In this digital age, many people still prefer to keep track of their finances using traditional pen and paper methods. One popular tool for this purpose is a checking ledger. A checking ledger helps individuals to monitor their income and expenses, ensuring that they stay within budget and avoid overspending.

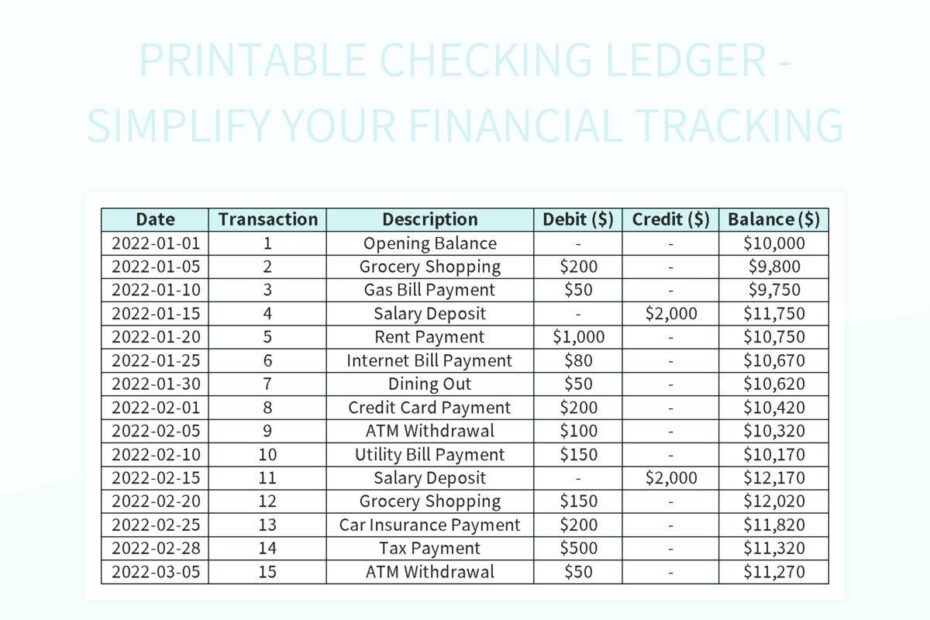

For those who prefer a more organized and neat approach to managing their finances, a checking ledger printable can be a great solution. These printables come in various formats, including templates that can be easily downloaded and printed at home. They provide a structured layout for recording transactions, making it easier to track spending and identify any discrepancies.

Download and Print Checking Ledger Printable

Using a checking ledger printable allows individuals to categorize their expenses, such as groceries, utilities, and entertainment, providing a clear overview of where their money is going. This can help in making informed decisions about budgeting and saving for future goals. Additionally, having a physical record of transactions can be useful for reference in case of any disputes or discrepancies with financial institutions.

One of the key benefits of using a checking ledger printable is the convenience it offers. With just a few clicks, individuals can access and print out a template that suits their needs. They can choose from various designs and layouts that cater to different preferences, whether they prefer a minimalist style or a more detailed format with additional columns for notes.

Moreover, checking ledger printables can also serve as a valuable tool for improving financial literacy. By regularly updating and reviewing their transactions, individuals can gain a better understanding of their spending habits and identify areas where they can cut back or save more. This can ultimately lead to smarter financial decisions and a more secure financial future.

In conclusion, a checking ledger printable is a useful resource for individuals who prefer a hands-on approach to managing their finances. With its structured layout and convenience, it can help individuals stay organized, track their expenses, and improve their financial literacy. By utilizing this tool, individuals can take control of their finances and work towards achieving their financial goals.