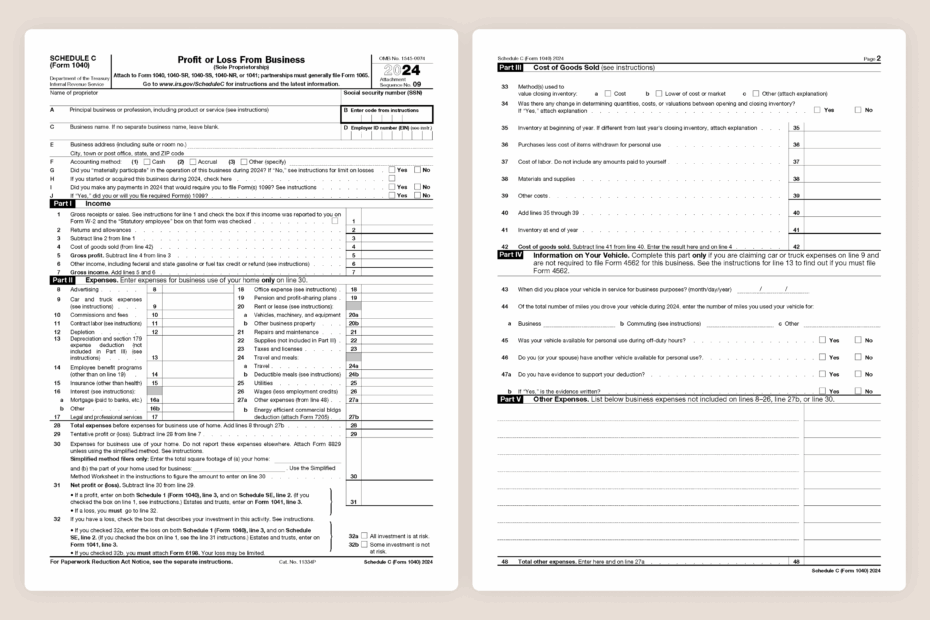

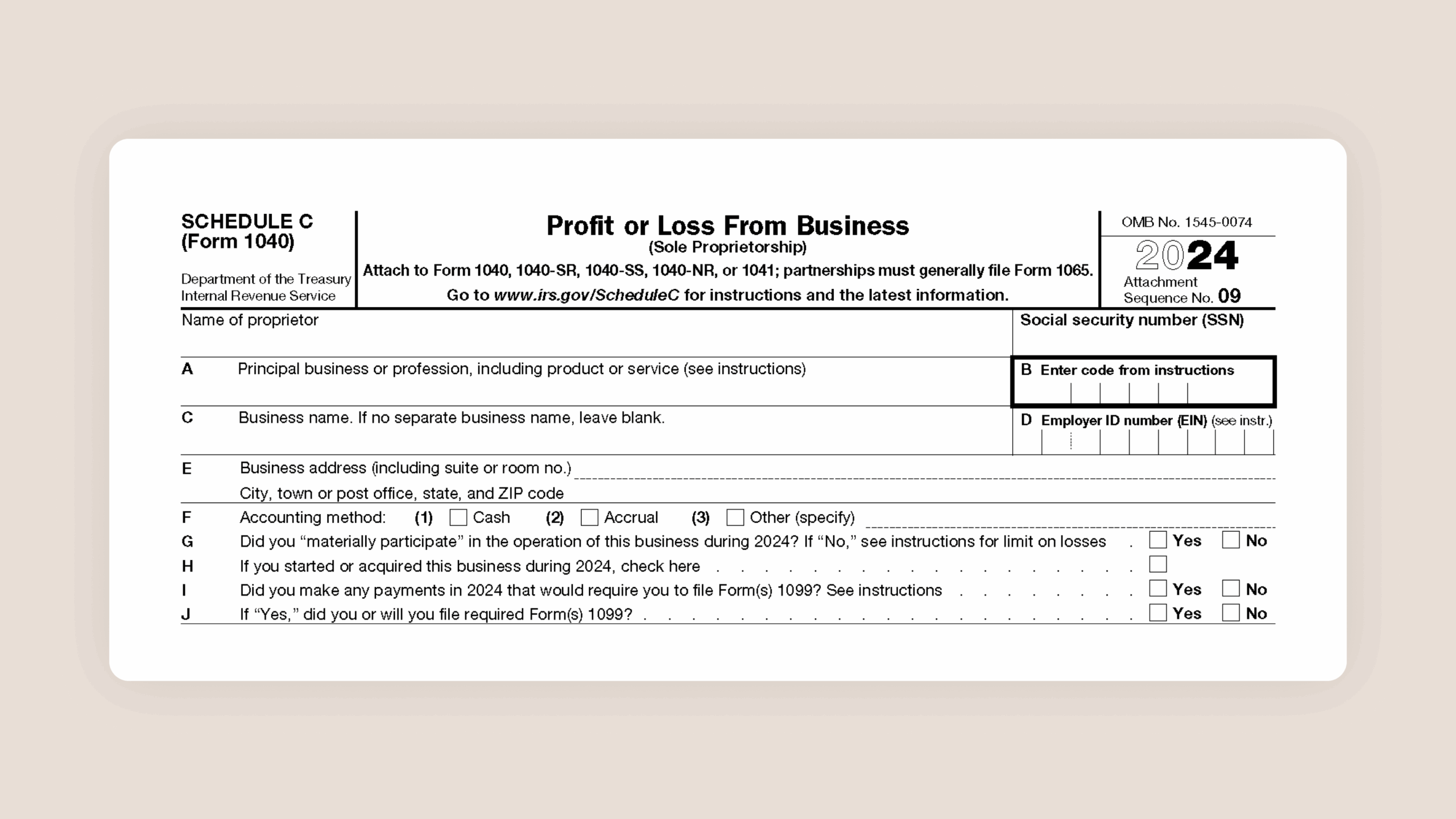

When it comes to filing your taxes as a self-employed individual or small business owner, one of the most important forms you’ll need is the IRS Schedule C. This form is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. It’s crucial to accurately fill out this form to ensure you’re complying with tax laws and maximizing your deductions.

The IRS Schedule C form is available for download on the official IRS website. It’s a relatively straightforward form that requires you to report your business income, expenses, and calculate your net profit or loss. This information is then used to determine your self-employment tax and ultimately, your total tax liability.

Get and Print Irs Schedule C Printable Form

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

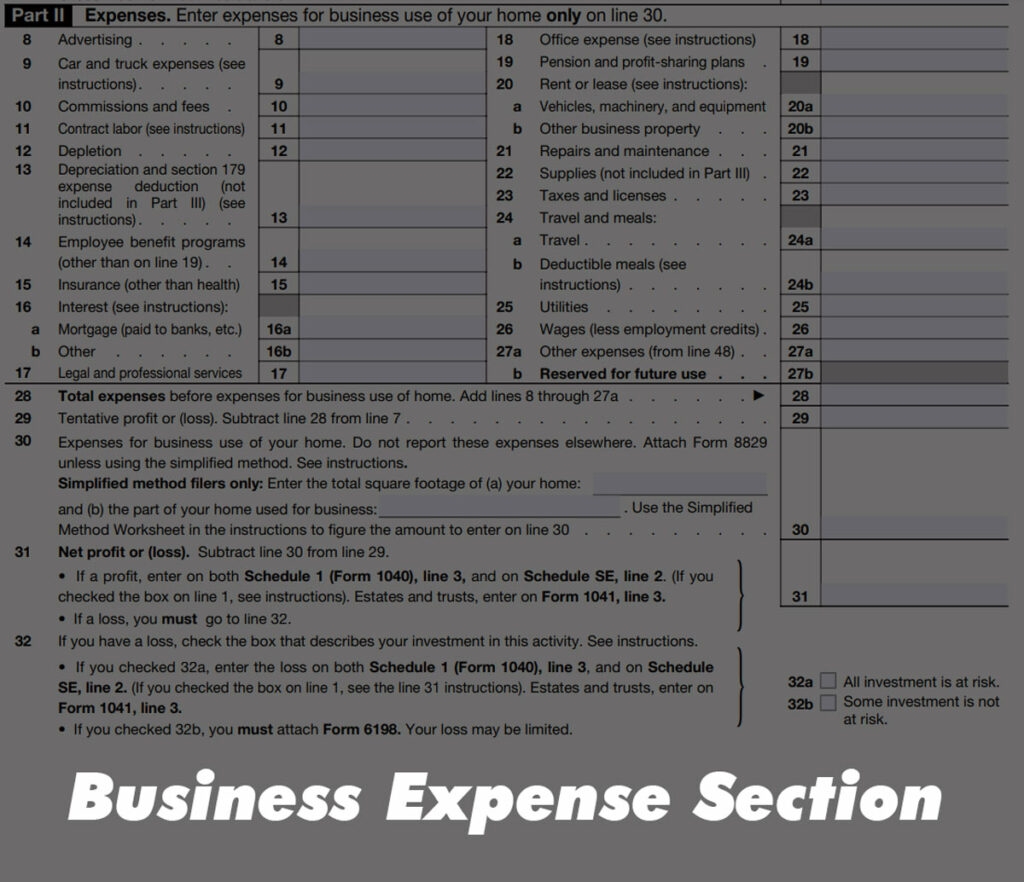

When filling out the IRS Schedule C form, it’s important to categorize your expenses accurately and keep detailed records to support your deductions. Common expenses that can be deducted include advertising, supplies, utilities, and travel expenses. By carefully documenting your expenses, you can reduce your taxable income and potentially lower your tax bill.

It’s also worth noting that the IRS Schedule C form allows you to report income from multiple businesses or professions on a single form. If you have more than one business, you’ll need to complete a separate Schedule C for each one. Additionally, if your business has a net profit of $400 or more, you may also need to pay self-employment tax.

Once you’ve completed the IRS Schedule C form, you can file it along with your individual tax return. It’s important to review your form for accuracy and ensure that all information is entered correctly. Keep in mind that any errors or omissions could result in penalties or delays in processing your return.

In conclusion, the IRS Schedule C form is an essential tool for self-employed individuals and small business owners to report their income and expenses. By accurately completing this form and keeping detailed records, you can maximize your deductions and minimize your tax liability. Be sure to download the IRS Schedule C printable form from the official IRS website and consult with a tax professional if you have any questions or need assistance.