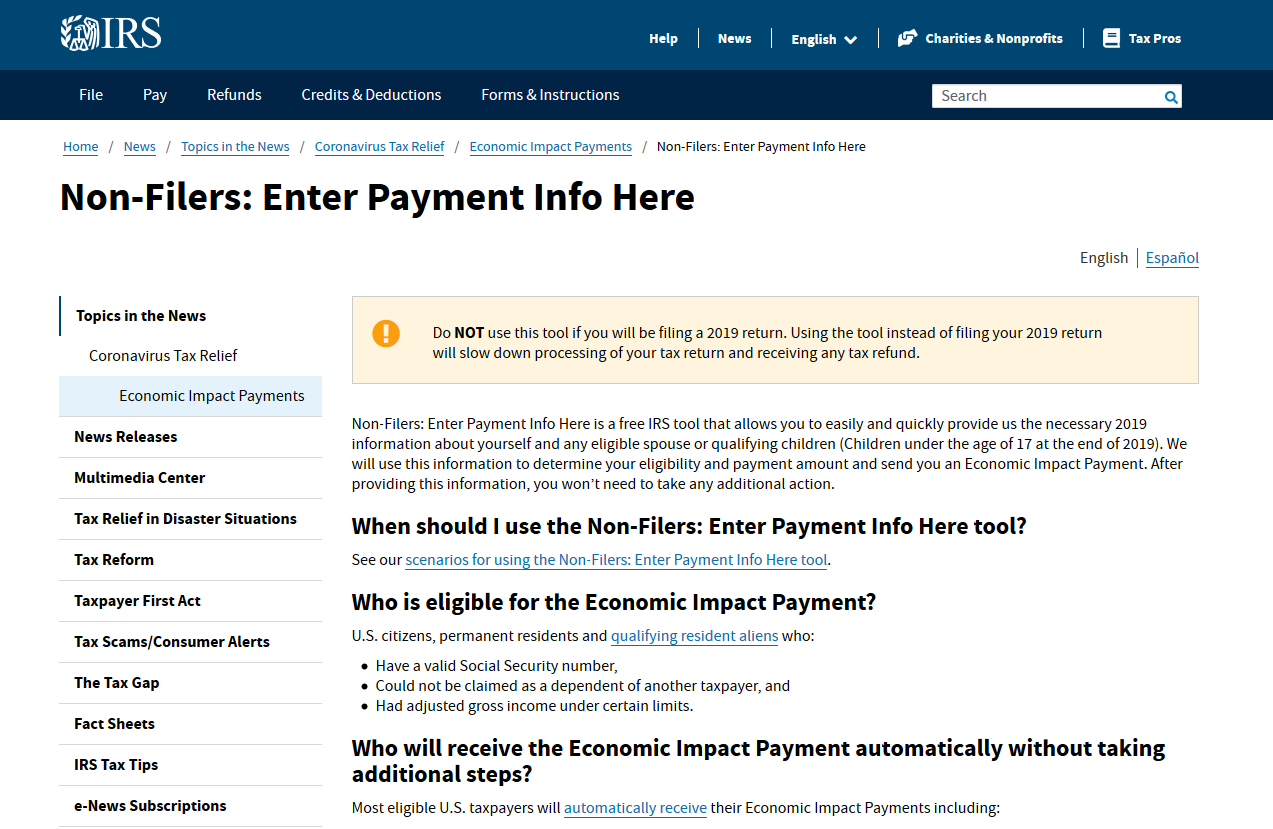

Are you someone who hasn’t filed your taxes with the IRS? If so, you may need to use the IRS Non Filer Form Printable. This form is designed for individuals who did not earn enough income to require filing a tax return. It is a simple way to provide the IRS with your basic information so they can determine your eligibility for certain benefits or stimulus payments.

By using the IRS Non Filer Form Printable, you can avoid any penalties for not filing your taxes on time. It is a quick and easy way to ensure that the IRS has your current information on file. This form can also be helpful if you missed the deadline to file your taxes and need to provide the IRS with your information promptly.

