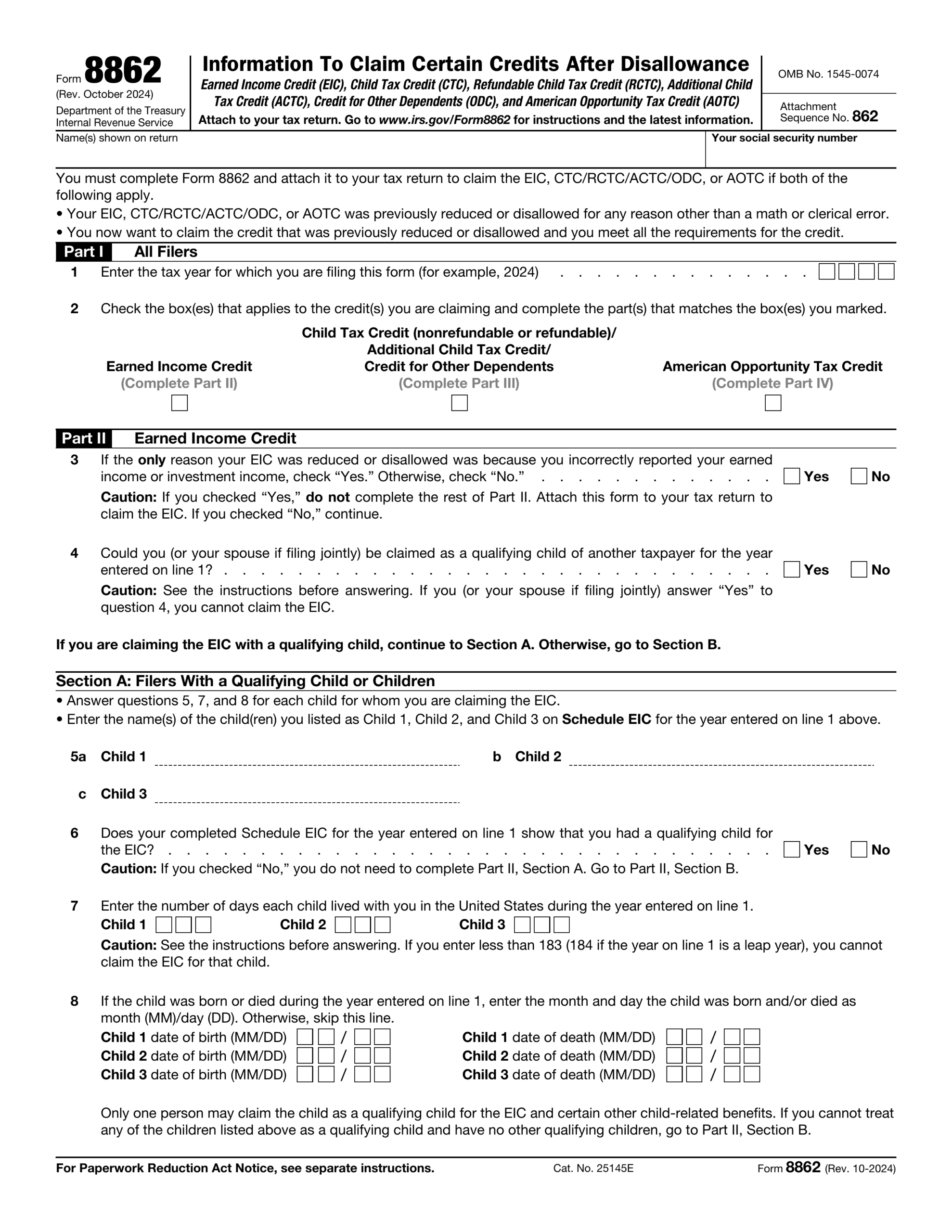

When it comes to filing taxes, it’s important to have all the necessary forms and documentation in order. One form that may be required for certain transactions is IRS Form 8300. This form is used to report cash payments over $10,000 received in a trade or business, as required by the Bank Secrecy Act.

Businesses that receive large cash payments must file Form 8300 to help prevent money laundering and other illegal activities. The form is used to track and report any suspicious transactions, ensuring that businesses are compliant with federal regulations.

