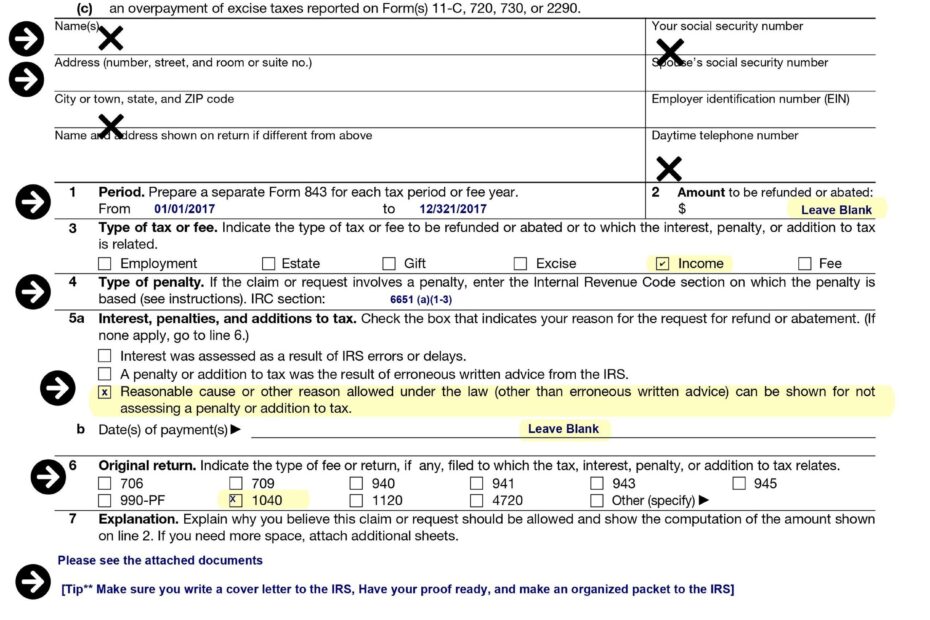

Dealing with taxes can be a stressful and confusing process, especially when you realize you’ve made a mistake on a previous tax return. Fortunately, the IRS provides a way for taxpayers to request abatement of certain penalties or interest through Form 843. This form allows individuals to explain their situation and request relief from penalties that may have been assessed by the IRS.

Printable IRS Form 843 is a valuable tool for taxpayers who believe they have a valid reason for requesting penalty relief. Whether it’s due to reasonable cause or a mistake made by the IRS, this form allows individuals to present their case and potentially reduce the amount they owe in penalties or interest.

