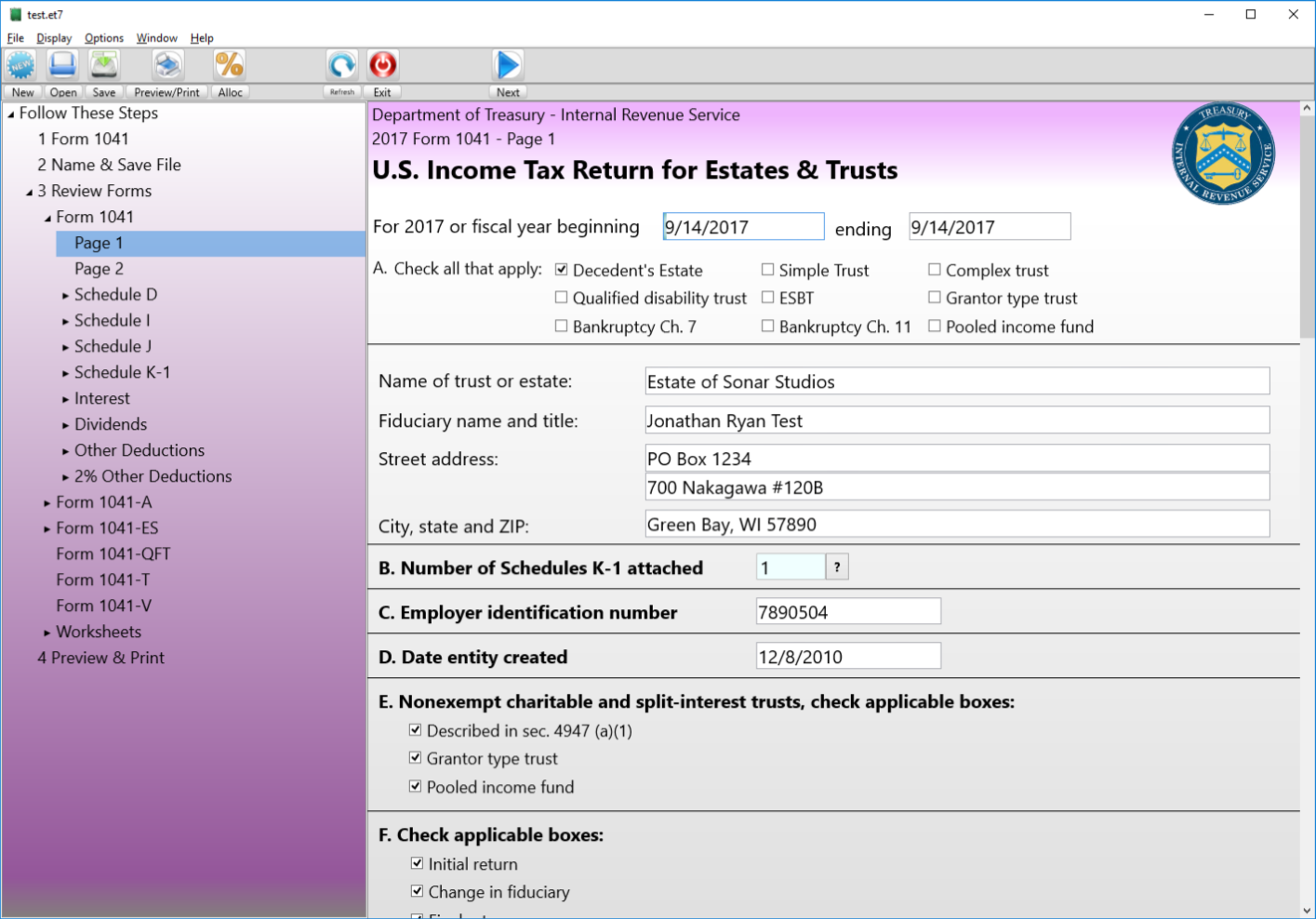

When it comes to filing taxes, it’s important to have all the necessary forms and documents ready. One such form that individuals and businesses may need to fill out is Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts. This form is used to report income, deductions, and credits for estates and trusts, and is required to be filed annually with the Internal Revenue Service (IRS).

