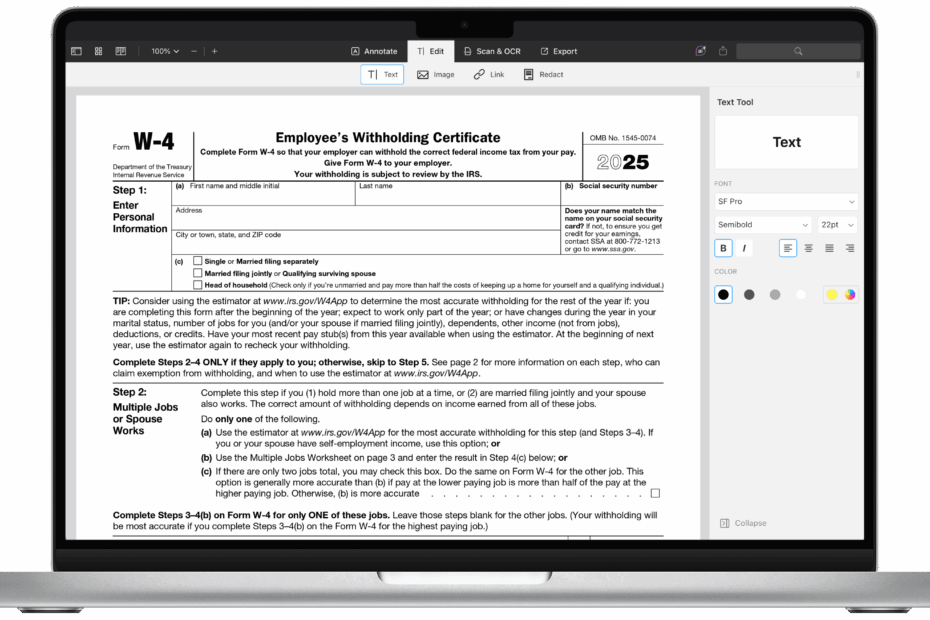

When starting a new job, one of the important forms you will need to fill out is the W4 form. This form is used by your employer to determine how much federal income tax to withhold from your paycheck. It’s crucial to fill out this form accurately to avoid any discrepancies in your tax withholding.

However, filling out a physical W4 form can sometimes be a hassle, especially if you need to make changes to your withholding throughout the year. That’s where printable W4 forms come in handy. With a printable W4 form, you can easily make changes and update your withholding whenever necessary.

Save and Print Printable W4 Form Irs

Printable W4 Form IRS

Printable W4 forms provided by the IRS are readily available online. These forms are in PDF format, making it easy to download, print, and fill out at your convenience. Whether you’re starting a new job, getting married, or having a child, you can use a printable W4 form to update your withholding status.

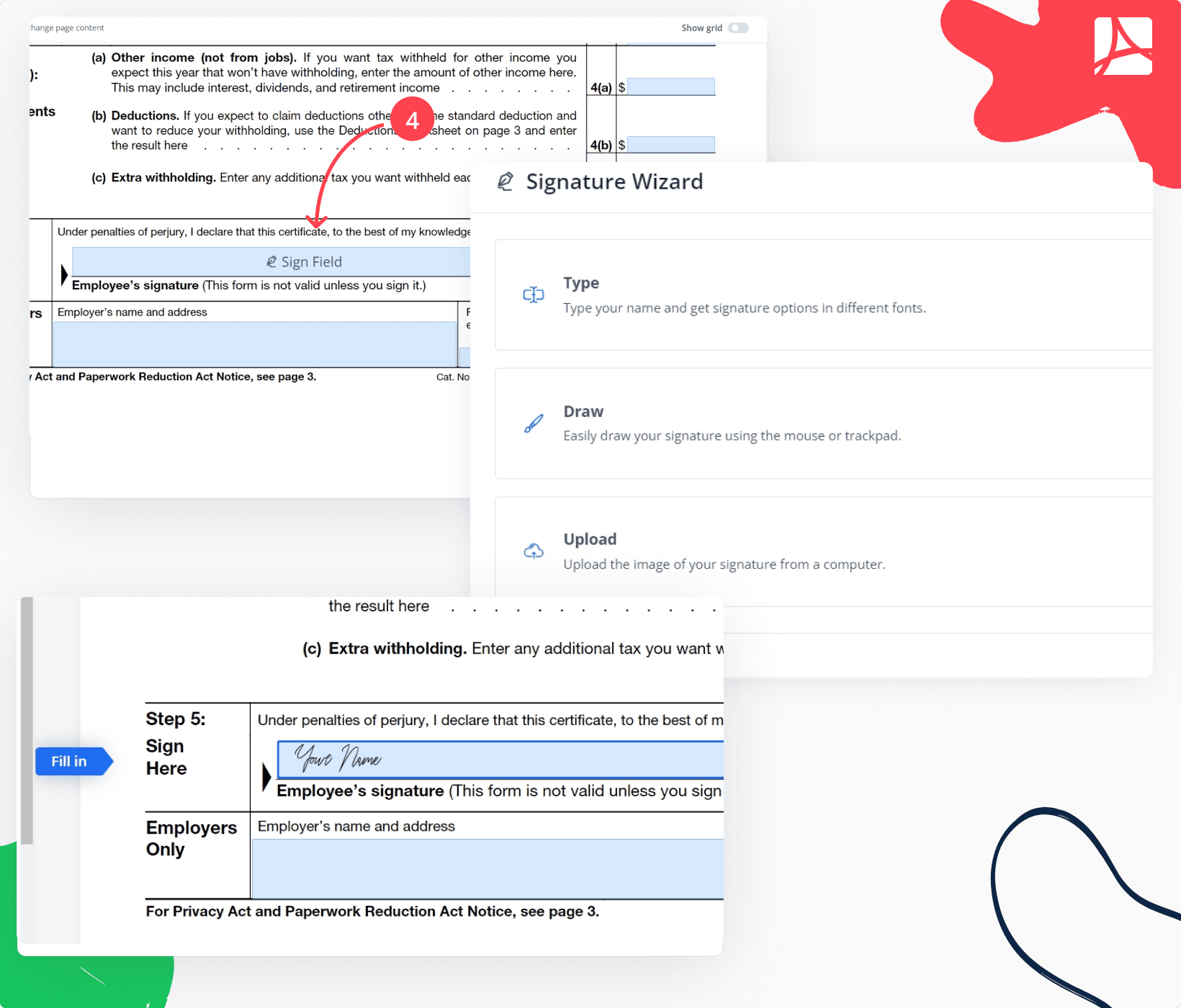

When filling out a printable W4 form, make sure to carefully follow the instructions provided by the IRS. You will need to provide information such as your filing status, number of dependents, and any additional withholding you wish to claim. Once completed, you can submit the form to your employer for processing.

It’s important to review your withholding periodically and make adjustments as needed. Life events such as marriage, divorce, or changes in income can impact your tax liability. By using a printable W4 form, you can easily update your withholding to ensure you’re not under or overpaying taxes.

In conclusion, printable W4 forms offered by the IRS are a convenient and efficient way to update your tax withholding. By accurately filling out this form, you can ensure that the right amount of federal income tax is withheld from your paycheck. Take advantage of printable W4 forms to stay on top of your tax obligations and avoid any surprises come tax season.