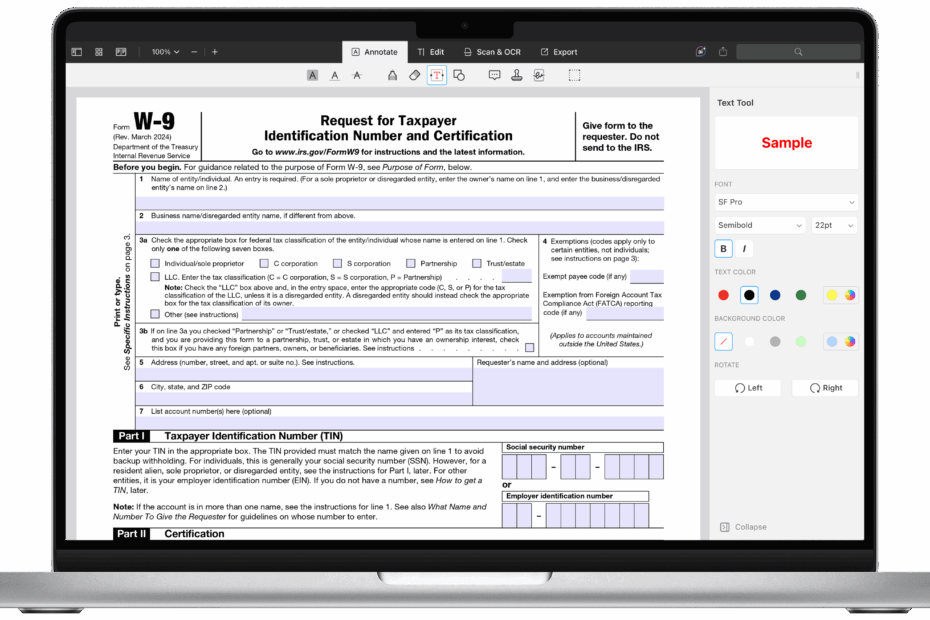

Are you a freelancer or independent contractor who needs to provide your taxpayer identification number to clients? If so, you may be familiar with the W9 form. The IRS W9 form is a document used by businesses to request the taxpayer identification number of a freelancer or independent contractor for tax purposes.

For the year 2024, the IRS has updated the W9 form to ensure accurate reporting and compliance with tax laws. It is important for freelancers and independent contractors to fill out this form correctly to avoid any issues with their taxes.

Save and Print Irs W9 Form 2024 Printable

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

When filling out the IRS W9 form, individuals will need to provide their name, business name (if applicable), taxpayer identification number (usually their social security number), address, and any other relevant information requested on the form. This information is crucial for businesses to accurately report payments made to freelancers and independent contractors.

It is important to note that the IRS W9 form is not submitted to the IRS itself. Instead, it is kept on file by the business requesting the information. This form helps businesses ensure they are complying with tax laws and reporting accurate information to the IRS.

Freelancers and independent contractors should be diligent in completing the IRS W9 form accurately and promptly when requested by a business. Failure to provide this information could result in delays in payment or even potential legal issues down the line. It is best to be proactive and ensure all necessary tax documentation is in order.

Overall, the IRS W9 form for 2024 is an essential document for freelancers and independent contractors to provide to businesses that they work with. By accurately completing this form, individuals can ensure that their tax information is reported correctly and avoid any potential issues with the IRS.

As tax laws and regulations continue to evolve, it is important for freelancers and independent contractors to stay informed and compliant with all requirements. The IRS W9 form is just one of the many tools available to help individuals navigate the complex world of taxes and ensure they are meeting all necessary obligations.