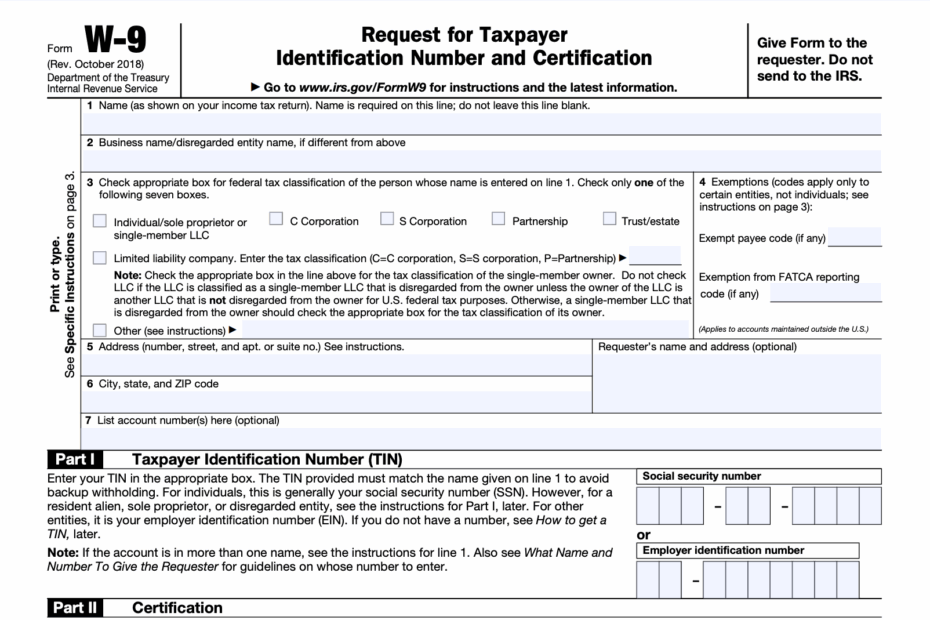

When it comes to tax season, one of the most important forms you may need to fill out is the W-9 form. This form is used by businesses to request information from independent contractors or vendors they plan to pay during the year. It is crucial for both parties to have accurate information on file to ensure tax compliance.

It is important to note that the W-9 form is not submitted to the IRS but is kept on file by the business that requested it. This form includes information such as the recipient’s name, address, and taxpayer identification number (TIN). Failure to provide accurate information on the W-9 form could result in penalties or tax issues down the road.

Easily Download and Print Irs Printable W 9 Form

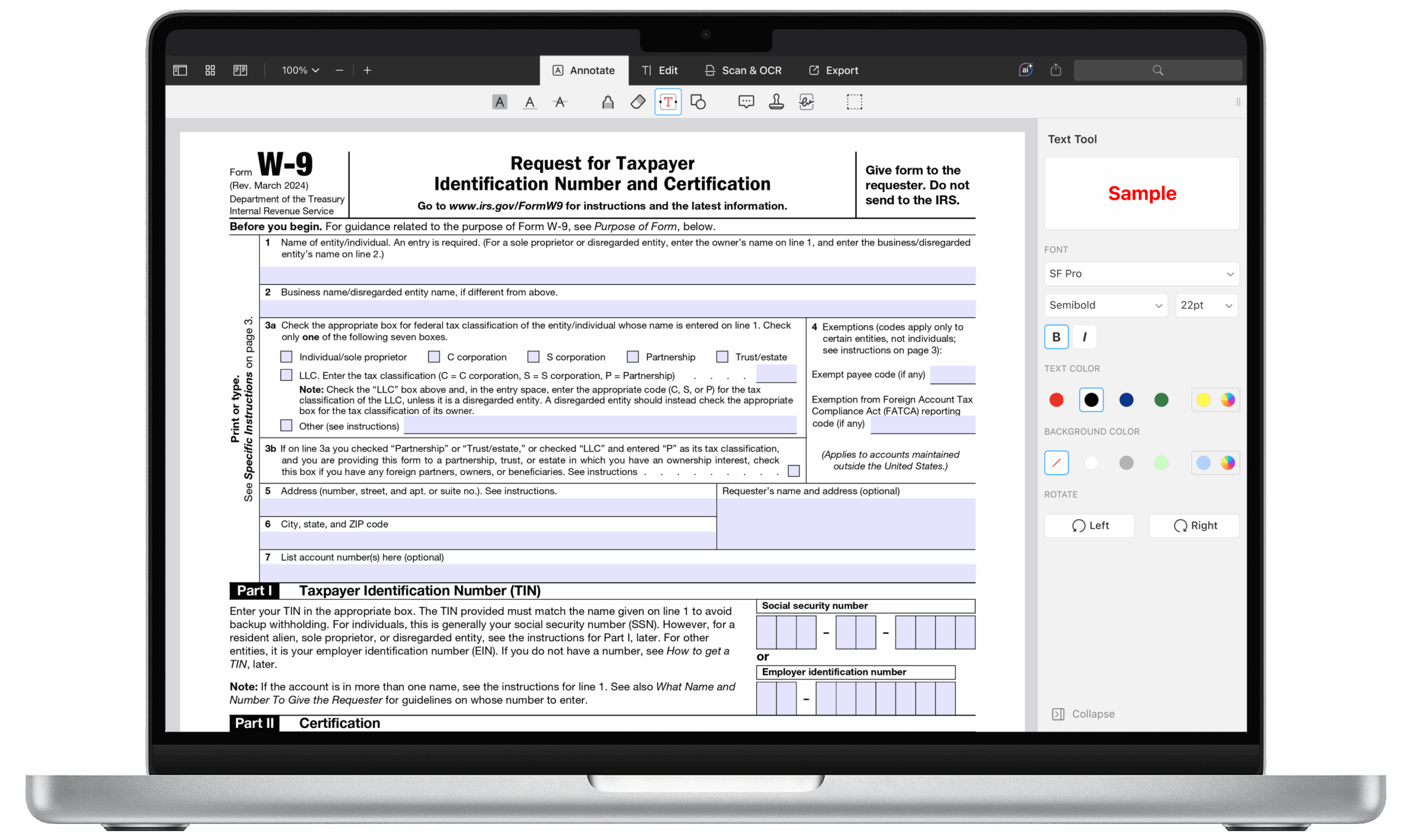

Fillable W 9 Form Template Formstack Documents

Fillable W 9 Form Template Formstack Documents

When filling out the W-9 form, it is essential to ensure all information is accurate and up to date. Any discrepancies could lead to delays in payment or potential issues with the IRS. It is always best to double-check the form before submitting it to the requesting party.

One of the benefits of the W-9 form is that it is easy to access and print. The IRS provides a printable version of the form on their website, making it convenient for individuals and businesses to obtain the necessary documentation. This saves time and ensures that all parties have the correct form on file.

In conclusion, the IRS printable W-9 form is a vital document for businesses and independent contractors alike. It is crucial to provide accurate information on this form to avoid any potential tax issues in the future. By utilizing the printable version provided by the IRS, individuals can easily access and fill out the form, ensuring compliance with tax regulations.