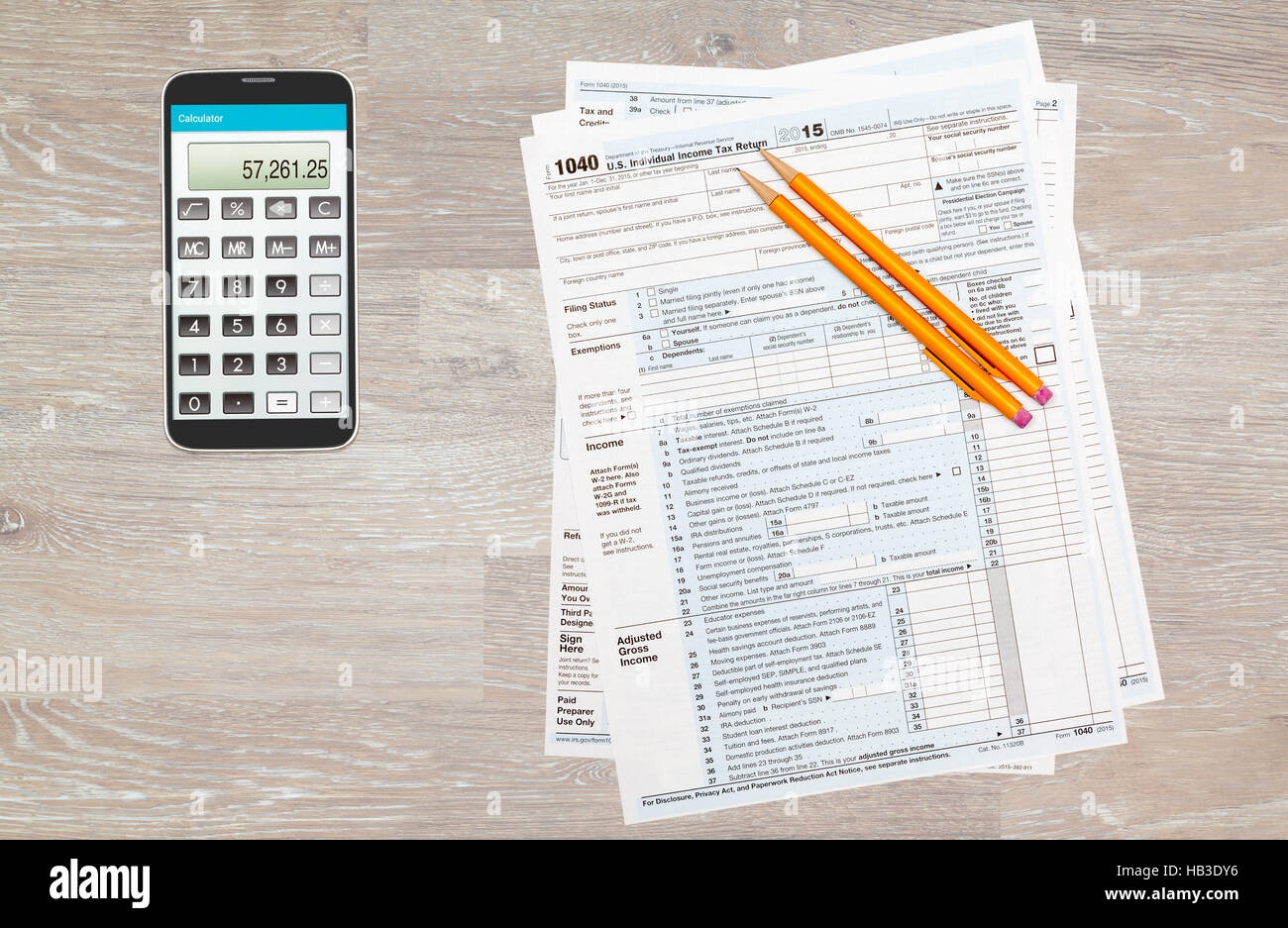

As tax season approaches, it’s important to make sure you have all the necessary forms to file your taxes accurately and on time. One resource that can be incredibly helpful is the IRS Printable Tax Forms 2015. These forms are easily accessible online and can be downloaded and printed for your convenience.

