As the year comes to a close, many Americans are beginning to prepare for tax season. One essential part of this process is obtaining the necessary forms to file your taxes accurately and on time. With the advancement of technology, more and more people are opting to file their taxes online. However, there are still many who prefer to do it the traditional way – by filling out physical forms. For those individuals, having access to printable IRS tax forms is crucial.

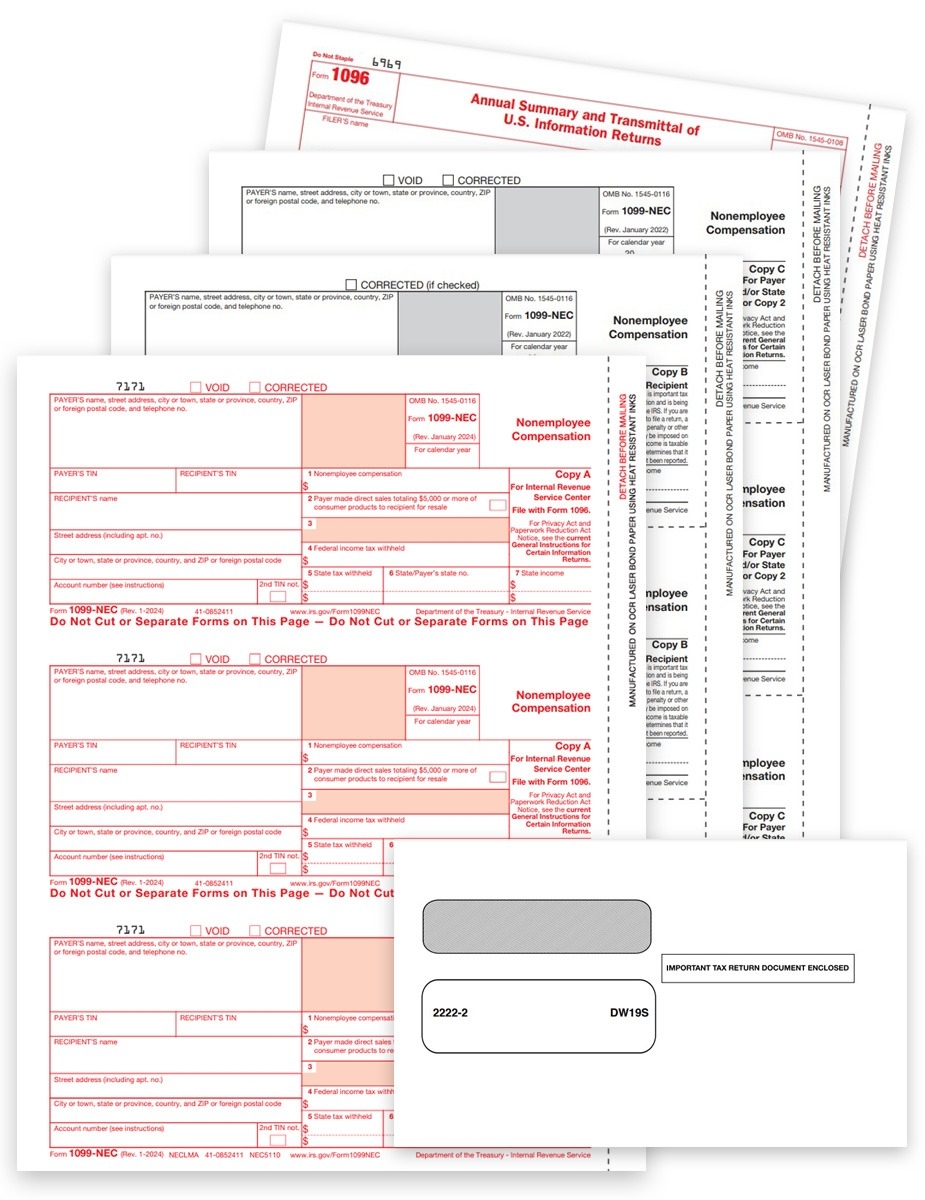

For the tax year 2025, the IRS will provide a range of tax forms that can be easily downloaded and printed from their official website. These forms will cover various aspects of income, deductions, credits, and more. Whether you are a salaried employee, a freelancer, a small business owner, or an investor, there will be a specific form tailored to your needs.

