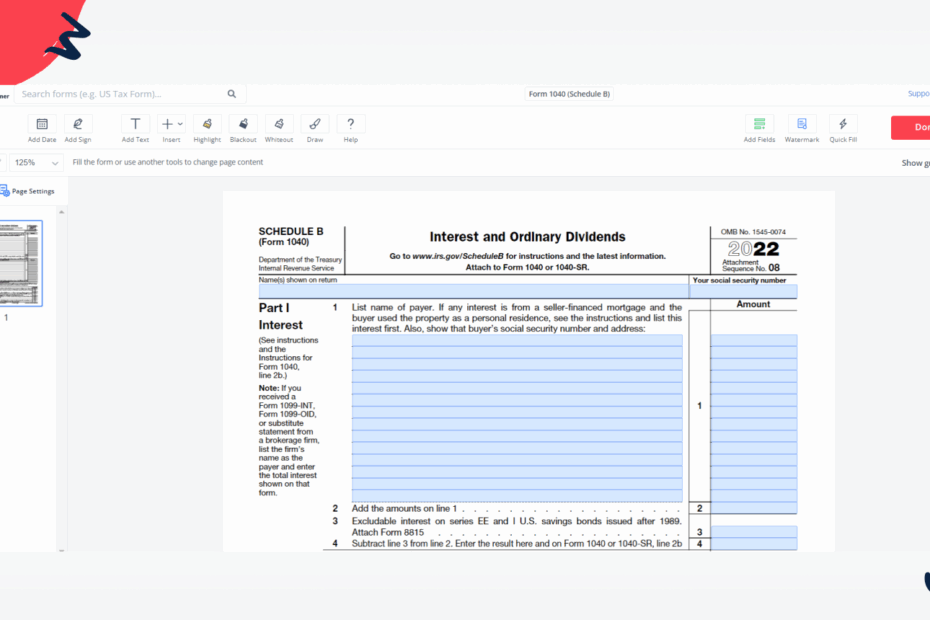

When it comes to tax season, it’s important to have all the necessary forms and documents in order to accurately file your taxes. One such form that you may need to fill out is Schedule B, which is used to report interest and dividend income. This form is required if you earned over a certain amount of interest or dividends during the tax year.

For those who received interest or dividends from investments, savings accounts, or other sources, Schedule B will help you report this income to the IRS. It’s important to accurately report this income to avoid any penalties or fines for underreporting.

Easily Download and Print Printable Irs Form Schedule B

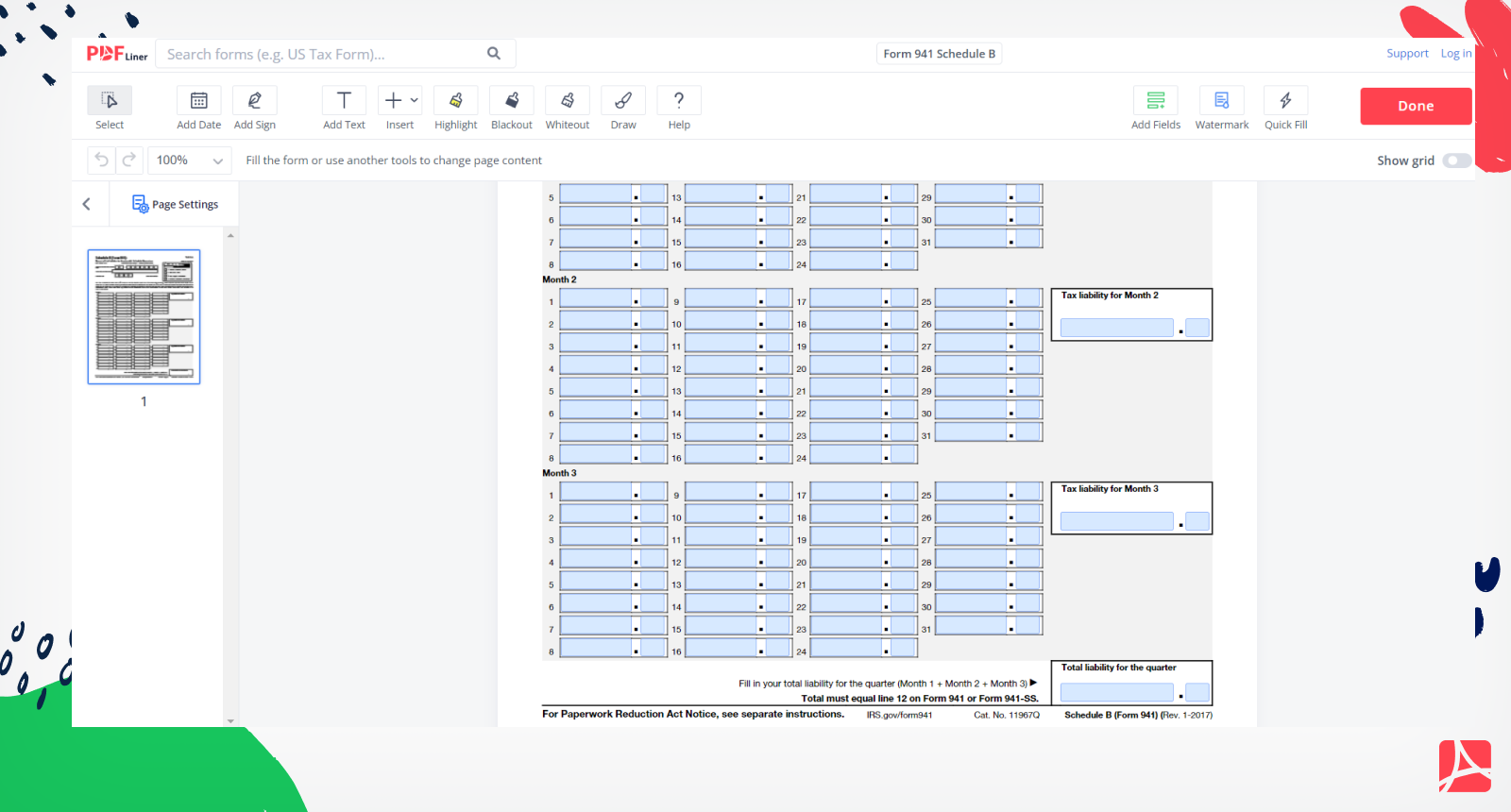

Form 941 Schedule B Print And Sign Form Online PDFliner

Form 941 Schedule B Print And Sign Form Online PDFliner

Printable IRS Form Schedule B

If you’re in need of a printable IRS Form Schedule B, you’re in luck. The IRS website offers a printable version of Schedule B that you can easily download and fill out. This form can be found on the IRS website under the “Forms & Publications” section.

When filling out Schedule B, make sure to accurately report all interest and dividend income, as well as any foreign accounts or trusts that you may have. It’s important to double-check all information before submitting your tax return to ensure accuracy.

Once you have completed Schedule B, you can attach it to your Form 1040 or Form 1040A when filing your taxes. This will ensure that the IRS has all the necessary information regarding your interest and dividend income for the tax year.

Remember, it’s always best to consult with a tax professional if you have any questions or concerns about filling out Schedule B or any other tax forms. They can provide guidance and ensure that you are in compliance with all tax laws and regulations.

In conclusion, printable IRS Form Schedule B is an essential document for reporting interest and dividend income to the IRS. By accurately filling out this form and attaching it to your tax return, you can avoid any potential issues with the IRS and ensure that your taxes are filed correctly.