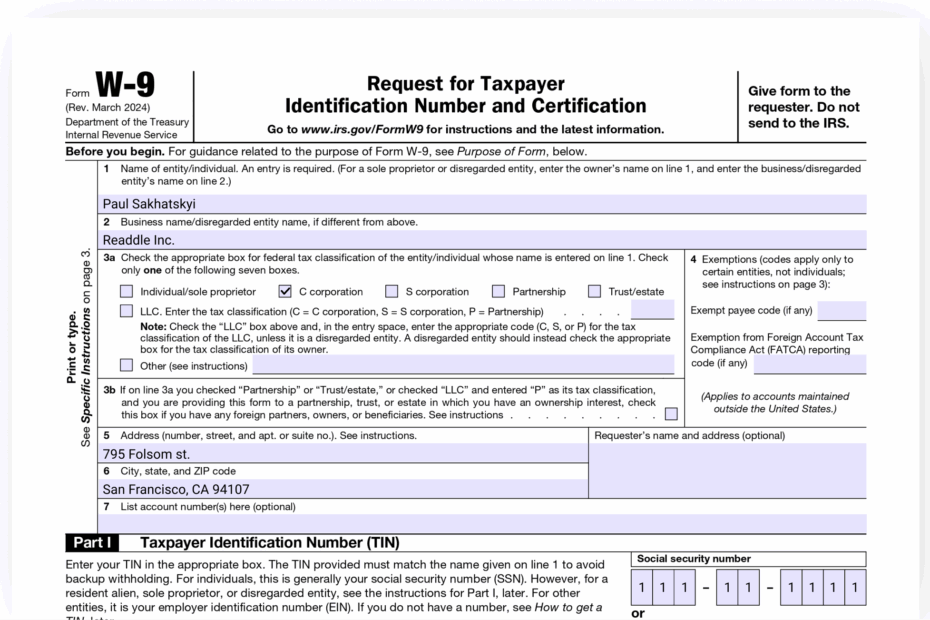

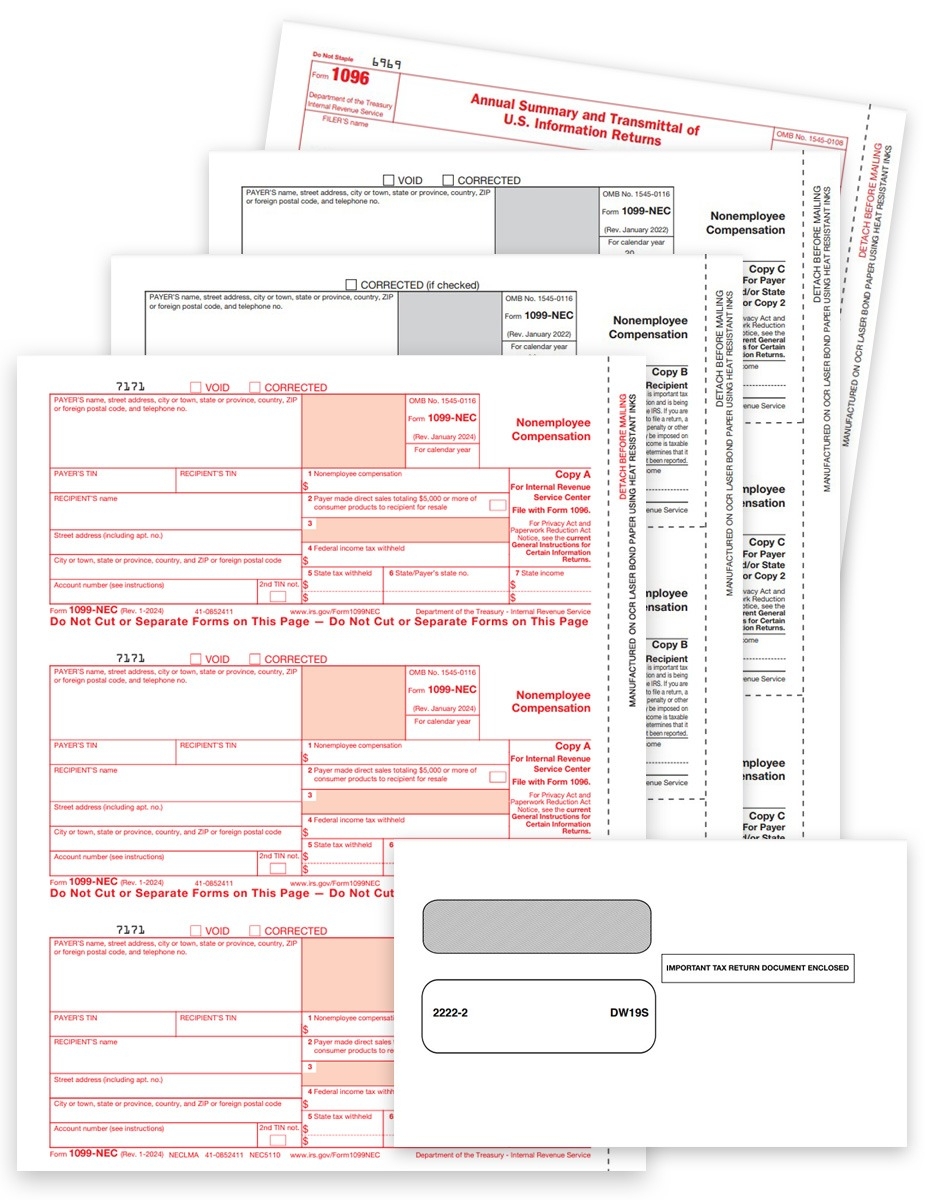

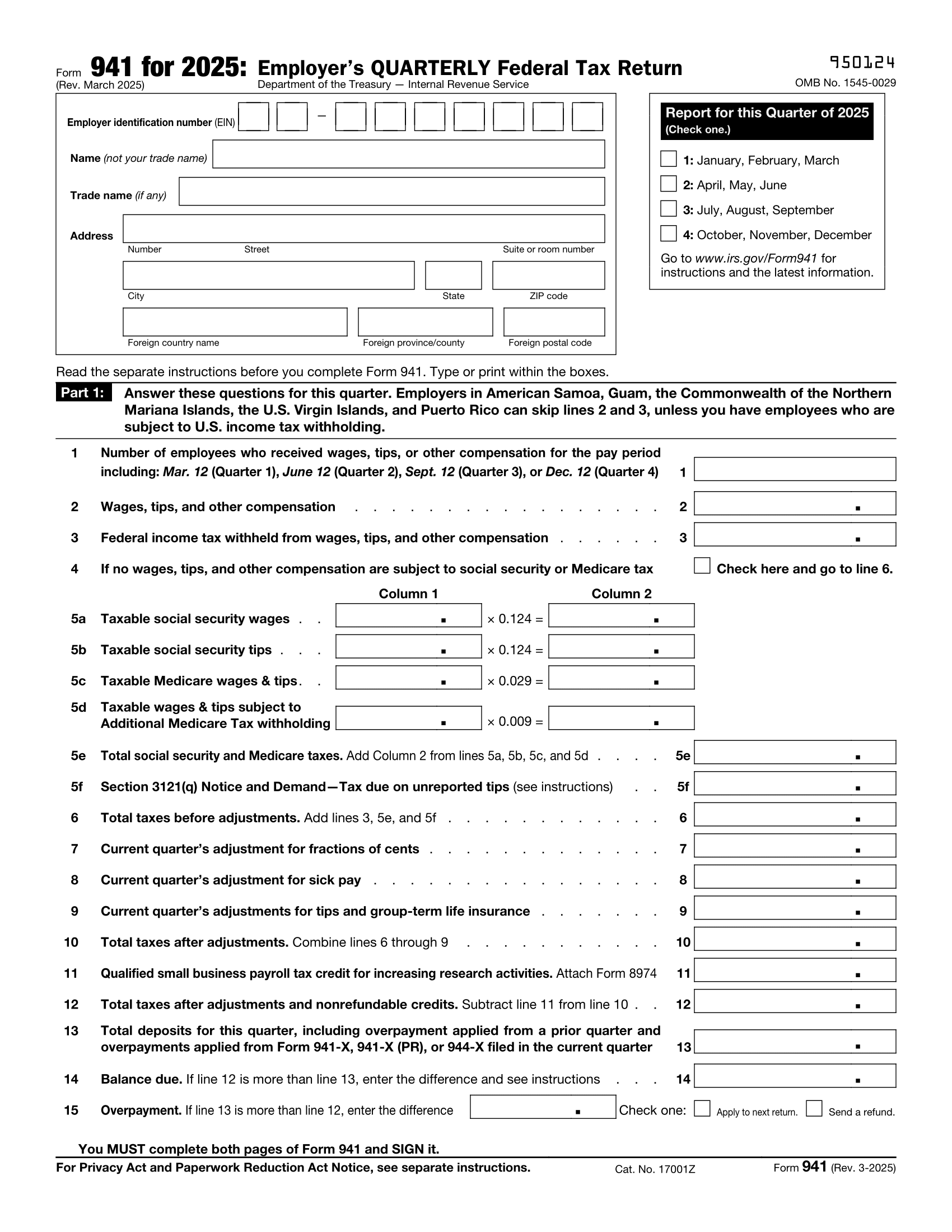

As we approach tax season, it’s important for both businesses and individuals to familiarize themselves with the necessary forms required by the IRS. One such form is the W9, which is used to gather essential information from independent contractors or vendors. Having a printable version of the W9 form makes it easier for both parties to complete the necessary paperwork efficiently and accurately.

For the year 2025, the IRS has made updates to the W9 form to ensure compliance with current tax regulations. It’s crucial for businesses to stay informed about these changes and provide the most up-to-date version of the form to their contractors. Having a printable W9 form readily available can simplify the process for everyone involved.

Easily Download and Print Printable W9 Form 2025 Irs

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

When it comes to filling out the W9 form, individuals and businesses need to provide information such as their name, address, taxpayer identification number, and certification of their tax status. By having a printable version of the form on hand, it’s easy to gather all the necessary information and submit it promptly to the IRS.

Using a printable W9 form also allows for greater convenience and organization. It eliminates the need for handwritten forms that can be hard to read and prone to errors. With a digital version of the form, both parties can easily type in the required information, ensuring accuracy and efficiency in the submission process.

By utilizing a printable W9 form for the year 2025, businesses and individuals can streamline the process of gathering essential tax information and ensure compliance with IRS regulations. Having a readily accessible form eliminates the hassle of searching for the correct document and simplifies the overall tax preparation process.

As tax season approaches, it’s essential to have all the necessary forms in order, including the W9 form for independent contractors and vendors. With a printable version of the form available, businesses and individuals can ensure they have all the required information at their fingertips, making tax preparation a smoother and more efficient process.