When dealing with the IRS, it’s important to have all your financial information in order. This includes filling out the necessary forms to report your income and expenses accurately. One such form is the IRS Form 433-D, which is used to provide detailed information about your monthly income and expenses.

By filling out this form, you are giving the IRS a clear picture of your financial situation, which can help them determine the best way for you to pay off any outstanding tax debt. It’s important to be thorough and accurate when completing this form to avoid any potential issues with the IRS.

Save and Print Printable Irs Form 433 D

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

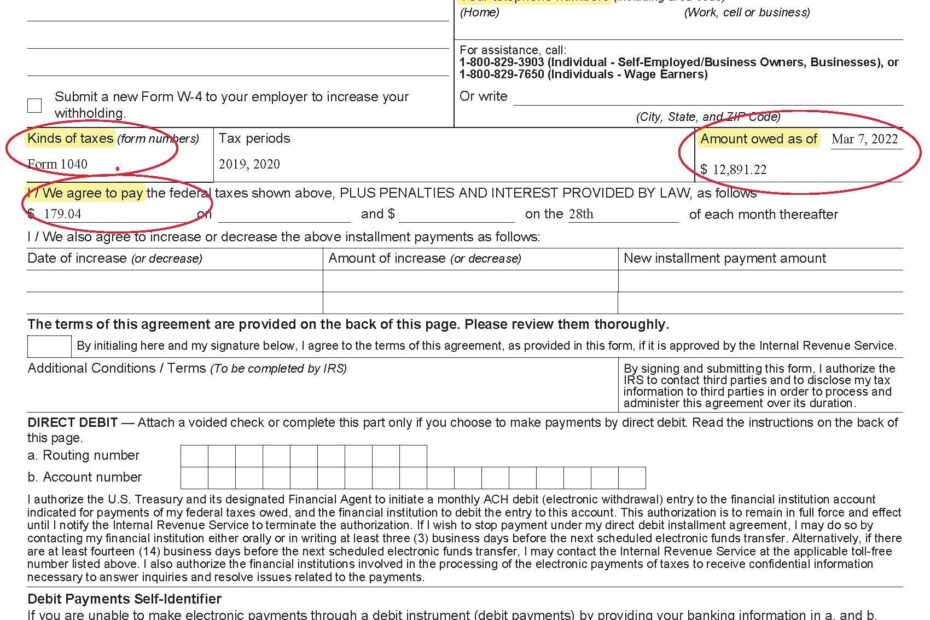

IRS Form 433-D is a crucial document for individuals who are looking to set up a payment plan with the IRS. This form requires detailed information about your income, expenses, and assets, which will help the IRS determine your ability to pay off your tax debt. By providing this information, you can work towards resolving your tax issues in a structured and organized manner.

It’s important to note that IRS Form 433-D is not the only form you may need to fill out when dealing with the IRS. Depending on your specific situation, you may also need to fill out additional forms to provide the IRS with a complete picture of your financial situation. Consulting with a tax professional can help ensure that you are filling out all the necessary forms correctly.

Overall, IRS Form 433-D is a valuable tool for individuals looking to resolve their tax debt with the IRS. By providing detailed information about your financial situation, you can work towards setting up a payment plan that is manageable for you. Remember to be thorough and accurate when filling out this form to avoid any potential issues with the IRS.

In conclusion, IRS Form 433-D is an important document for individuals looking to address their tax debt with the IRS. By providing detailed information about your income, expenses, and assets, you can work towards finding a solution that works for both you and the IRS. Be sure to fill out this form accurately and consult with a tax professional if needed to ensure that you are on the right track towards resolving your tax issues.