As tax season approaches, many individuals and businesses are gathering their financial documents and preparing to file their taxes. One essential part of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits to the Internal Revenue Service (IRS). In 2016, the IRS released a variety of forms that taxpayers can use to fulfill their tax obligations.

Printable IRS tax forms provide a convenient way for taxpayers to access and complete their tax documents. Whether you are filing as an individual, a small business owner, or a corporation, having access to printable forms can simplify the tax preparation process. These forms can be easily downloaded from the IRS website or obtained from tax preparation services.

Get and Print Printable Irs Tax Forms 2016

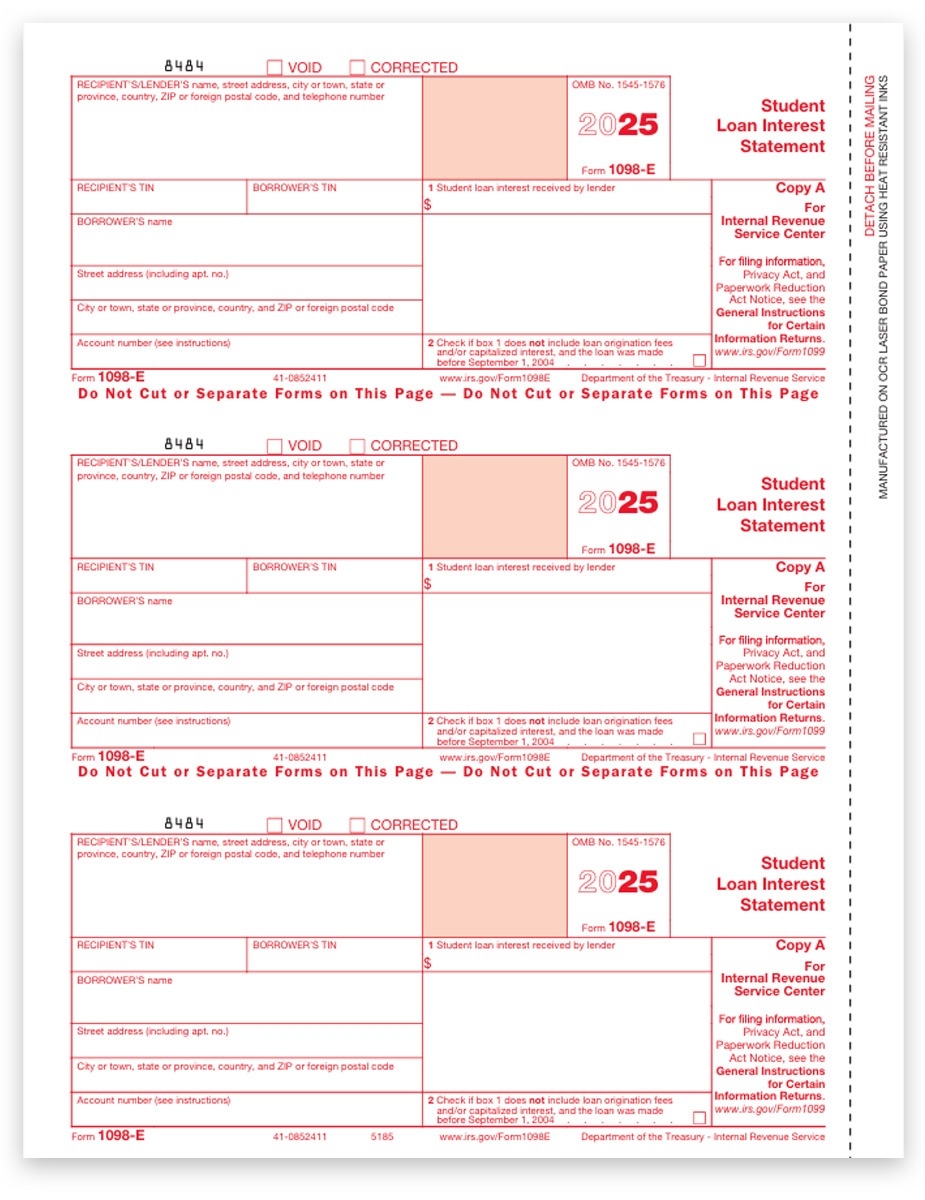

1098E Tax Forms For Student Loan Interest IRS Copy DiscountTaxForms

1098E Tax Forms For Student Loan Interest IRS Copy DiscountTaxForms

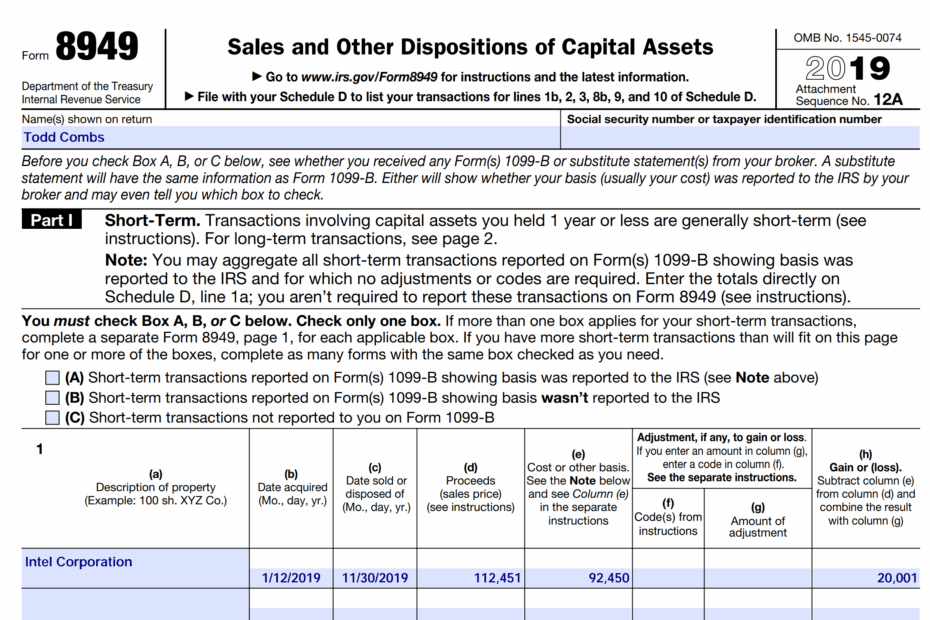

One of the most commonly used forms for individual taxpayers is the Form 1040, which is used to report income, deductions, and credits for the tax year. Additionally, Schedule A can be attached to Form 1040 to itemize deductions such as medical expenses, charitable contributions, and mortgage interest. For those who have investments, Schedule D is used to report capital gains and losses.

Small business owners and self-employed individuals may need to file Form 1099 to report income received from clients or customers. Form 1120 is used by corporations to report their income and expenses. These forms are essential for accurately reporting income and ensuring compliance with tax laws.

It is important to note that some taxpayers may be eligible for tax credits, such as the Earned Income Tax Credit or the Child Tax Credit. These credits can help reduce the amount of tax owed or provide a refund. To claim these credits, taxpayers must complete the appropriate forms and submit them with their tax return.

In conclusion, printable IRS tax forms for the year 2016 are essential tools for individuals and businesses to accurately report their income and fulfill their tax obligations. By using these forms, taxpayers can ensure that they are complying with tax laws and maximizing their deductions and credits. Whether you are filing as an individual or a business, having access to printable tax forms can make the tax preparation process easier and more efficient.