Get and Print Irs Non Filer Form Printable

New IRS Site Could Make It Easy For Thieves To Intercept Some

New IRS Site Could Make It Easy For Thieves To Intercept Some

IRS Non Filer Form Printable

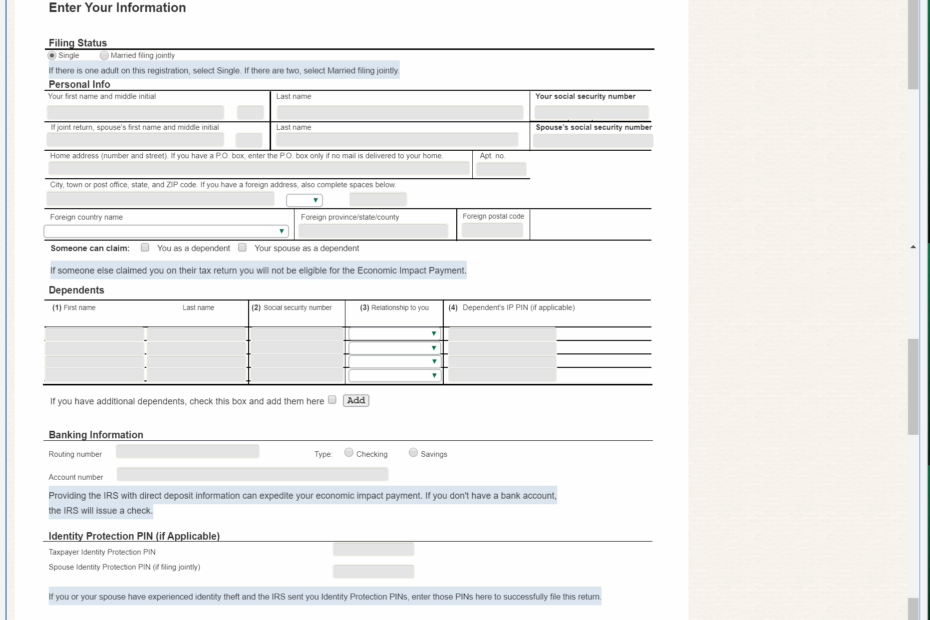

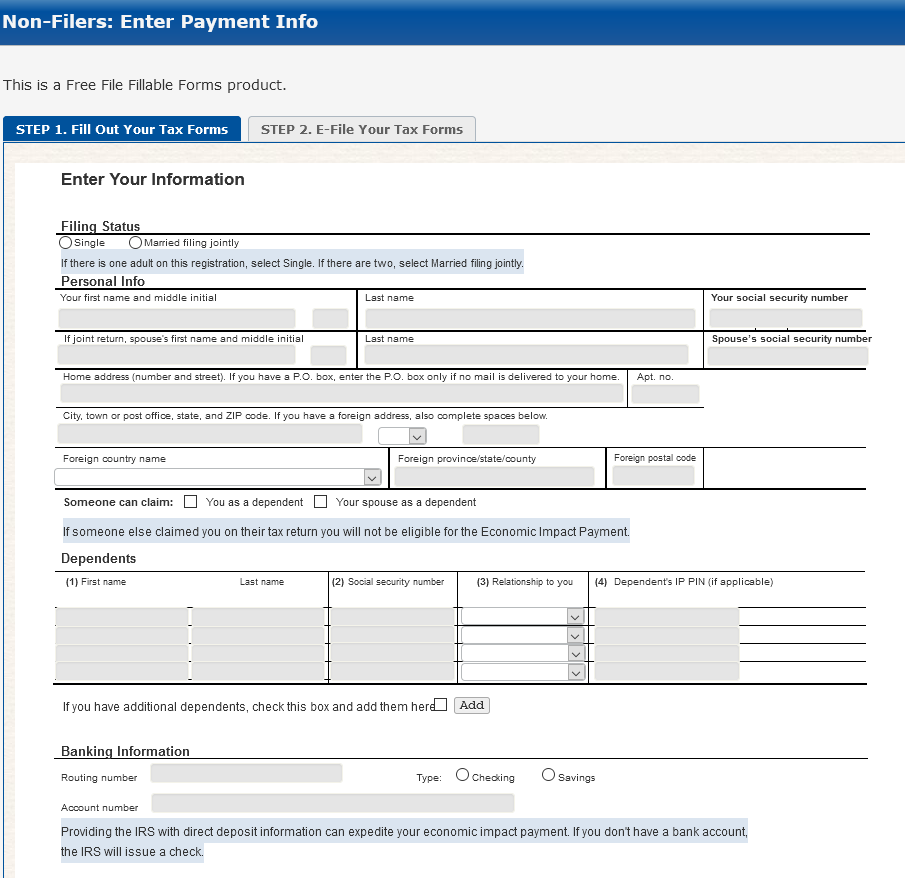

When filling out the IRS Non Filer Form Printable, you will need to provide your basic information such as your name, address, social security number, and any dependents you may have. You will also need to indicate if someone can claim you as a dependent on their tax return. Once you have completed the form, you can either mail it to the IRS or submit it online through their website.

It is important to note that the IRS Non Filer Form Printable is only for individuals who did not earn enough income to require filing a tax return. If you have earned income and are required to file taxes, you will need to use the appropriate tax forms provided by the IRS. Additionally, if you receive any income that is reported to the IRS (such as wages or unemployment benefits), you will need to report this income on your tax return.

Overall, the IRS Non Filer Form Printable is a useful tool for individuals who did not earn enough income to require filing a tax return. It is a simple way to provide the IRS with your basic information so they can determine your eligibility for certain benefits or stimulus payments. By using this form, you can ensure that the IRS has your current information on file and avoid any penalties for not filing your taxes on time.

So, if you find yourself in a situation where you need to provide the IRS with your information but did not earn enough income to require filing a tax return, be sure to use the IRS Non Filer Form Printable to meet your obligations.