When it comes to reporting suspected tax fraud, the IRS provides Form 3949 A for individuals to fill out and submit. This form is used to report any suspicious activity or behavior related to tax evasion, fraudulent tax returns, or any other tax-related crimes. It is important to report such activities to help ensure that everyone is paying their fair share of taxes and to prevent fraud.

IRS Form 3949 A can be easily downloaded and printed from the IRS website. It is a simple form that requires basic information about the individual reporting the fraud, as well as details about the suspected fraudulent activity. The form can be filled out anonymously, so individuals can feel comfortable reporting suspicious behavior without fear of retaliation.

Quickly Access and Print Printable Irs Form 3949 A

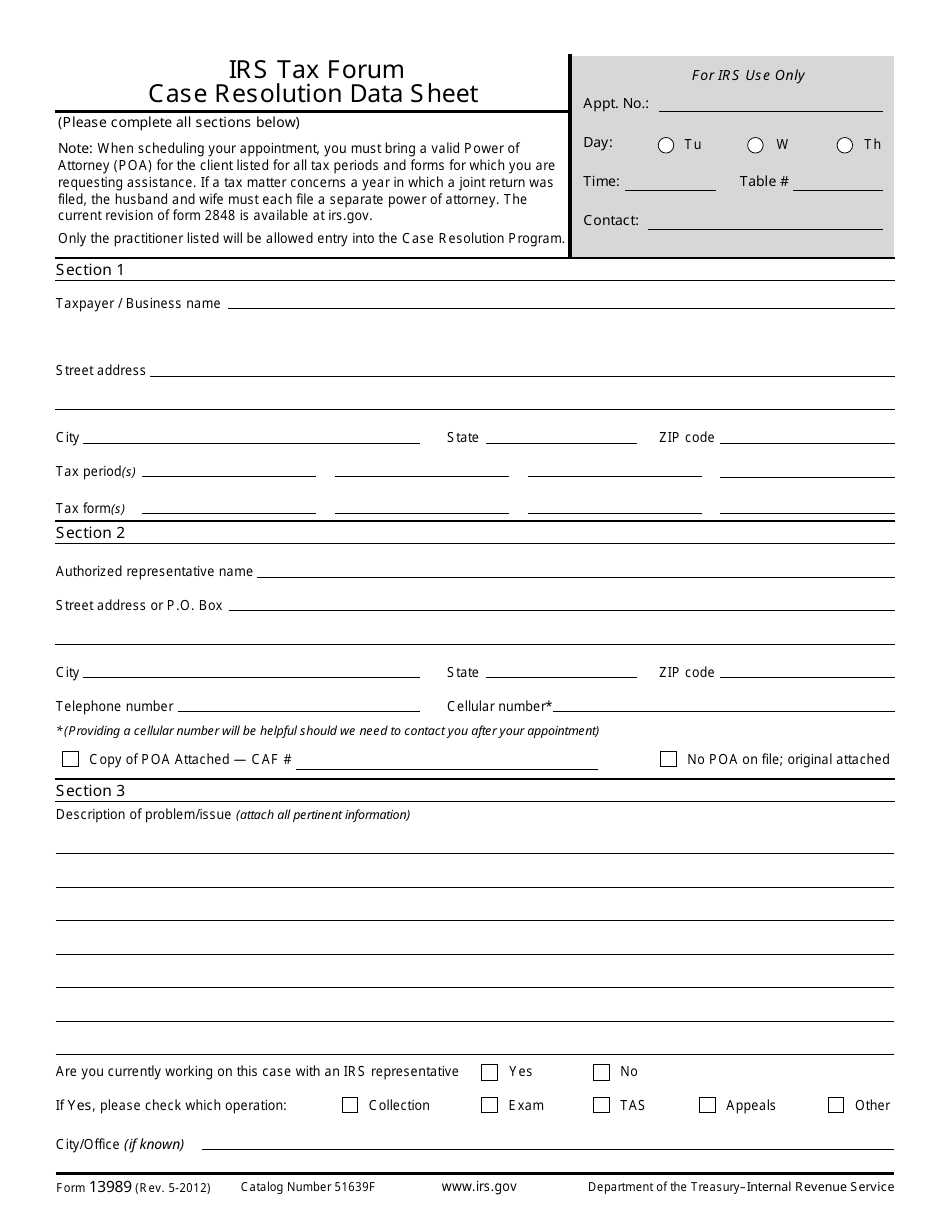

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

When filling out IRS Form 3949 A, it is important to provide as much detail as possible about the suspected tax fraud. This information can help the IRS investigate the matter thoroughly and take appropriate action. It is also important to provide any supporting documentation or evidence that may help support the report of fraud.

Once the form is completed, it can be mailed to the address provided on the form or submitted online through the IRS website. The IRS takes reports of tax fraud seriously and will investigate all reports to determine the validity of the claims. By reporting suspected tax fraud, individuals can help protect the integrity of the tax system and ensure that everyone is following the law.

In conclusion, Printable IRS Form 3949 A is an important tool for individuals to report suspected tax fraud. By filling out this form and providing as much detail as possible, individuals can help the IRS investigate and take action against those who are committing tax-related crimes. It is important for everyone to do their part in reporting suspicious behavior to help uphold the integrity of the tax system.