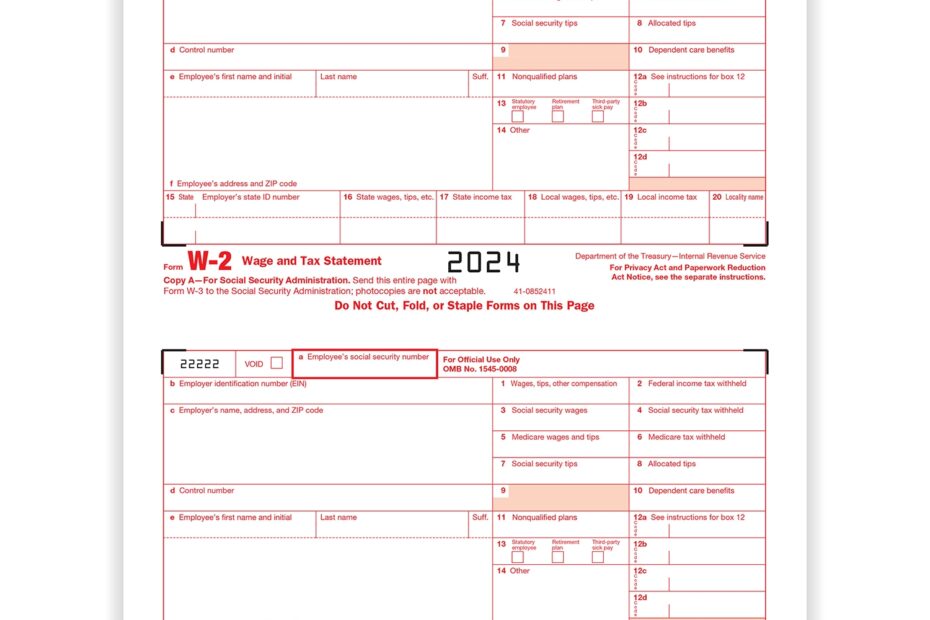

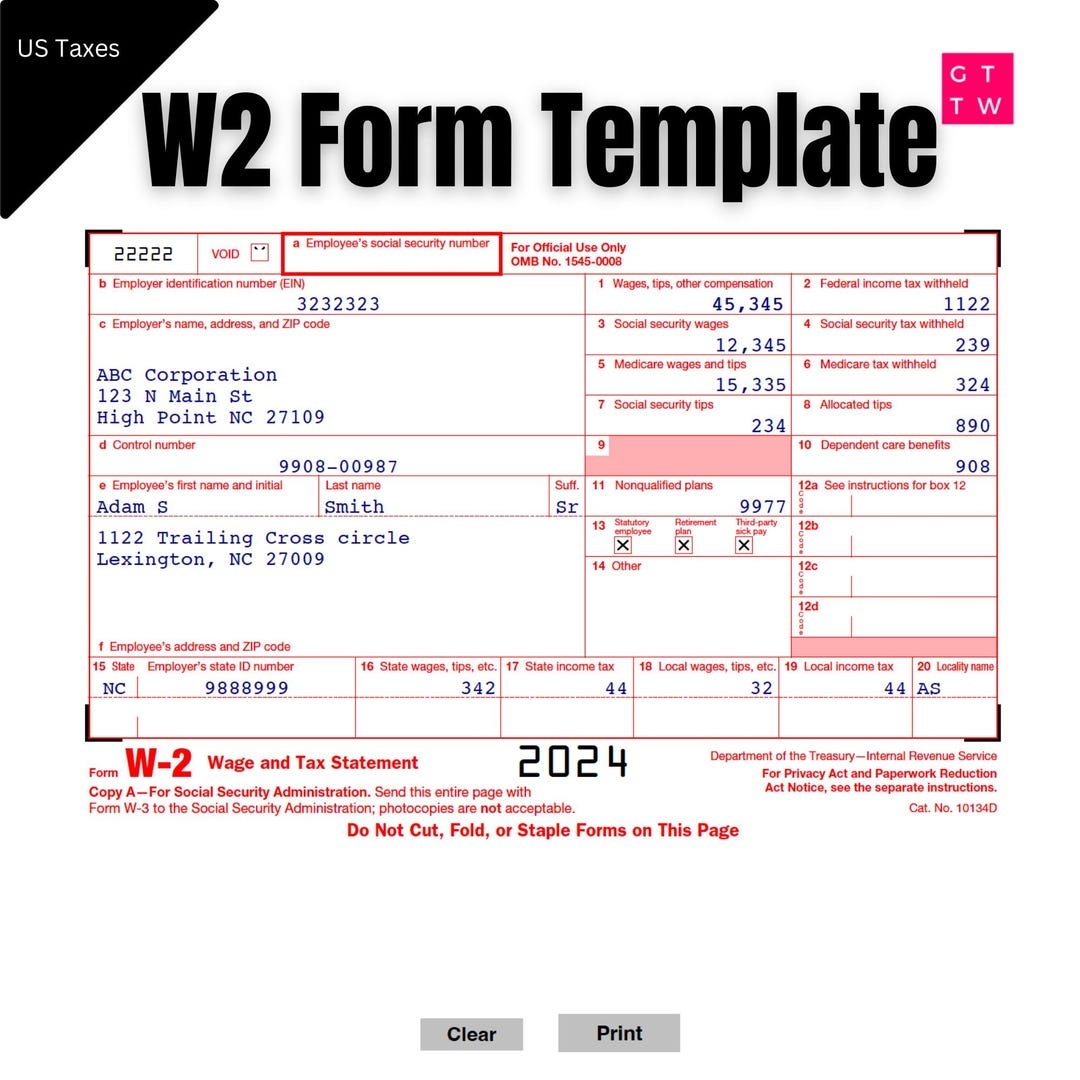

When tax season rolls around, it’s essential to have all the necessary forms ready to ensure a smooth filing process. One crucial document that many individuals need is the IRS Form W2, which reports an employee’s annual wages and the amount of taxes withheld from their paycheck. The Form W2 is typically provided by employers to their employees by the end of January each year, allowing them to accurately report their income to the IRS.

For the year 2024, the IRS has made available a printable version of the Form W2 on their website for individuals to easily access and fill out. This form is essential for both employees and employers as it provides detailed information on wages earned, taxes withheld, and any other relevant deductions. Having a printable version of the Form W2 allows individuals to complete their tax returns accurately and efficiently.

Easily Download and Print Irs Form W2 2024 Printable

Fillable W2 Form 2025 Printable IRS Template Digital Download Etsy

Fillable W2 Form 2025 Printable IRS Template Digital Download Etsy

When filling out the IRS Form W2 for the year 2024, individuals must ensure that all information is accurate and up-to-date. This includes verifying personal information such as name, social security number, and address, as well as double-checking income and tax withholding amounts. Any discrepancies or errors on the form could lead to delays in processing or potential penalties from the IRS.

Employers play a crucial role in providing employees with their Form W2 in a timely manner and ensuring that all information is correct. By using the printable version of the Form W2 for the year 2024, employers can easily generate and distribute these forms to their employees, streamlining the tax reporting process for everyone involved. It is essential for employers to comply with IRS regulations and deadlines regarding the distribution of Form W2 to avoid any penalties.

Overall, the IRS Form W2 for the year 2024 is a vital document that individuals need to accurately report their income and taxes to the IRS. By utilizing the printable version of this form, individuals can ensure that all information is correct and submit their tax returns on time. Employers also play a crucial role in providing employees with their Form W2 and must adhere to IRS guidelines to avoid any potential repercussions. With the right tools and resources, tax season can be a smooth and straightforward process for everyone involved.