Are you feeling overwhelmed with the approaching tax deadline? Don’t worry, you’re not alone. Many taxpayers find themselves in a rush to file their taxes on time. However, if you need more time to gather your documents or simply can’t meet the deadline, you have the option to file for a tax extension with the IRS. This will give you an additional six months to file your taxes without facing any penalties.

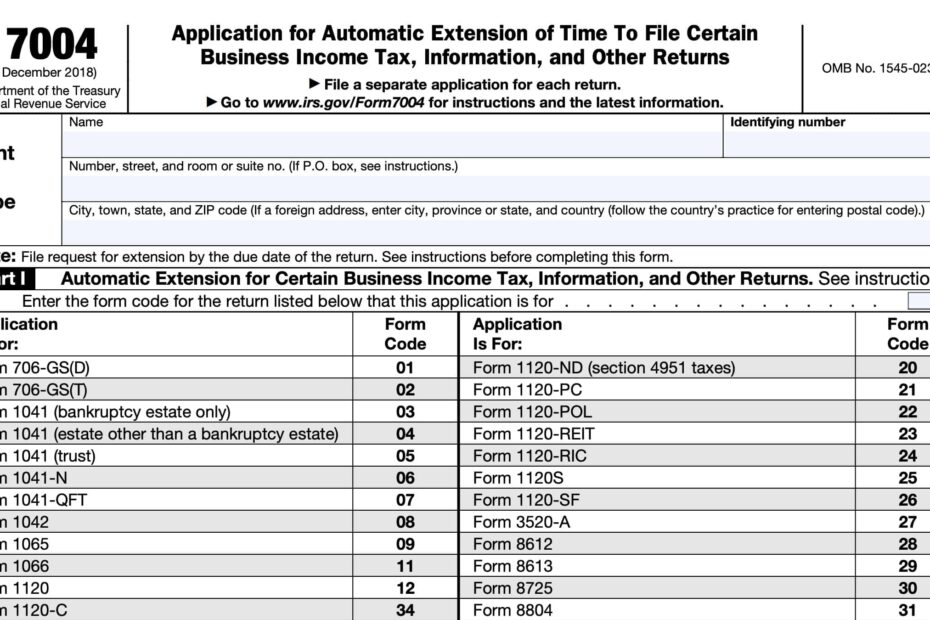

One of the easiest ways to file for a tax extension is by using the printable IRS tax extension form. This form, known as Form 4868, can be easily downloaded from the IRS website and filled out in a matter of minutes. It only requires basic information such as your name, address, social security number, and an estimate of your total tax liability for the year. Once completed, you can either mail the form to the IRS or submit it electronically.

Printable Irs Tax Extension Form

Printable Irs Tax Extension Form

Quickly Access and Print Printable Irs Tax Extension Form

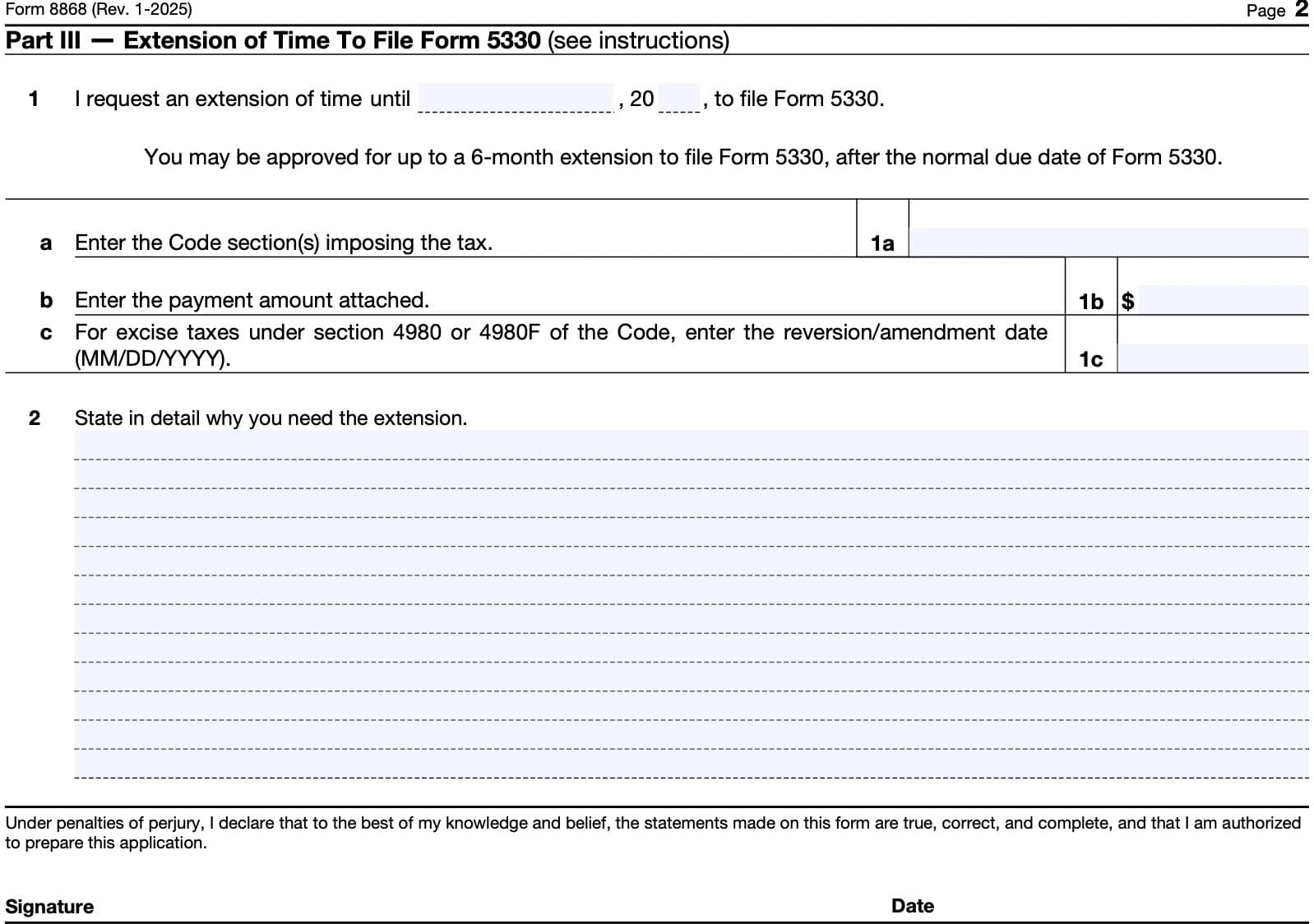

3 11 212 Applications For Extension Of Time To File Internal

3 11 212 Applications For Extension Of Time To File Internal

When filing for a tax extension, it’s important to keep in mind that while an extension gives you more time to file your taxes, it does not give you more time to pay any taxes owed. If you anticipate owing taxes, it’s recommended to make a payment along with your extension request to avoid any interest or penalties. The IRS offers several payment options, including credit card payments, electronic funds withdrawal, or mailing a check along with your form.

After submitting your tax extension form, you will receive a confirmation from the IRS confirming that your request has been approved. This will give you peace of mind knowing that you have successfully extended your filing deadline. Remember to mark the new deadline on your calendar and make a plan to file your taxes before the extended due date to avoid any last-minute stress.

In conclusion, if you find yourself in need of more time to file your taxes, consider filing for a tax extension using the printable IRS tax extension form. This simple process can save you from unnecessary penalties and give you the breathing room you need to gather all necessary documents. Take advantage of this option and ensure that you file your taxes accurately and on time.