Get and Print Printable Irs Form 843

Printable IRS Form 843

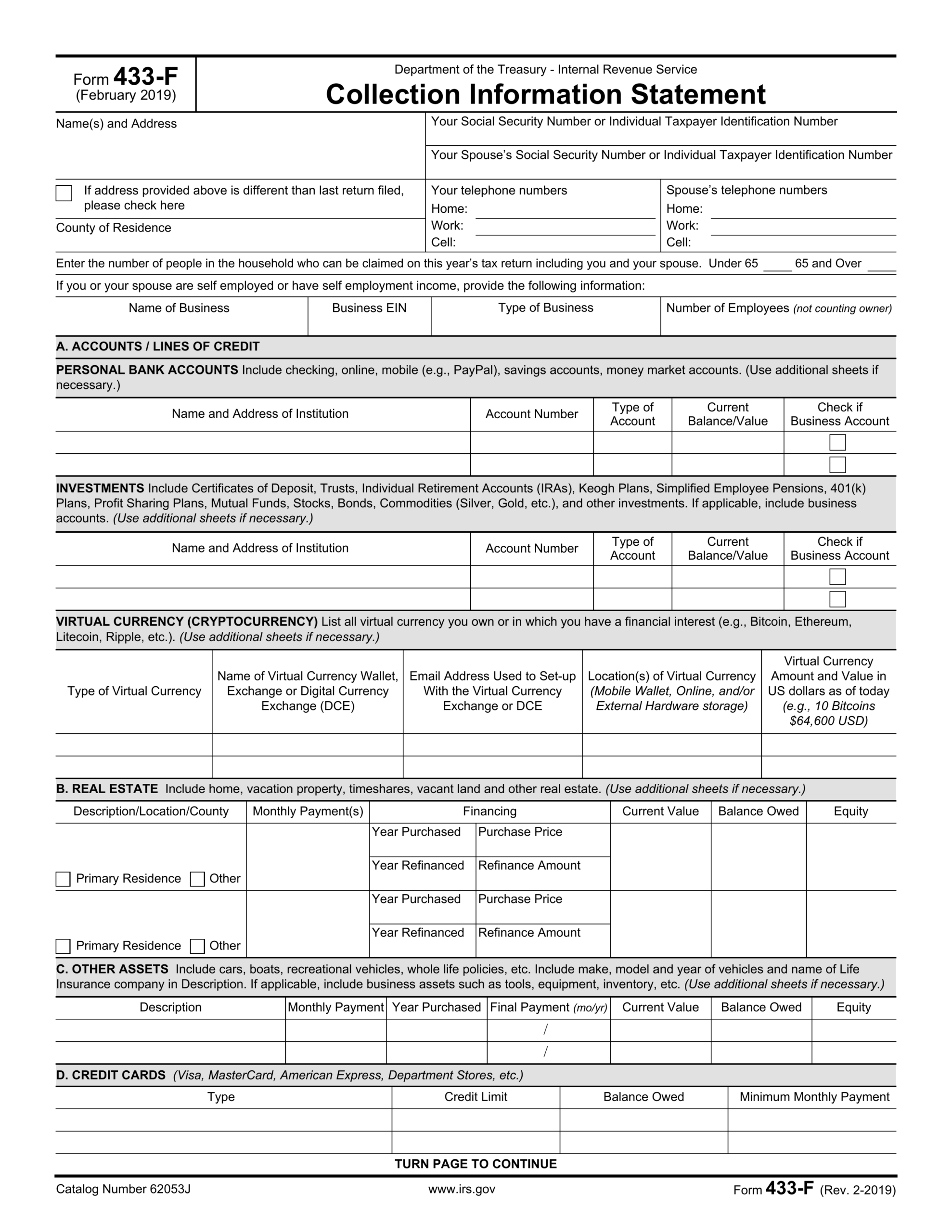

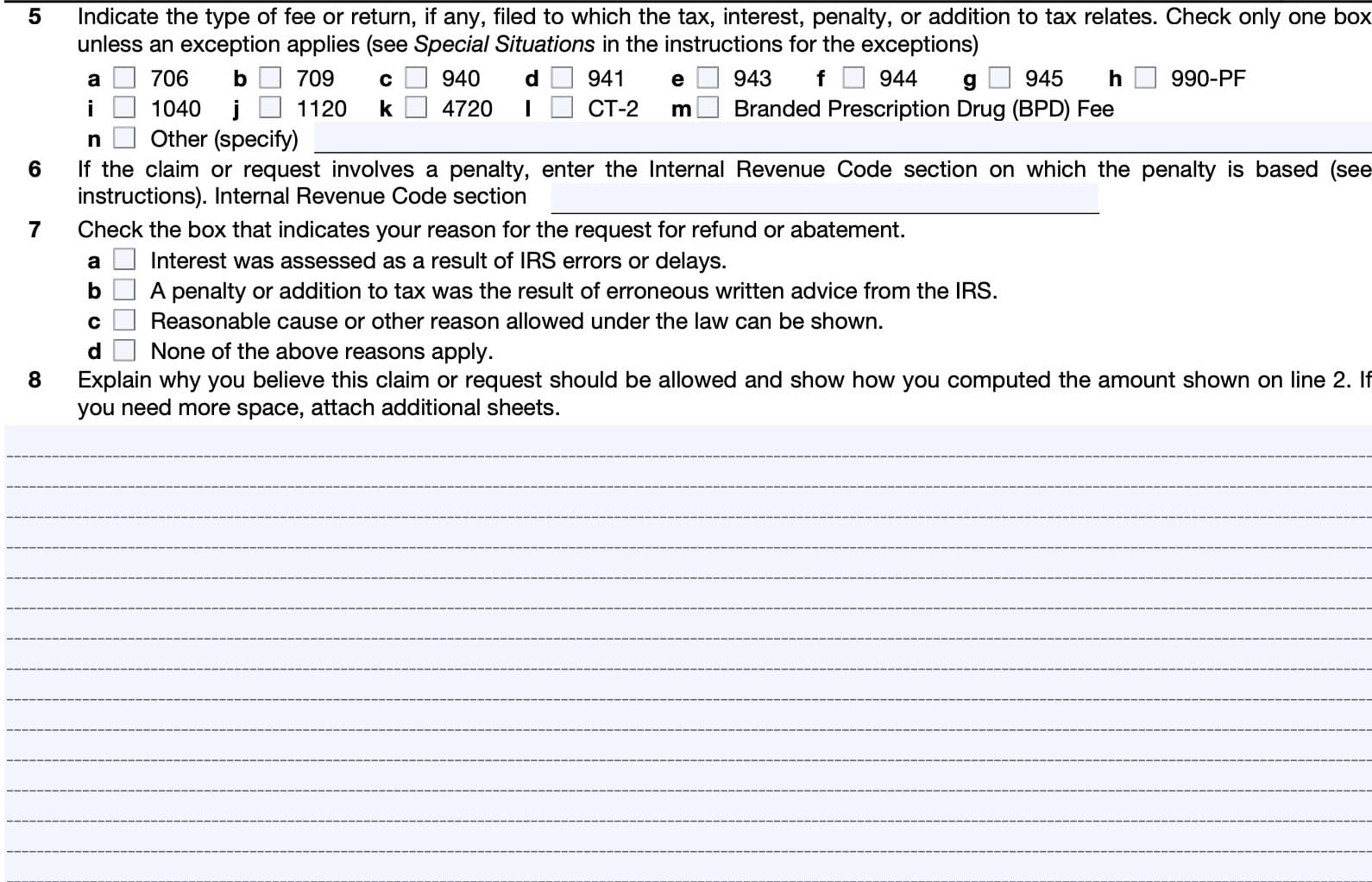

When completing Form 843, taxpayers must provide detailed information about the tax period in question, the specific penalty or interest they are seeking relief from, and the reason for their request. It’s important to include any supporting documentation that can help make your case, such as medical records, court documents, or financial statements.

Once the form is completed, it should be submitted to the IRS along with any required documentation. The IRS will review the information provided and make a decision on whether to grant the requested relief. It’s important to be honest and thorough when completing Form 843, as any misleading information could result in a denial of your request.

If your request for penalty relief is approved, the IRS will adjust your account accordingly and you may receive a refund for any overpayment. However, if your request is denied, you will receive a written explanation from the IRS outlining the reasons for their decision. In some cases, taxpayers may have the option to appeal the decision through a formal process.

Overall, Printable IRS Form 843 can be a valuable resource for taxpayers who find themselves facing penalties or interest charges from the IRS. By providing a detailed explanation of your situation and supporting documentation, you may be able to successfully request relief and reduce the amount you owe. It’s important to carefully follow the instructions provided on the form and seek assistance from a tax professional if needed.

Don’t let tax penalties or interest charges overwhelm you. Take advantage of Printable IRS Form 843 to request relief and potentially reduce your tax liability. Remember to be honest, thorough, and timely in submitting your request to the IRS for the best chance of success.