Get and Print Printable Irs Form 8300

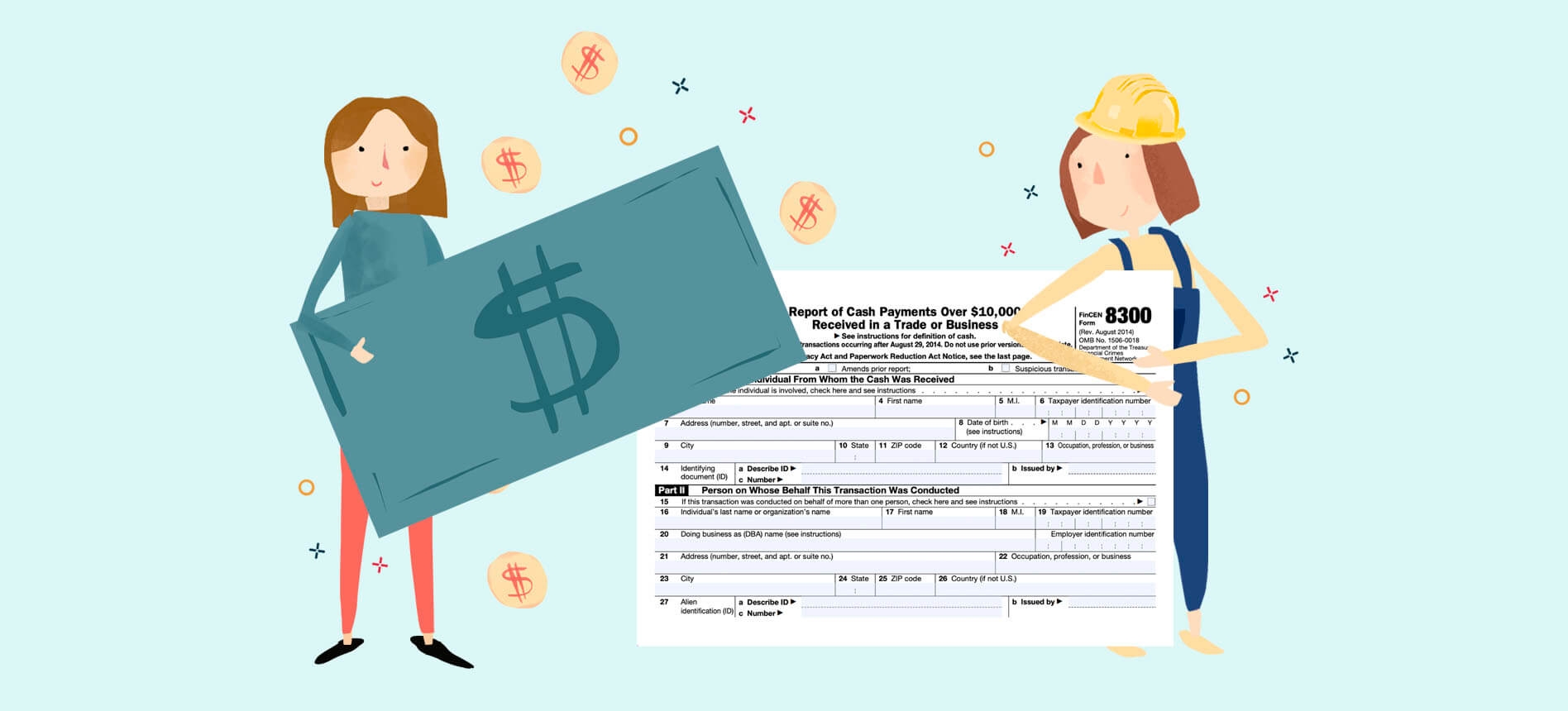

What Is Form 8300 And How Do You File It Hourly Inc

What Is Form 8300 And How Do You File It Hourly Inc

Printable IRS Form 8300

For those who need to file IRS Form 8300, it’s important to have a printable version of the form on hand. The IRS website offers a downloadable and printable version of Form 8300, making it easy for businesses to fill out and submit the necessary information.

When filling out Form 8300, businesses must provide details about the cash transaction, including the amount received, the date of the transaction, and the name and address of the payer. Once the form is complete, it must be filed with the IRS within 15 days of receiving the cash payment.

Businesses that fail to file Form 8300 or provide inaccurate information may face penalties from the IRS. It’s important to carefully review the form and ensure all information is accurate before submitting it to the IRS.

Overall, IRS Form 8300 is an important tool for businesses to report large cash transactions and comply with federal regulations. By using the printable version of the form, businesses can easily stay on top of their reporting requirements and avoid potential penalties from the IRS.

So, if you find yourself in need of filing Form 8300 for your business, be sure to download the printable version from the IRS website and fill it out accurately and promptly. Compliance with tax regulations is crucial for the success and integrity of your business.