When it comes to tax season, one of the most important forms you’ll need to fill out is the IRS W4 form. This form is used by employers to determine how much federal income tax to withhold from an employee’s paycheck. It’s crucial to fill out this form accurately to avoid any under or over withholding of taxes.

For the year 2025, the IRS has released an updated version of the W4 form that is available for printing. This printable form makes it easy for employees to fill out the necessary information and submit it to their employer. It’s important to review this form each year to ensure that your tax withholding is accurate based on your current financial situation.

Easily Download and Print Irs W4 Form 2025 Printable

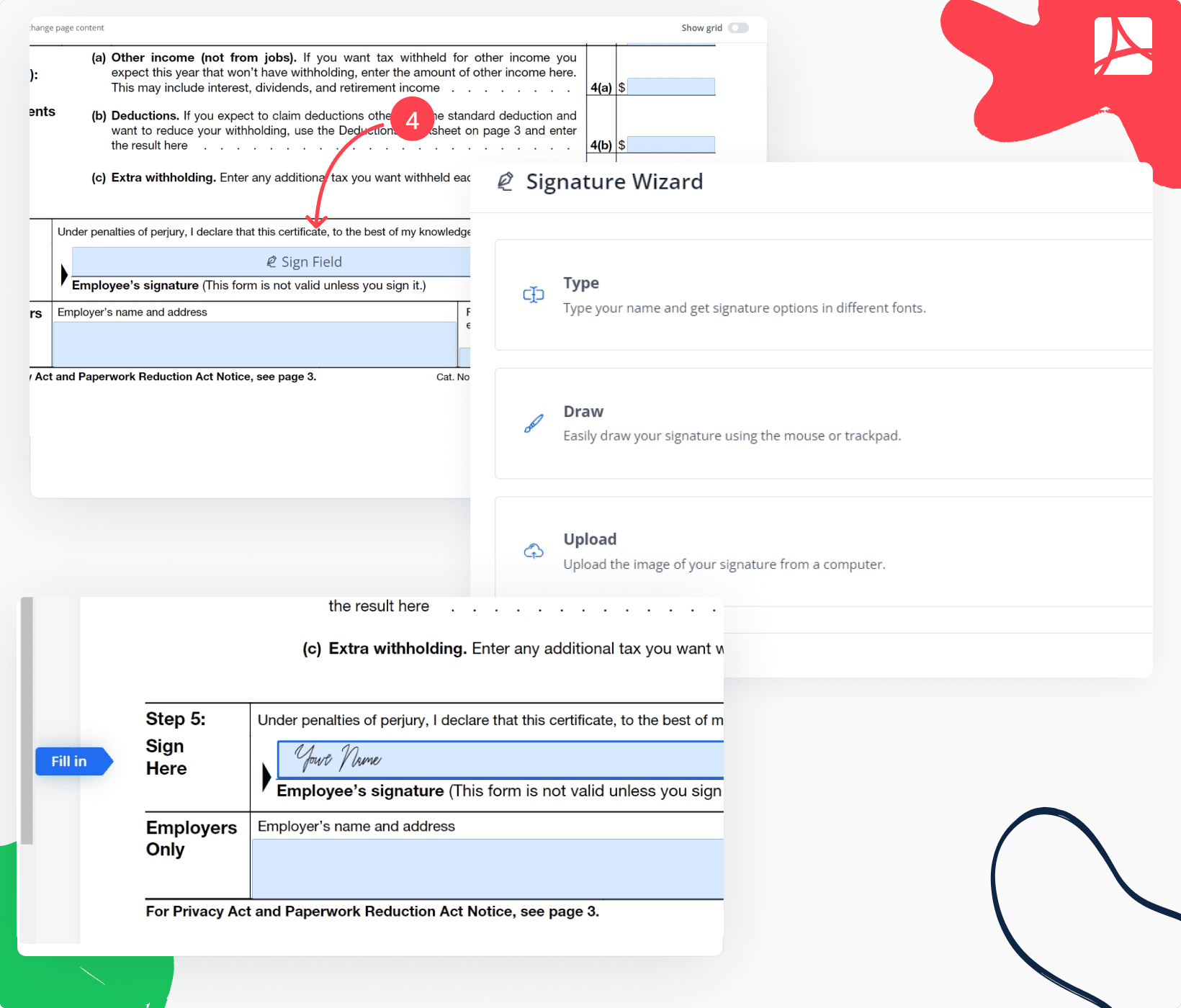

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

Irs W4 Form 2025 Printable

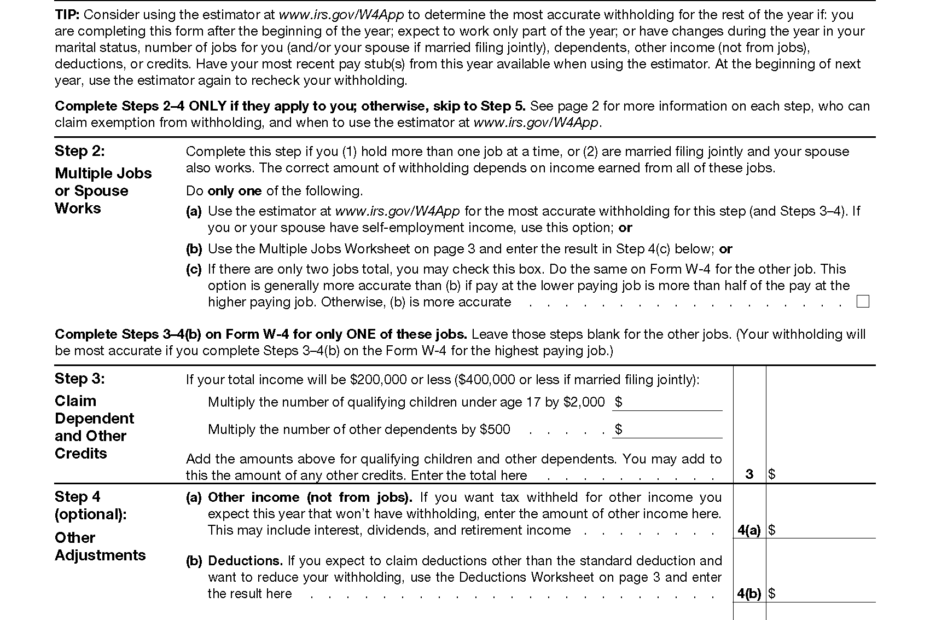

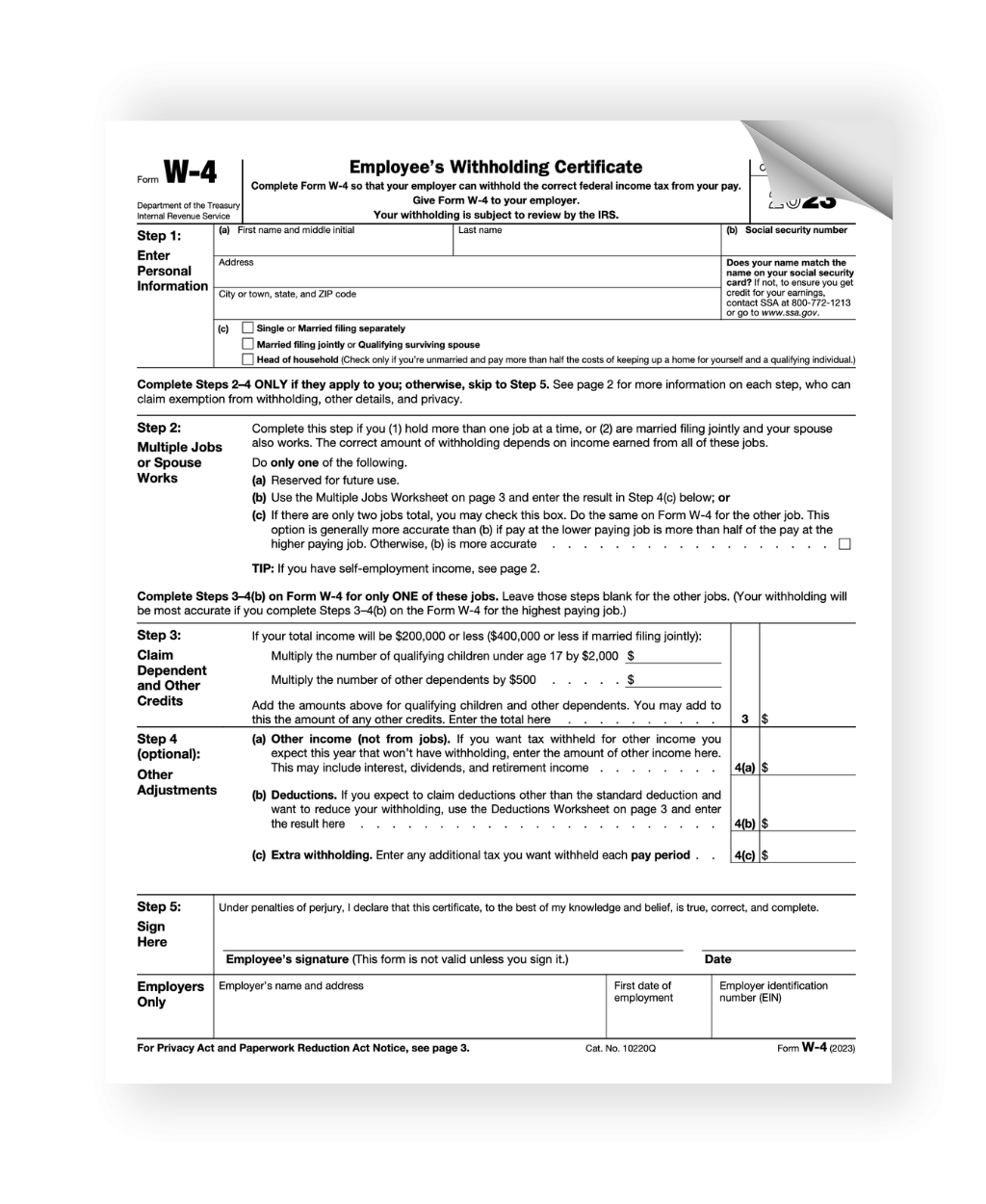

The IRS W4 form for 2025 includes sections for personal information, such as your name, address, and social security number. It also includes sections for indicating your filing status, any dependents you may have, and any additional income or deductions you want to take into account when calculating your withholding.

One of the key changes in the 2025 W4 form is the removal of allowances. Instead of claiming a certain number of allowances, you will now indicate any additional income or deductions that should be taken into account when calculating your withholding. This simplifies the process and ensures a more accurate withholding amount.

It’s important to take the time to carefully review and fill out the W4 form to avoid any potential issues with your tax withholding. By using the printable form provided by the IRS, you can easily submit the necessary information to your employer and ensure that your taxes are withheld correctly throughout the year.

Overall, the IRS W4 form for 2025 is a crucial document that helps ensure accurate tax withholding for employees. By utilizing the printable form available, you can easily provide the necessary information to your employer and avoid any potential issues with your taxes. Be sure to review and update your W4 form each year to reflect any changes in your financial situation and ensure that your withholding is accurate.

Make sure to download and fill out the IRS W4 form for 2025 to stay on top of your tax obligations and avoid any surprises come tax season.