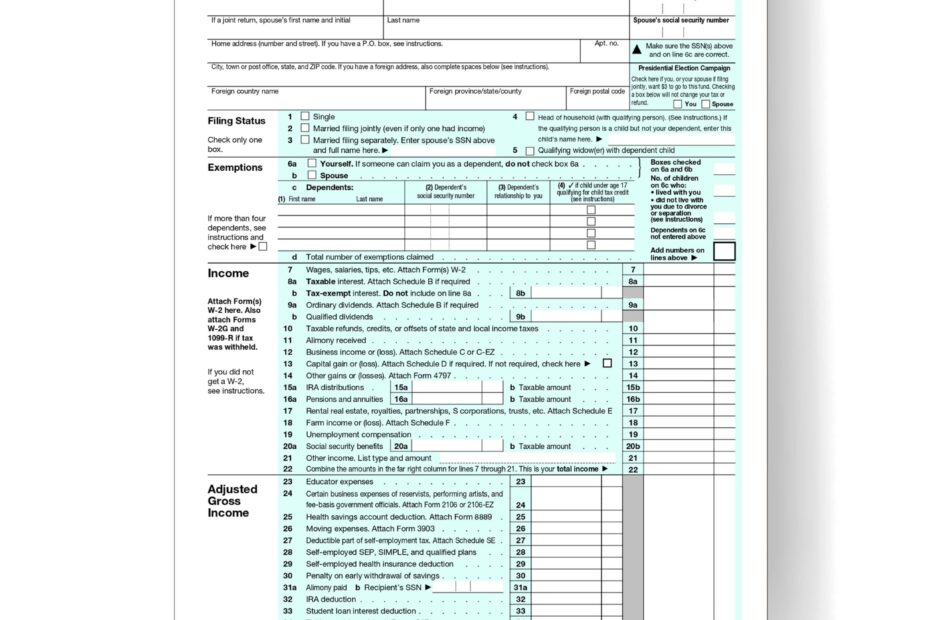

Whether you’re filing as an individual, a business, or a non-profit organization, the IRS Printable Tax Forms 2015 has everything you need to complete your tax return. From the 1040 form for individual income taxes to the various schedules and worksheets for deductions and credits, these forms cover a wide range of tax situations.

Save and Print Irs Printable Tax Forms 2015

2015 Irs 1040 Form Hi Res Stock Photography And Images Alamy

2015 Irs 1040 Form Hi Res Stock Photography And Images Alamy

Irs Printable Tax Forms 2015

One of the most commonly used forms from the IRS Printable Tax Forms 2015 is the 1040 form. This form is used by individuals to report their annual income and calculate their tax liability. It also allows taxpayers to claim various deductions and credits to reduce their tax bill. Additionally, there are separate forms for self-employment income, investment income, and rental income, among others.

For businesses, the IRS Printable Tax Forms 2015 includes forms such as the 1120 for corporations, the 1065 for partnerships, and the Schedule C for sole proprietors. These forms are essential for reporting business income, expenses, and deductions to determine the business’s tax liability for the year.

Non-profit organizations can also find the necessary forms in the IRS Printable Tax Forms 2015. These forms include the 990 for tax-exempt organizations, which details the organization’s finances, activities, and governance. Non-profits must file this form annually to maintain their tax-exempt status.

In conclusion, the IRS Printable Tax Forms 2015 are a valuable resource for individuals, businesses, and non-profit organizations to accurately report their income and expenses and calculate their tax liability. By using these forms, taxpayers can ensure they are complying with IRS regulations and avoid any potential penalties for inaccuracies or omissions on their tax returns.