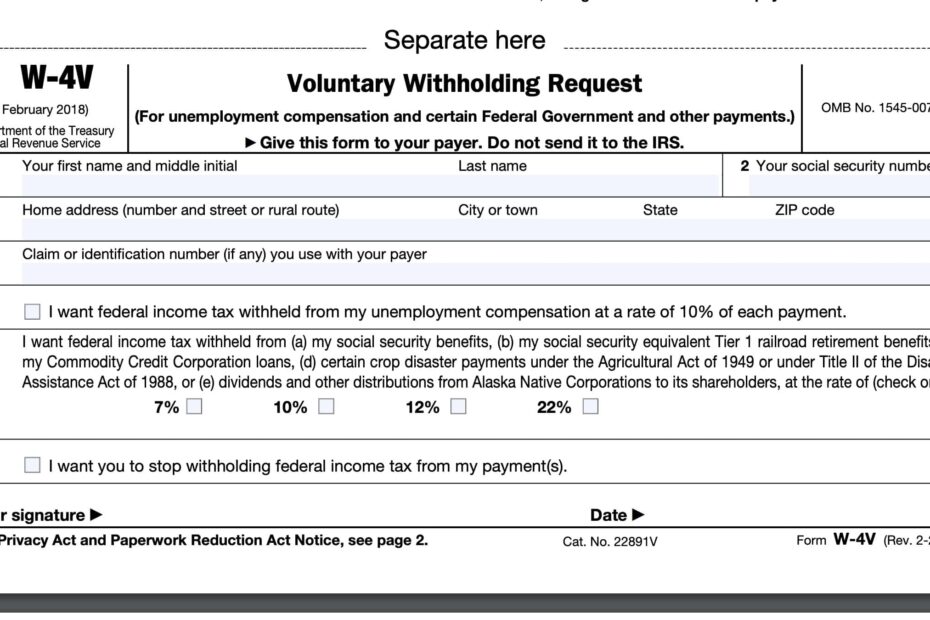

When it comes to taxes, it’s important to stay organized and keep track of all necessary forms. One important form that individuals may need to fill out is the IRS Form W-4V. This form is used to request a withholding of federal income tax from certain government payments, such as Social Security benefits.

It’s essential to understand how to properly fill out and submit this form in order to avoid any issues with your tax withholding. The IRS provides a printable version of Form W-4V on their website, making it easy for individuals to access and complete the form as needed.

Quickly Access and Print Irs Form W4v Printable

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

How to Fill Out IRS Form W-4V

When filling out IRS Form W-4V, you will need to provide your name, address, Social Security number, and the amount of federal income tax you want withheld from your payments. You will also need to specify the type of payment you are receiving, such as Social Security benefits or unemployment compensation.

It’s important to double-check all information provided on the form to ensure accuracy and avoid any potential errors. Once the form is completed, you can then submit it to the appropriate government agency that is issuing your payments.

Keep in mind that the amount of federal income tax withheld from your payments may impact your overall tax liability at the end of the year. It’s a good idea to consult with a tax professional if you have any questions or concerns about how much tax should be withheld.

By utilizing the IRS Form W-4V printable version, individuals can easily access and complete the necessary form to request federal income tax withholding from their government payments. Staying organized and up-to-date with your tax forms can help prevent any issues come tax time.

Overall, understanding how to properly fill out and submit IRS Form W-4V is crucial for individuals receiving certain government payments. By utilizing the printable version of the form provided by the IRS, individuals can easily navigate the process and ensure that their federal income tax withholding is in order.