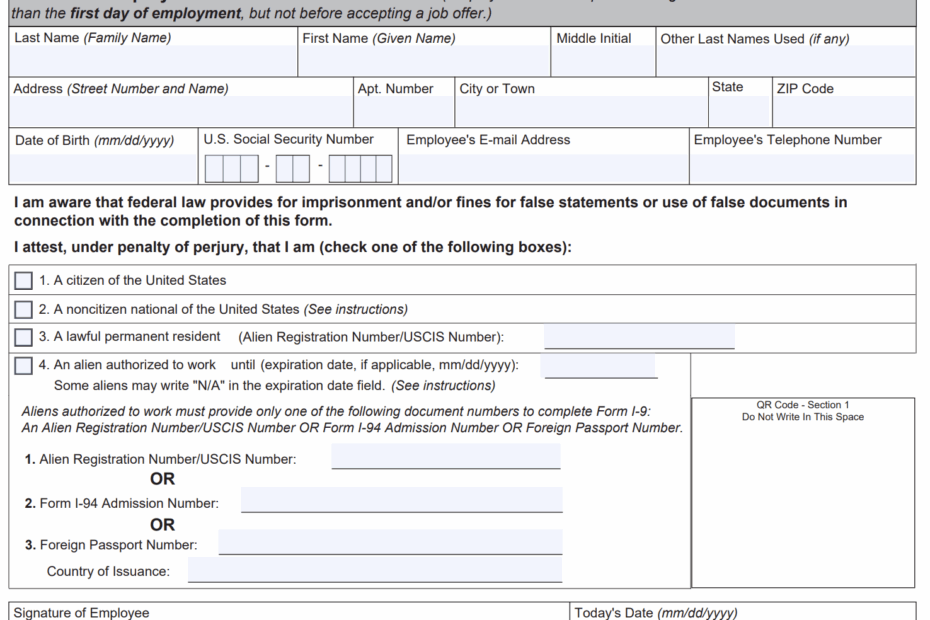

IRS I-9 Printable Form is a crucial document that all employers in the United States must have on file for each employee. This form verifies the identity and employment authorization of individuals hired for employment in the country. It is required by law to be completed by both the employer and the employee within three days of the employee’s start date.

Failure to properly complete and retain Form I-9 can result in serious consequences for employers, including fines and penalties. Therefore, it is essential for employers to understand the importance of this form and ensure that it is completed accurately and on time.

Download and Print Irs I 9 Printable Form

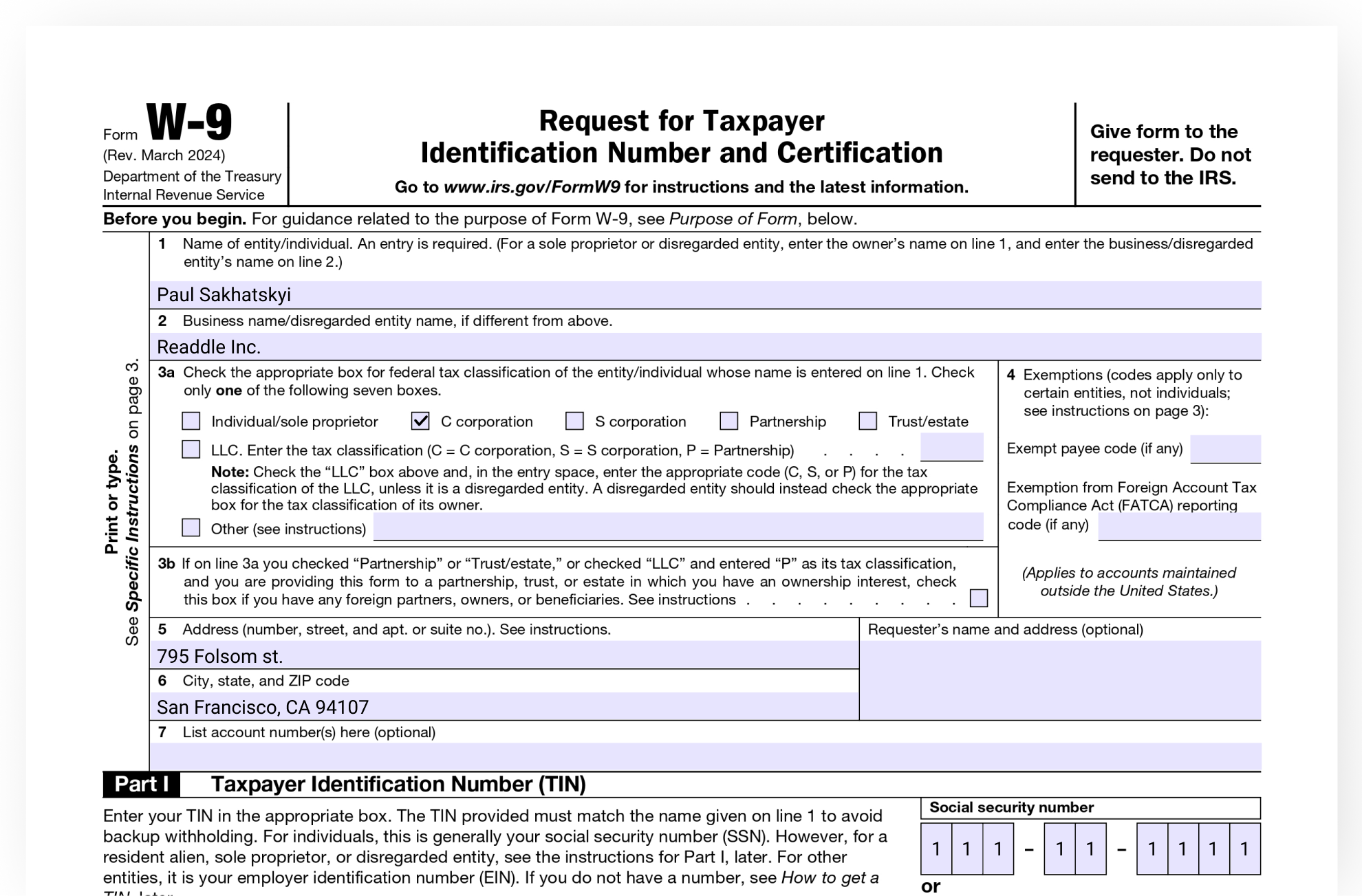

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

IRS I-9 Printable Form

The IRS I-9 Printable Form consists of three sections that must be completed by both the employer and the employee. Section 1 requires the employee to provide personal information, including their full name, date of birth, and contact information. This section also requires the employee to attest to their employment authorization status.

Section 2 of the form must be completed by the employer and requires them to examine the employee’s documents to verify their identity and employment authorization. The employer must record the document information in this section and attest to the authenticity of the documents presented.

Finally, in Section 3, the employer must re-verify the employee’s eligibility to work in the United States if necessary. This section is only completed in specific circumstances, such as when an employee’s work authorization document expires.

Employers must retain Form I-9 for each employee for a specified period after the employee’s termination date. The form must be made available for inspection by authorized government officials if requested. Employers who fail to comply with these requirements may face fines and penalties.

In conclusion, IRS I-9 Printable Form is a vital document that all employers must ensure is completed accurately and on time. By understanding the importance of this form and following the necessary steps to complete it, employers can avoid costly penalties and ensure compliance with federal regulations.