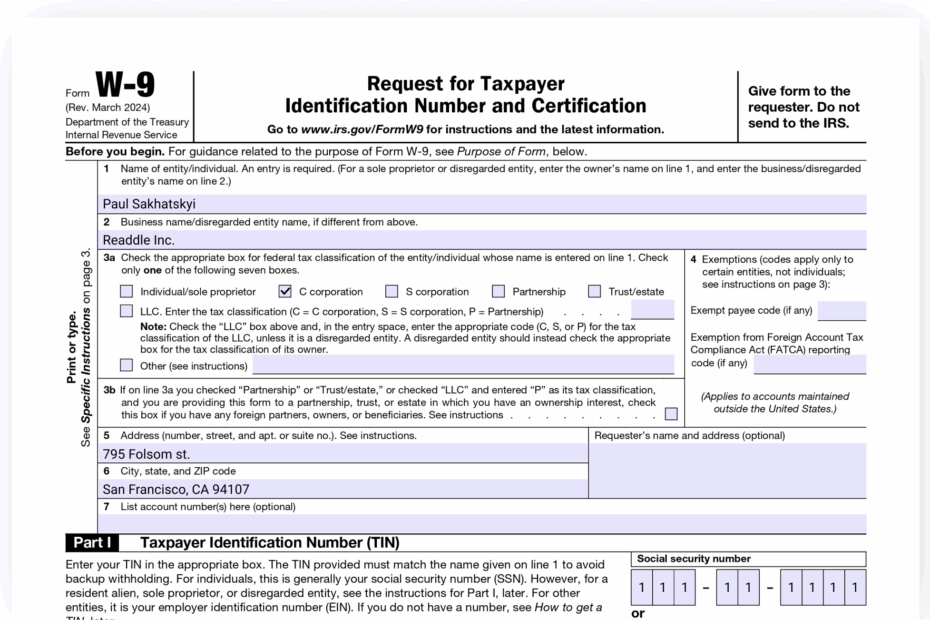

When it comes to tax season, there are a variety of forms that individuals and businesses need to fill out in order to comply with IRS regulations. One such form is the W9 Printable Form 2025 IRS. This form is used by businesses to request taxpayer identification numbers from individuals or entities they are paying for services rendered.

It is important for individuals to accurately fill out the W9 form to ensure that the correct information is provided to the IRS. Failure to do so could result in delays in payments or even penalties for incorrect information. The W9 form is a standard document that is required by the IRS for tax reporting purposes.

Save and Print W9 Printable Form 2025 Irs

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

When filling out the W9 Printable Form 2025 IRS, individuals will need to provide their name, address, taxpayer identification number, and certification of their tax status. This information is used by businesses to report payments made to the IRS and to the individual receiving the payment.

It is important to note that the W9 form is not submitted to the IRS directly by the individual. Instead, it is kept on file by the business that requested the information. The business will use the information provided on the W9 form to complete their own tax reporting obligations.

Overall, the W9 Printable Form 2025 IRS is a vital document that ensures accurate tax reporting and compliance with IRS regulations. By filling out this form accurately and completely, individuals can help businesses fulfill their tax obligations and ensure that payments are made in a timely manner.

As tax season approaches, it is important for individuals to familiarize themselves with the various forms required by the IRS, including the W9 form. By understanding the purpose of the W9 form and how to accurately fill it out, individuals can help streamline the tax reporting process for businesses and ensure compliance with IRS regulations.