When it comes to tax season, one of the most important forms that individuals need to be familiar with is IRS Form 8962. This form is used to reconcile any advance premium tax credits that were received to help pay for health insurance through the Health Insurance Marketplace. It is crucial to accurately complete this form to avoid any potential issues with your tax return.

Understanding how to properly fill out Form 8962 can be a daunting task, but having a printable version of the form can make the process much easier. With the ability to fill it out at your own pace and refer back to it as needed, a printable IRS Form 8962 can be a valuable tool in ensuring that you accurately report your premium tax credit.

Easily Download and Print Printable Irs Form 8962

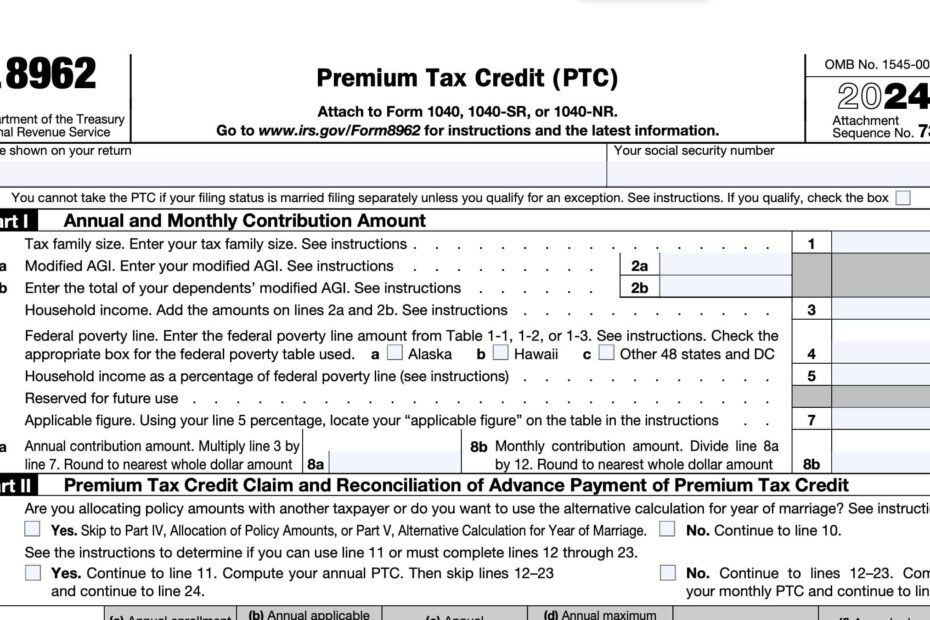

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

Printable IRS Form 8962

Form 8962 consists of several sections that require detailed information about your household income, tax credits, and health insurance coverage. By using a printable version of the form, you can easily input this information and calculate any premium tax credit that you may be eligible for. Additionally, having a physical copy of the form allows you to review your entries before submitting it to the IRS.

One of the key benefits of using a printable IRS Form 8962 is the convenience it provides. Rather than having to manually fill out the form by hand, you can type in your information directly on the document and make any necessary edits as you go along. This can help reduce errors and ensure that your form is completed accurately.

Another advantage of utilizing a printable version of Form 8962 is the ability to save a copy for your records. By keeping a digital or physical copy of the form, you can refer back to it in the future if needed. This can be especially helpful if you ever need to provide documentation of your premium tax credit for any reason.

In conclusion, having access to a printable IRS Form 8962 can simplify the process of reconciling your premium tax credit and ensure that you accurately report this information on your tax return. By utilizing this tool, you can streamline the filing process and avoid potential errors that could result in delays or penalties. Be sure to take advantage of printable forms to make tax season a little bit easier!