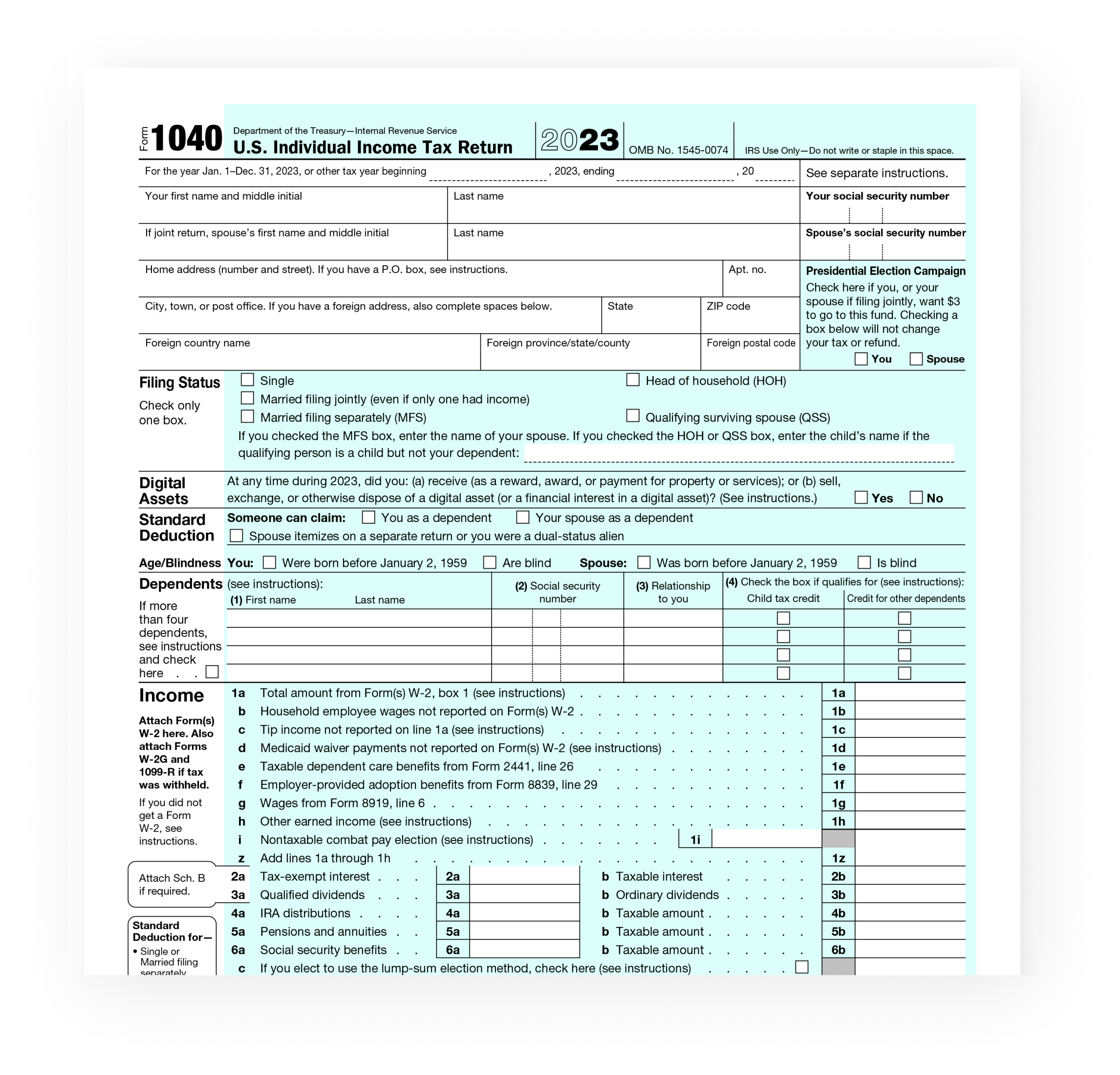

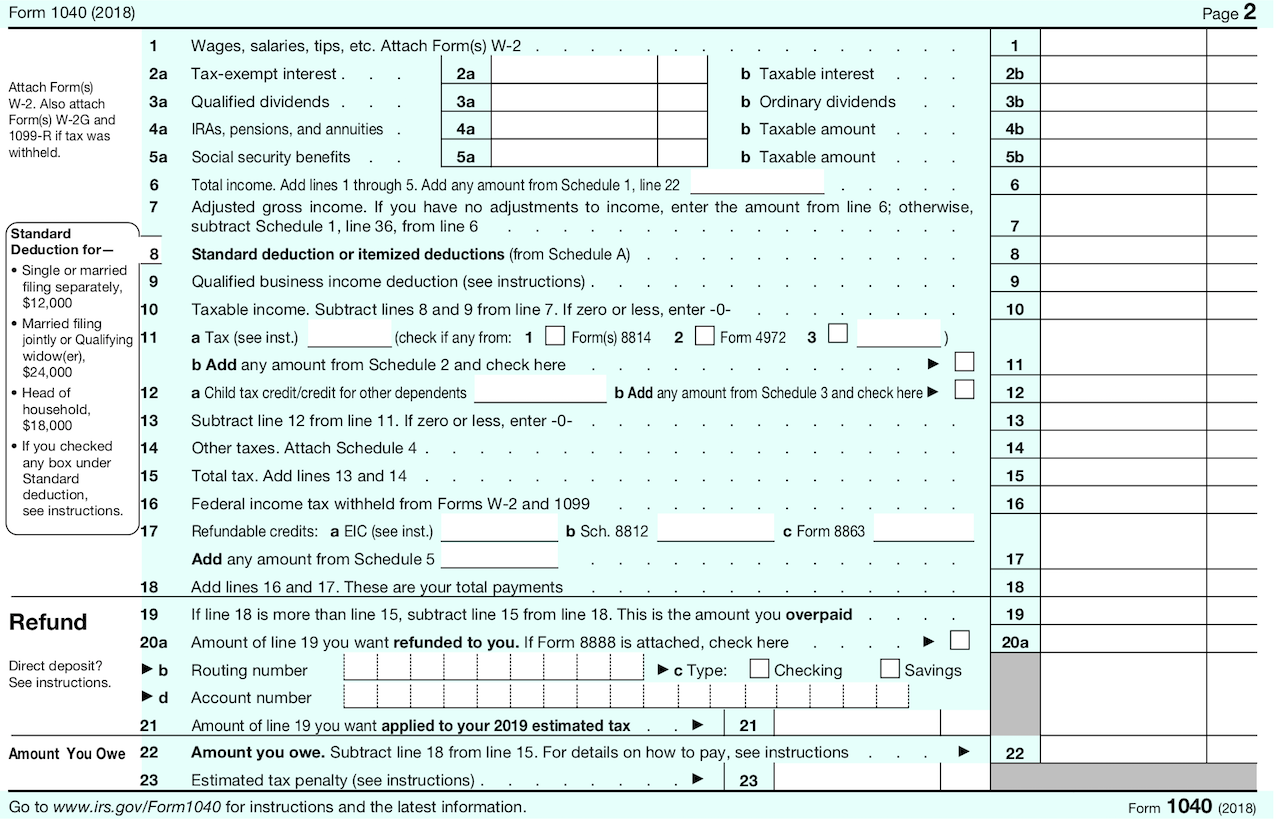

Describes New Form 1040 Schedules Tax Tables

Describes New Form 1040 Schedules Tax Tables

Benefits of Using IRS Schedule A Printable Form

One of the main benefits of using the IRS Schedule A form is that it allows taxpayers to deduct a variety of expenses, such as medical expenses, mortgage interest, state and local taxes, and charitable contributions. By itemizing these deductions, taxpayers may be able to lower their taxable income and potentially receive a larger tax refund.

Another benefit of using the IRS Schedule A form is that it is easy to access and print online. Taxpayers can simply visit the IRS website, locate the form, and print it out to fill in by hand. This can be a convenient option for those who prefer to handle their taxes on their own.

When filling out the IRS Schedule A form, taxpayers should be sure to have all necessary documentation on hand, such as receipts, invoices, and other supporting documents. It’s important to accurately report all deductions to avoid any potential issues with the IRS.

Overall, using the IRS Schedule A printable form can be a helpful tool for taxpayers looking to maximize their deductions and potentially save money on their taxes. By taking the time to fill out this form accurately, taxpayers can ensure that they are claiming all eligible deductions and reducing their taxable income.

In conclusion, the IRS Schedule A printable form is a valuable resource for taxpayers who want to itemize their deductions and potentially lower their taxable income. By utilizing this form, taxpayers can take advantage of various deductions and potentially save money on their taxes. So, next time you sit down to file your taxes, consider using the IRS Schedule A form to maximize your deductions and potentially increase your tax refund.