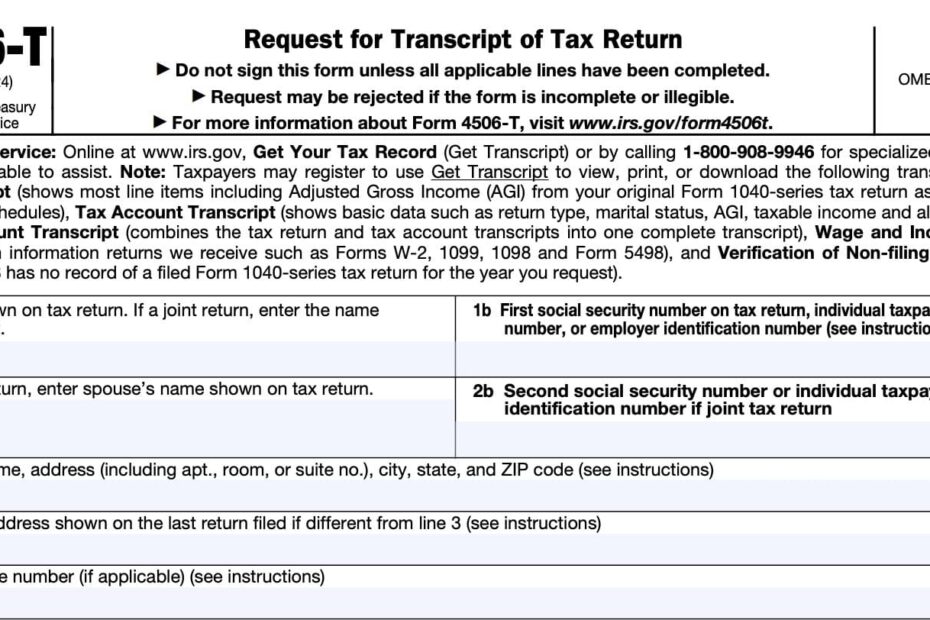

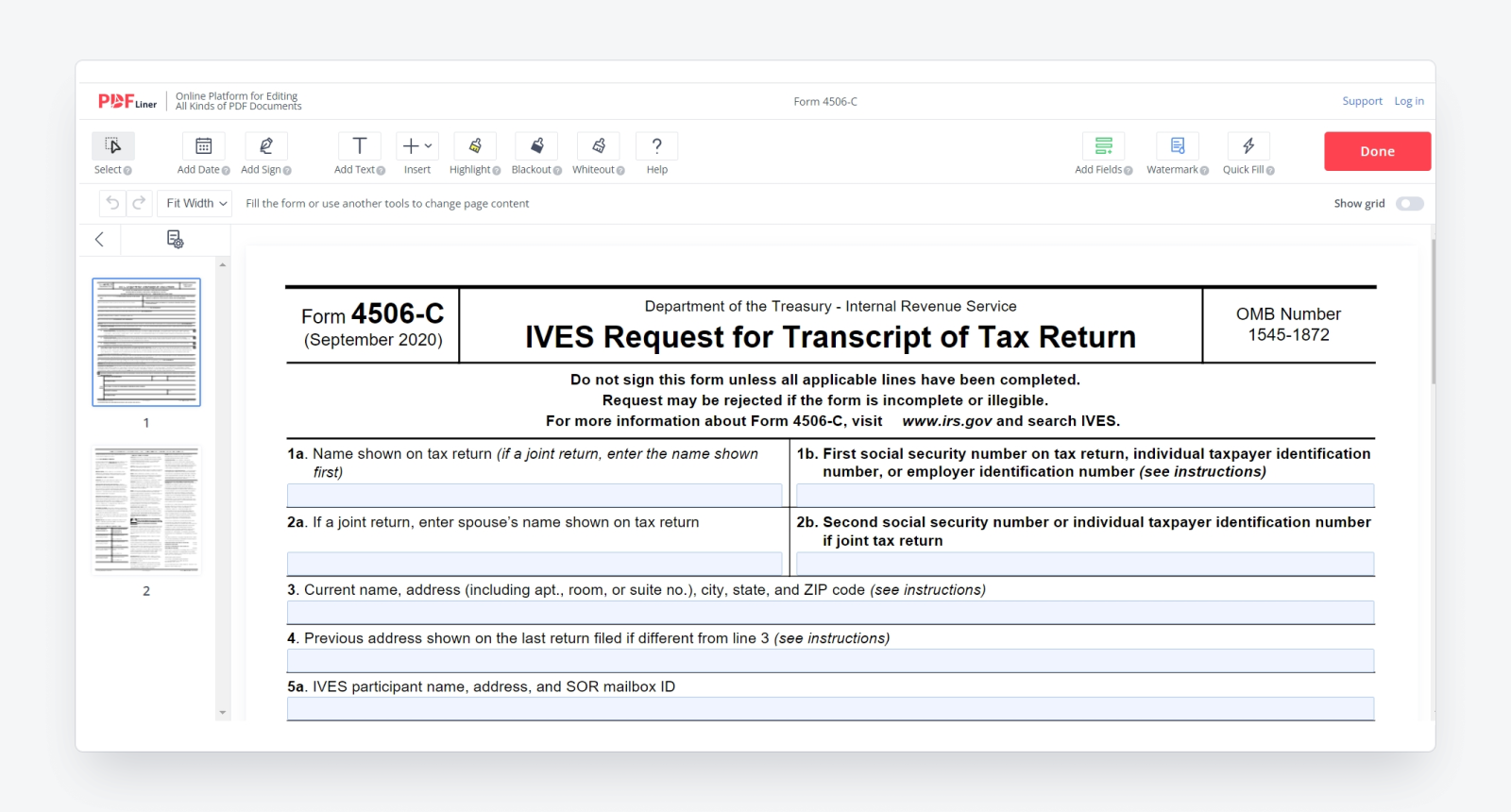

IRS Form 4506-T is a Request for Transcript of Tax Return form issued by the Internal Revenue Service (IRS). This form is used to request a transcript or a copy of a previously filed tax return. It is often required by financial institutions, mortgage lenders, and other entities to verify income for loan applications or other financial purposes.

Completing Form 4506-T allows the IRS to release the requested tax return information to the designated third party. This form is important for individuals who need to provide proof of income or tax filing status for various reasons.

Get and Print Printable Irs Form 4506-T

Form 4506 T 2024 2025 How To Fill Out And Download PDF Guru

Form 4506 T 2024 2025 How To Fill Out And Download PDF Guru

When filling out Form 4506-T, it is crucial to provide accurate information to ensure that the requested tax return transcript is processed correctly. The form requires details such as the taxpayer’s name, Social Security number, address, and signature.

It is important to note that the IRS does not charge a fee for transcripts requested on Form 4506-T. However, there may be a fee for obtaining copies of tax returns. The processing time for transcript requests can vary, so it is recommended to submit the form well in advance of any deadlines.

Once the IRS processes the Form 4506-T request, the transcript or copy of the tax return will be sent to the designated third party. This information can then be used for verification purposes in loan applications, mortgage approvals, or other financial transactions.

In conclusion, IRS Form 4506-T is a valuable tool for individuals who need to provide proof of income or tax filing status to third parties. By accurately completing this form and submitting it to the IRS, individuals can easily obtain the necessary tax return information for various financial purposes.