Download and Print Printable Irs Tax Forms 2025

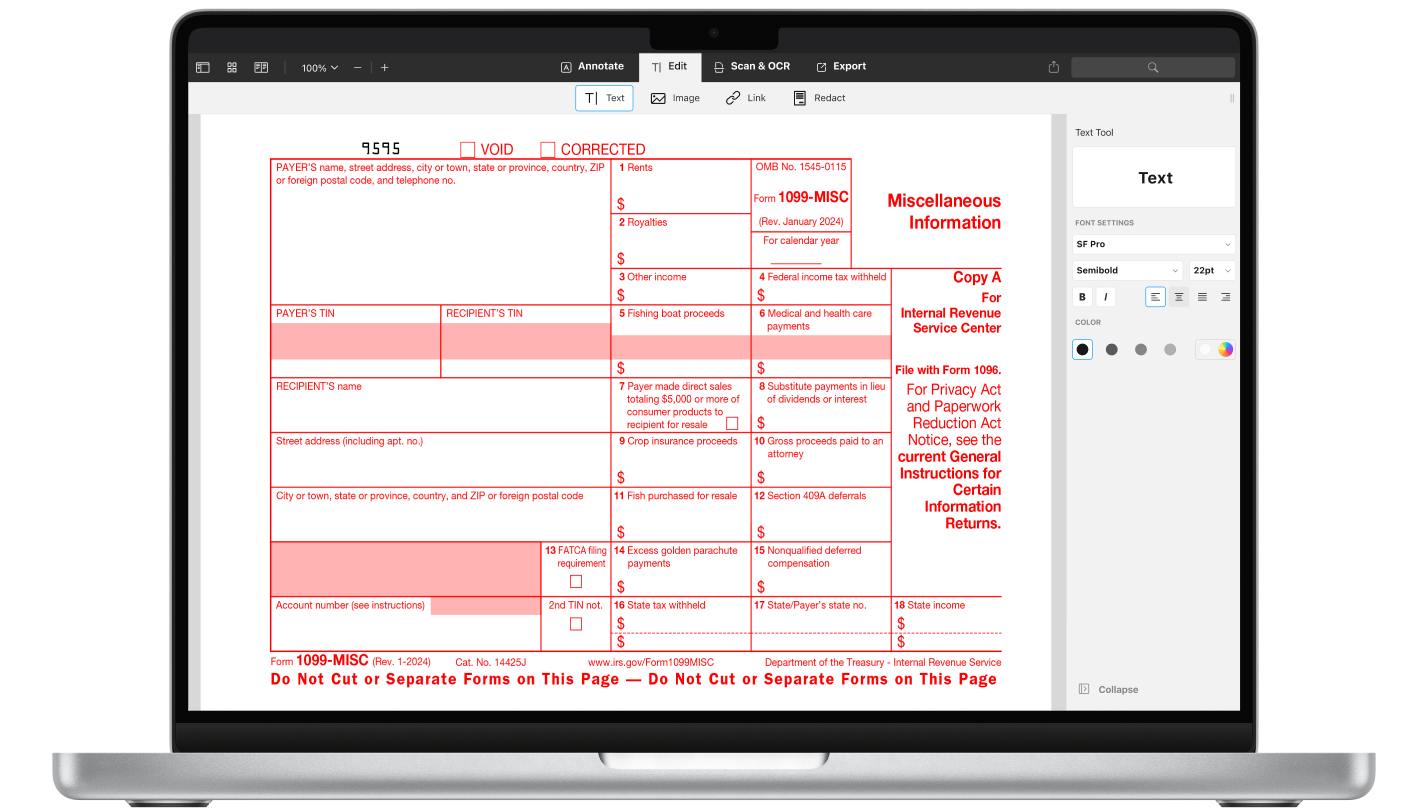

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

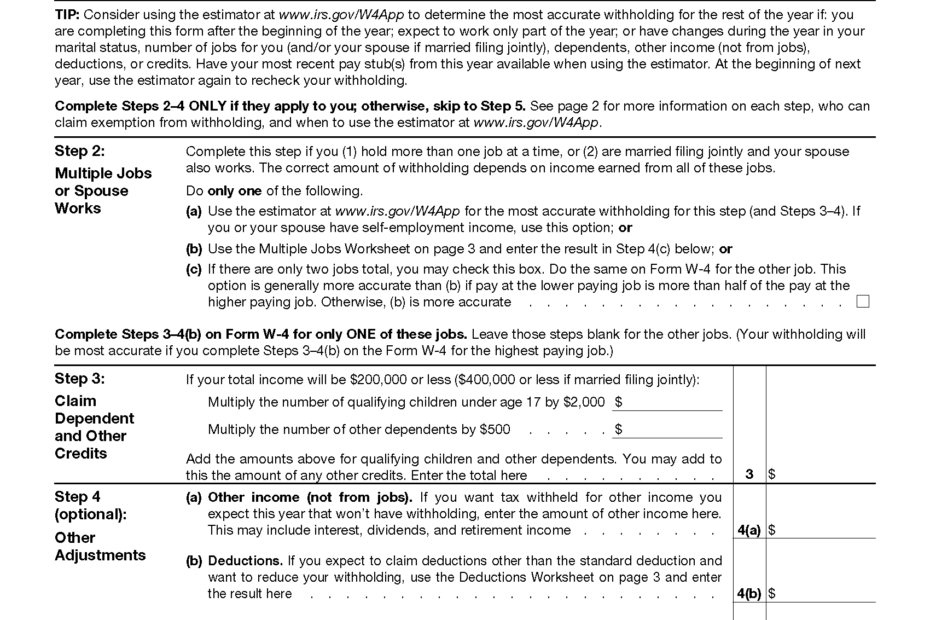

One of the most commonly used forms is the 1040 form, which is used by individuals to report their income, deductions, and credits. Additionally, there are schedules that can be attached to the 1040 form for reporting specific types of income or deductions, such as Schedule A for itemized deductions or Schedule C for business income.

It is important to note that while many forms can be filled out electronically, having a physical copy can be beneficial for reference and record-keeping purposes. Additionally, some individuals may not have access to the internet or may prefer to file their taxes offline, making printable IRS tax forms essential.

As tax laws and regulations can change from year to year, it is crucial to ensure that you are using the correct forms for the tax year 2025. By downloading and printing the forms directly from the IRS website, you can be confident that you are using the most up-to-date and accurate forms for filing your taxes.

In conclusion, having access to printable IRS tax forms for the tax year 2025 is essential for individuals who prefer to file their taxes offline or who may not have access to the internet. By obtaining the necessary forms and filling them out accurately, you can ensure a smooth and hassle-free tax filing process.