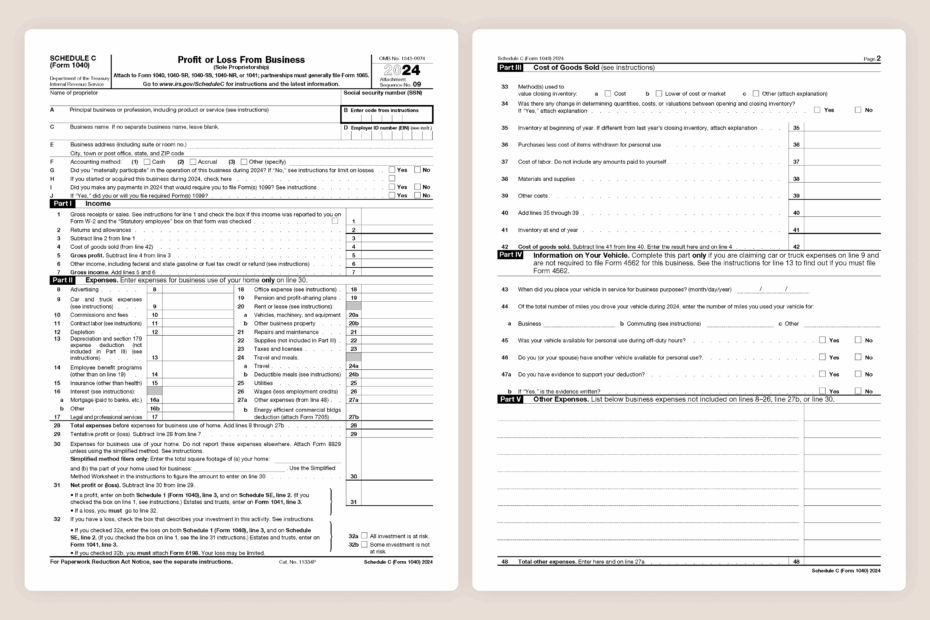

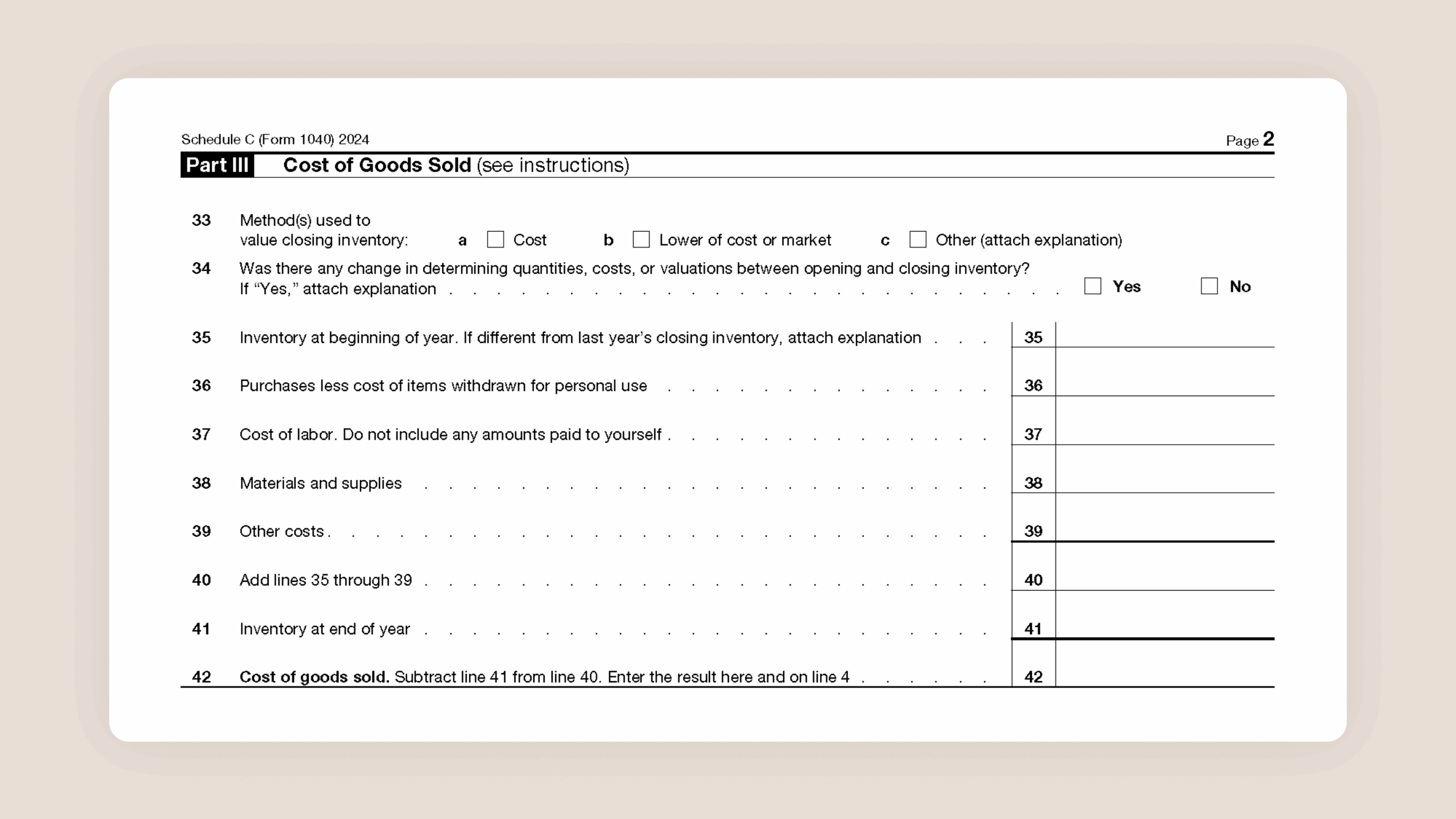

When it comes to filing taxes as a self-employed individual or small business owner, IRS Form 1040 Schedule C is a crucial document that must be completed accurately. This form is used to report income or losses from a sole proprietorship or single-member LLC. It allows you to deduct various business expenses and calculate your net profit or loss.

Printable IRS Form 1040 Schedule C can be easily found on the IRS website or through various tax preparation software. This form is essential for those who are self-employed and need to report their business income and expenses to the IRS.

Printable Irs Form 1040 Schedule C

Printable Irs Form 1040 Schedule C

Easily Download and Print Printable Irs Form 1040 Schedule C

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru

Printable IRS Form 1040 Schedule C

Once you have obtained the form, you will need to gather all relevant financial information related to your business. This includes income statements, receipts for expenses, and any other documentation that supports your reported figures. You will then need to fill out the form accurately, ensuring that all information is complete and correct.

When filling out Printable IRS Form 1040 Schedule C, you will be required to provide details about your business, such as the type of business you operate, your gross income, and various deductions you are eligible for. You will also need to calculate your net profit or loss, which will be used to determine your tax liability.

It is important to keep in mind that accurate reporting is crucial when completing IRS Form 1040 Schedule C. Any errors or discrepancies could result in penalties or audits by the IRS. Therefore, it is advisable to seek the assistance of a tax professional if you are unsure about how to fill out the form correctly.

Once you have completed Printable IRS Form 1040 Schedule C, you will need to include it with your annual tax return. This form will be used by the IRS to assess your tax liability and ensure that you have reported your business income and expenses accurately. Make sure to keep a copy of the form for your records.

In conclusion, Printable IRS Form 1040 Schedule C is an important document for self-employed individuals and small business owners to report their business income and expenses. By accurately completing this form, you can ensure compliance with IRS regulations and avoid potential penalties. Remember to seek professional assistance if needed and file your taxes on time to avoid any issues with the IRS.