If you are a taxpayer, you may need to file a form 1099 to report certain types of income you receive throughout the year. The IRS 1099 form is used to report various types of income, such as self-employment earnings, interest, dividends, and more. It is important to accurately report this income to avoid penalties and ensure compliance with tax laws.

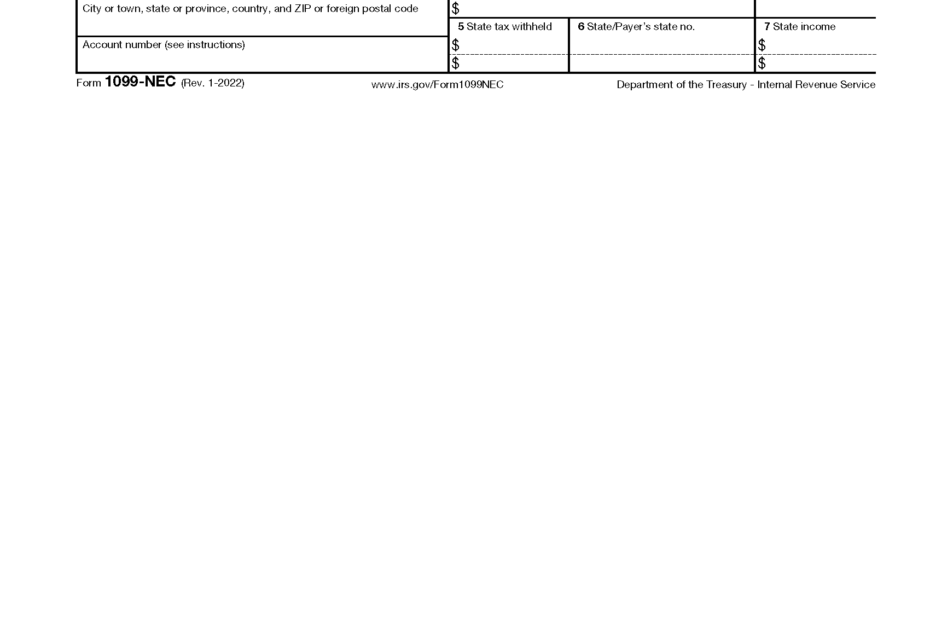

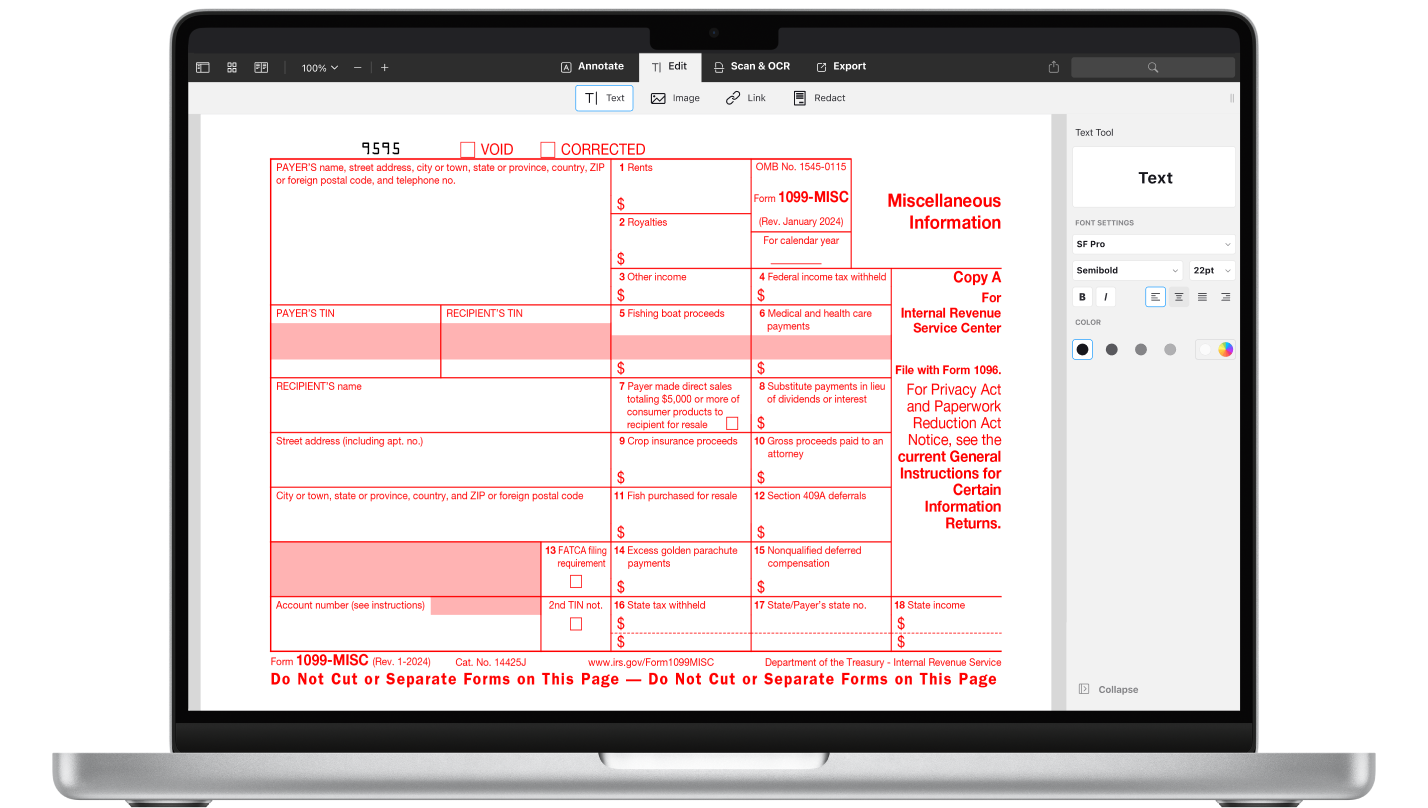

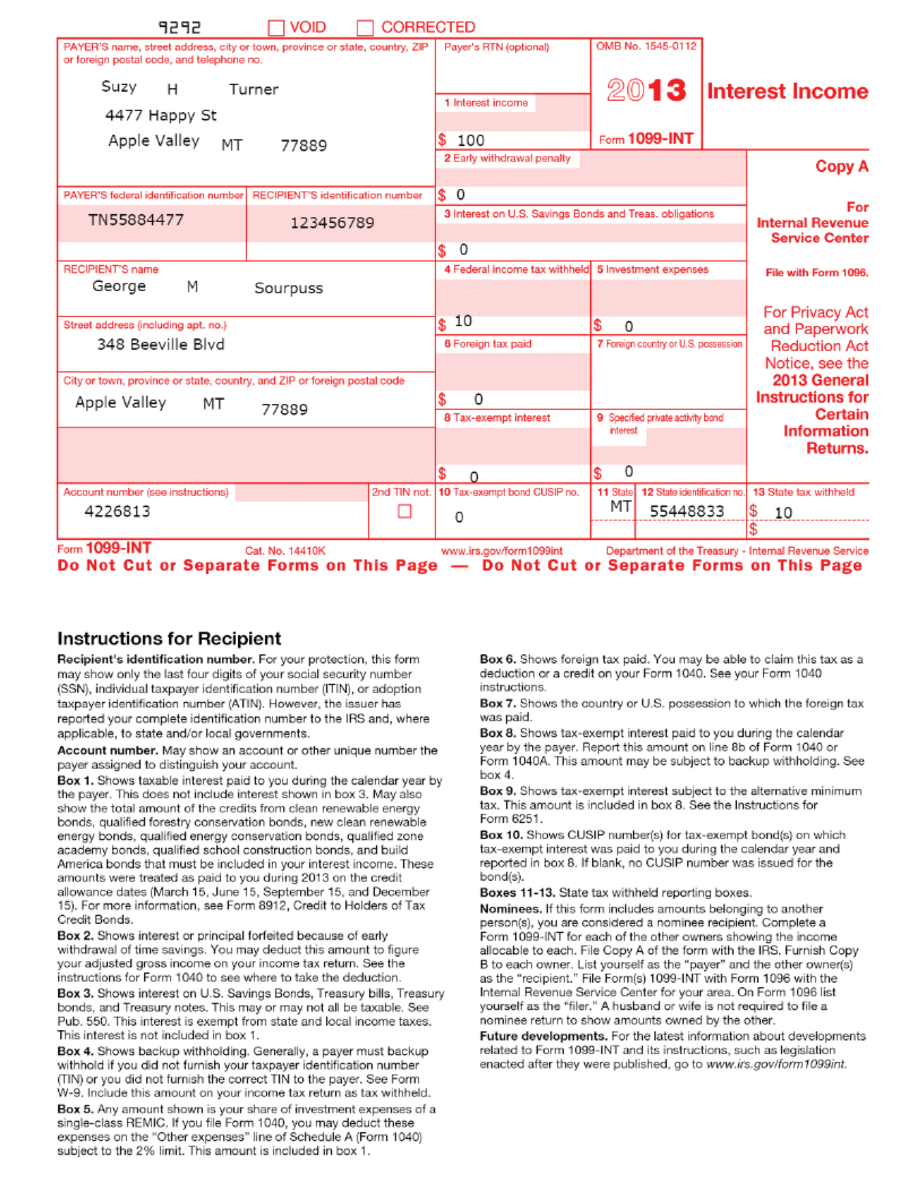

The IRS provides taxpayers with printable 1099 forms that can be easily accessed and filled out online. These forms are available on the IRS website and can be downloaded and printed for submission. Printable IRS 1099 forms come in various versions depending on the type of income being reported, such as 1099-INT for interest income or 1099-MISC for miscellaneous income.

Save and Print Printable Irs 1099 Form

Printable 1099 Int Form 2024 1099 INT Tax Forms 25 Pack IRS Approved For Interest Income Reporting 1099 Int Form 2023

Printable 1099 Int Form 2024 1099 INT Tax Forms 25 Pack IRS Approved For Interest Income Reporting 1099 Int Form 2023

When filling out a printable IRS 1099 form, it is important to accurately report the income earned and provide the necessary information, such as your name, address, and Social Security number. Additionally, you will need to provide the recipient’s information, including their name, address, and taxpayer identification number.

Once the form is completed, you can either mail it to the IRS or submit it electronically through the IRS e-file system. It is important to file the form by the deadline to avoid penalties and interest charges. The deadline for filing 1099 forms varies depending on the type of income being reported, so be sure to check the IRS website for specific deadlines.

Overall, printable IRS 1099 forms are a convenient way to report income and ensure compliance with tax laws. By accurately filling out and submitting these forms, you can avoid potential penalties and ensure that your tax return is filed correctly. Be sure to keep a copy of the form for your records and consult with a tax professional if you have any questions about reporting income on your tax return.

In conclusion, printable IRS 1099 forms are an essential tool for reporting various types of income to the IRS. By accurately filling out and submitting these forms, you can ensure compliance with tax laws and avoid penalties. Be sure to take advantage of these printable forms to accurately report your income and file your tax return on time.