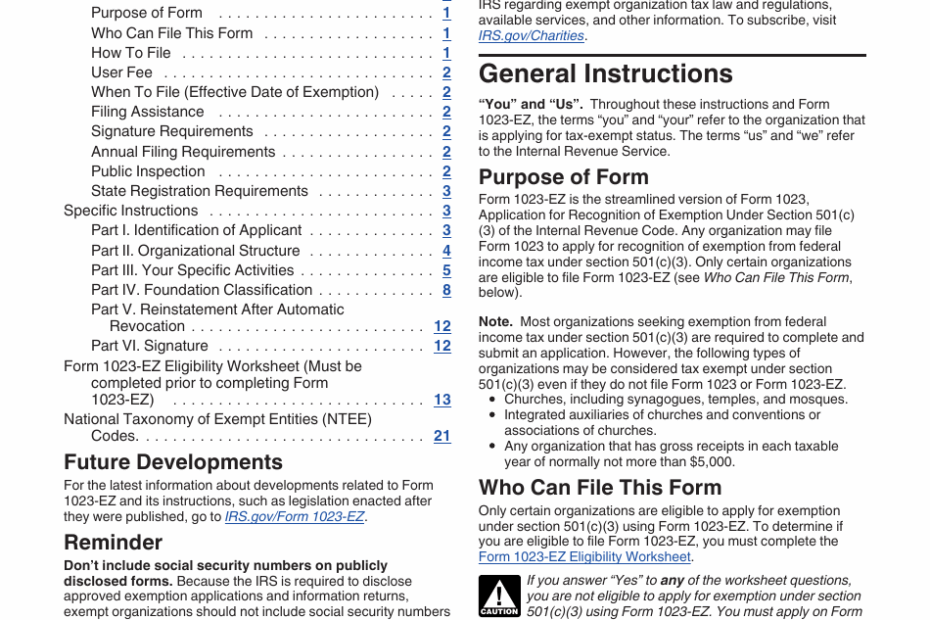

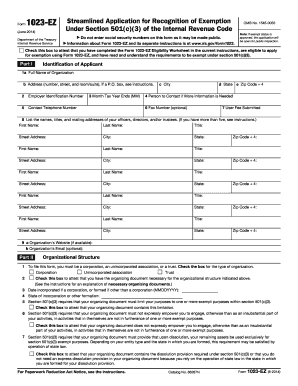

IRS Form 1023-EZ is a simplified version of the longer Form 1023, which is used by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This shorter form was introduced to streamline the application process for smaller organizations with less complex financial structures.

For organizations looking to file for tax-exempt status, Form 1023-EZ can be a time-saving and convenient option. It is important to ensure that your organization meets all the eligibility requirements before opting for this simplified form.

Get and Print Irs Form 1023-Ez Printable

Irs Form 1023 Ez Templates Fillable Printable Samples For PDF Word

Irs Form 1023 Ez Templates Fillable Printable Samples For PDF Word

IRS Form 1023-EZ Printable

IRS Form 1023-EZ is available for download on the official IRS website. The form can be easily filled out electronically and printed for submission. It is important to carefully read the instructions and guidelines provided with the form to ensure accurate completion.

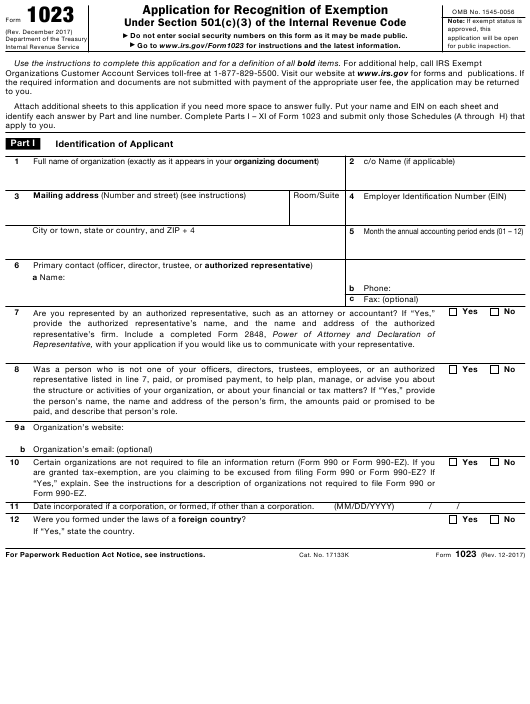

When filling out Form 1023-EZ, make sure to provide all the necessary information about your organization, including its purpose, activities, and financial details. It is also important to include any required attachments, such as articles of incorporation and bylaws.

After completing the form, it should be signed by an authorized individual within the organization and submitted to the IRS for review. It is recommended to keep a copy of the completed form for your records.

Once the IRS receives your Form 1023-EZ, they will review it to determine if your organization qualifies for tax-exempt status. If approved, your organization will receive a determination letter confirming its tax-exempt status.

It is important to note that not all organizations are eligible to use Form 1023-EZ. If your organization does not meet the eligibility requirements or has a more complex financial structure, you may need to file the longer Form 1023 instead.

In conclusion, IRS Form 1023-EZ can be a convenient option for smaller organizations seeking tax-exempt status. By carefully filling out the form and meeting all eligibility requirements, your organization can streamline the application process and receive timely approval from the IRS.