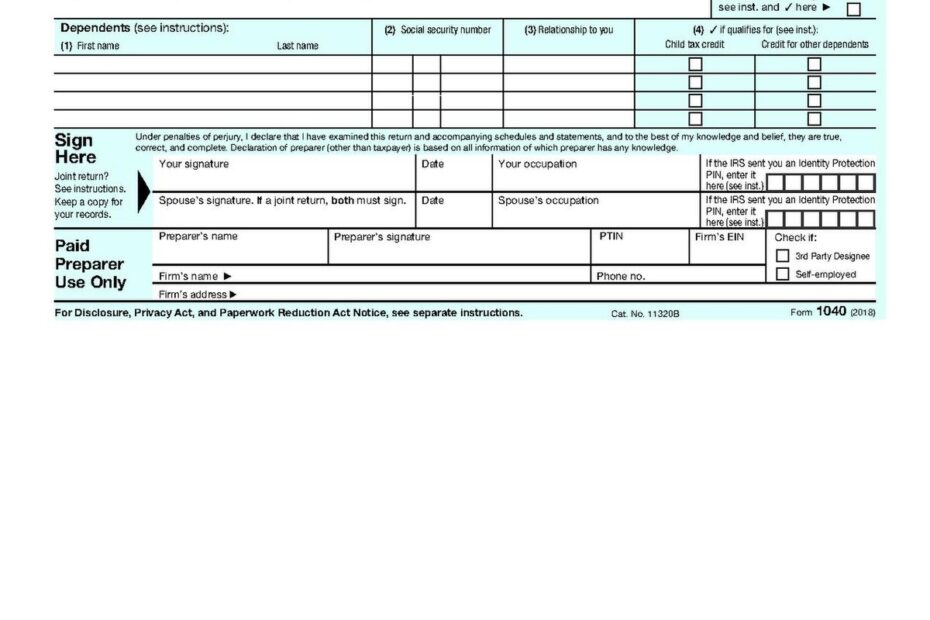

IRS Form 1040 is the standard tax form used by individuals to file their annual income tax returns with the Internal Revenue Service (IRS) in the United States. This form is used to report income, calculate and pay taxes owed, and claim any tax deductions or credits.

For many taxpayers, the process of filling out Form 1040 can be daunting and confusing. That’s why having access to free printable versions of the form can be incredibly helpful. With a printable Form 1040, individuals can easily fill out their tax information and submit it to the IRS without the need for expensive tax preparation software or services.

Save and Print Free Printable Irs Form 1040

Free 1040 Form Generator Fillable 1040 By Jotform

Free 1040 Form Generator Fillable 1040 By Jotform

Free Printable IRS Form 1040

There are several websites and online resources that offer free printable versions of IRS Form 1040. These forms are typically available in PDF format, making them easy to download, print, and fill out. By using a printable Form 1040, taxpayers can save time and money while still ensuring that their taxes are filed accurately and on time.

When using a printable Form 1040, it’s important to carefully follow the instructions provided by the IRS. This will help ensure that all necessary information is included and that the form is filled out correctly. Additionally, taxpayers should double-check their calculations and review their completed form before submitting it to the IRS to avoid any potential errors or delays.

Overall, having access to free printable IRS Form 1040 can make the tax filing process much easier and more convenient for individuals. By using these printable forms, taxpayers can save time and money while still meeting their legal obligation to report their income and pay any taxes owed to the government.

So, if you’re getting ready to file your taxes and need a copy of IRS Form 1040, be sure to take advantage of the free printable versions available online. With just a few clicks, you can have your tax form in hand and be one step closer to completing your annual tax return.