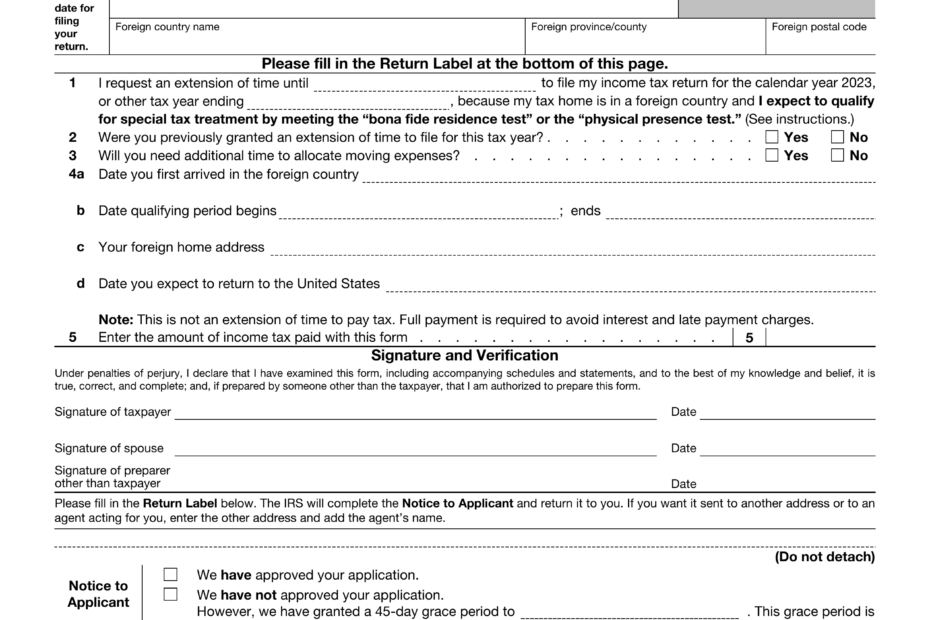

IRS Form 8889 is used by individuals who have a Health Savings Account (HSA) to report contributions, distributions, and other important information related to their HSA. It is important to fill out this form accurately to ensure compliance with IRS regulations and avoid any penalties or fines.

For individuals who prefer to file their taxes manually or do not have access to tax preparation software, printable IRS Form 8889 is available online. This form can be easily downloaded, printed, and filled out by hand, making it convenient for those who prefer a more traditional approach to tax filing.

Easily Download and Print Printable Irs Form 8889

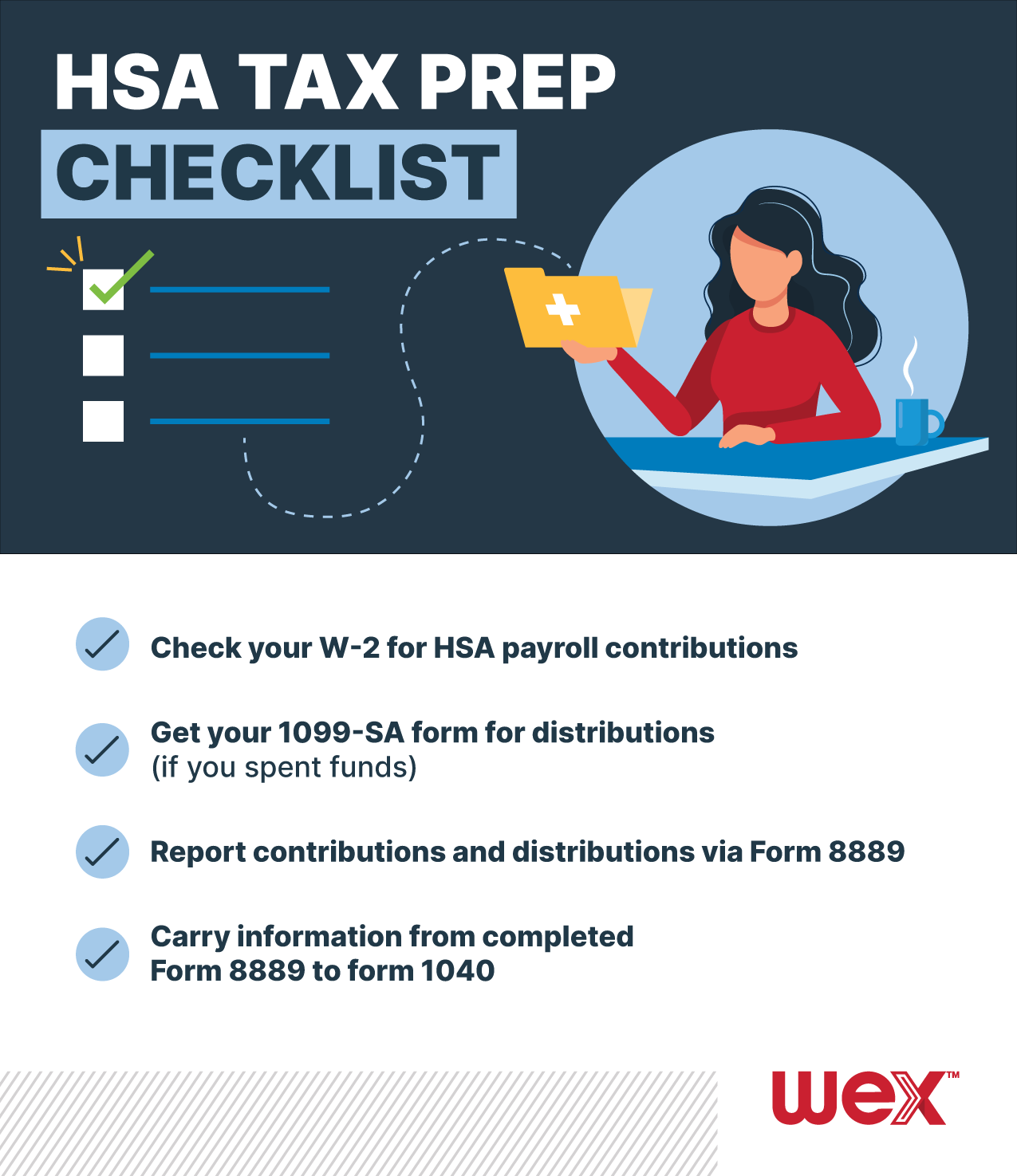

Your HSA And Your Tax Return 4 Tips For Filing WEX Inc

Your HSA And Your Tax Return 4 Tips For Filing WEX Inc

Why Use Printable IRS Form 8889?

Printable IRS Form 8889 is a convenient option for individuals who prefer to file their taxes manually or do not have access to tax preparation software. By downloading and printing this form, individuals can easily fill out the necessary information related to their HSA contributions and distributions without the need for specialized software or online tools.

Additionally, using printable IRS Form 8889 allows individuals to have a physical copy of their tax documents for their records. This can be helpful for reference in the future or in the event of an audit by the IRS. By keeping accurate records of HSA contributions and distributions, individuals can ensure they are in compliance with IRS regulations and avoid any potential issues with their taxes.

It is important to note that while printable IRS Form 8889 is a convenient option for some individuals, it may not be suitable for everyone. Those with complex tax situations or who are unsure of how to properly fill out the form may benefit from seeking assistance from a tax professional or using tax preparation software.

In conclusion, printable IRS Form 8889 is a helpful tool for individuals with Health Savings Accounts who prefer to file their taxes manually. By downloading and printing this form, individuals can easily report their HSA contributions, distributions, and other important information to ensure compliance with IRS regulations. However, it is important to consider individual circumstances and seek assistance if needed to ensure accurate and timely tax filing.