Form 1041 is essential for estates and trusts that generate income, as it helps determine the tax liability for these entities. It is important to accurately fill out this form to avoid any penalties or fines from the IRS. Fortunately, the IRS provides a printable version of Form 1041 on their website, making it easy for individuals and businesses to access and complete.

Download and Print Irs Printable Form 1041

U S Estate U0026 Trust Income Tax 1041 2024 Puritas Springs Legal Software

U S Estate U0026 Trust Income Tax 1041 2024 Puritas Springs Legal Software

Irs Printable Form 1041

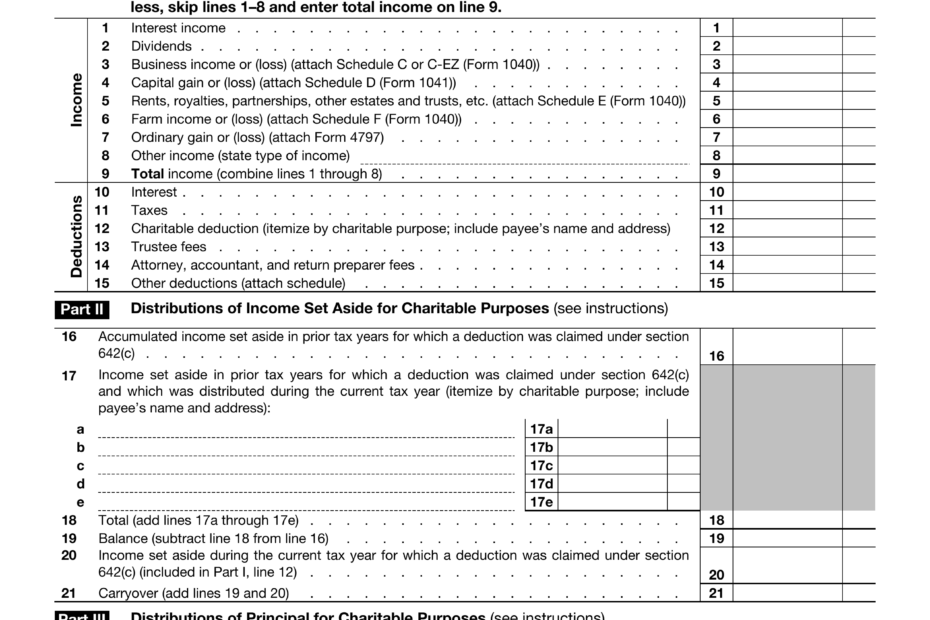

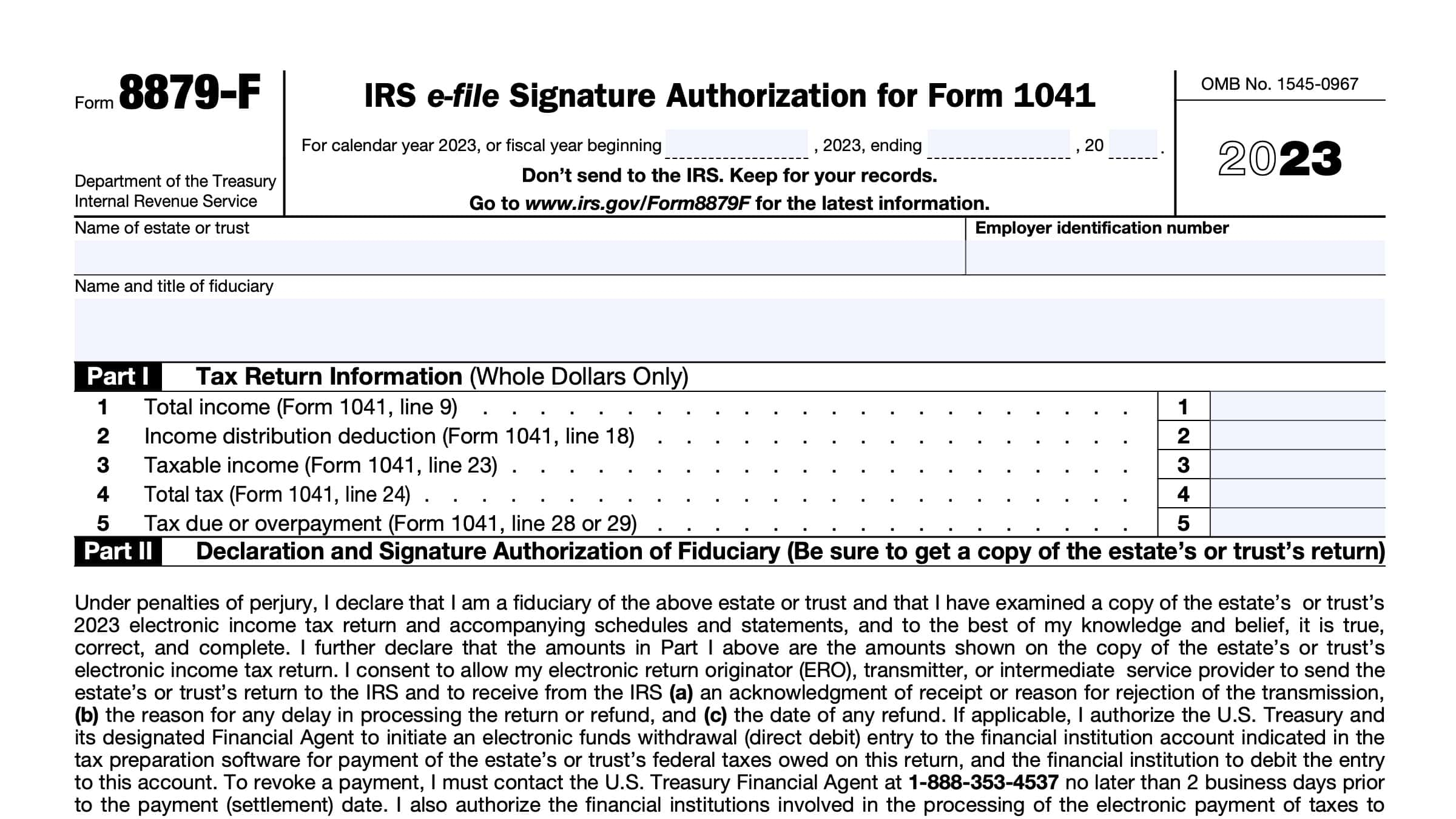

When filling out Form 1041, individuals and businesses will need to provide information such as the estate or trust’s income, deductions, credits, and tax liability. It is important to carefully review the instructions provided by the IRS to ensure that the form is filled out correctly. Additionally, individuals and businesses may need to attach additional schedules and forms to fully report their income and deductions.

One important aspect of Form 1041 is the distribution of income to beneficiaries. This information is crucial for determining the tax liability of the estate or trust, as well as the tax liability of the beneficiaries. It is important to accurately report this information to avoid any discrepancies or audits from the IRS.

After completing Form 1041, individuals and businesses will need to file the form with the IRS by the deadline. The deadline for filing Form 1041 is typically April 15th, unless an extension has been granted. It is important to file the form on time to avoid any penalties or fines from the IRS.

In conclusion, Form 1041 is an important document for estates and trusts that generate income. By accurately filling out this form and submitting it to the IRS on time, individuals and businesses can ensure compliance with tax laws and avoid any penalties or fines. The IRS provides a printable version of Form 1041 on their website, making it easy for individuals and businesses to access and complete.