As tax season approaches, it’s essential to have all the necessary forms ready for filing your taxes. The IRS forms for 2016 are crucial for individuals and businesses to accurately report their income and deductions. These forms provide the necessary information for the IRS to determine how much tax you owe or if you are eligible for a refund.

Having the IRS forms for 2016 printed out and ready to go can make the tax-filing process much easier and more efficient. Whether you are filing as an individual, a business owner, or a self-employed individual, having these forms on hand can help ensure that you are complying with all tax laws and regulations.

Get and Print Irs Forms 2016 Printable

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

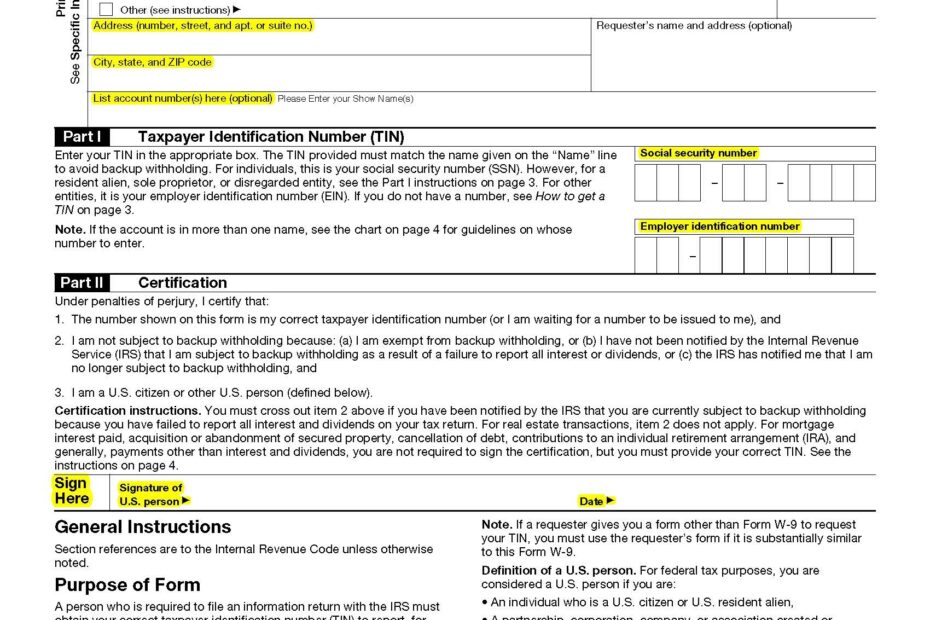

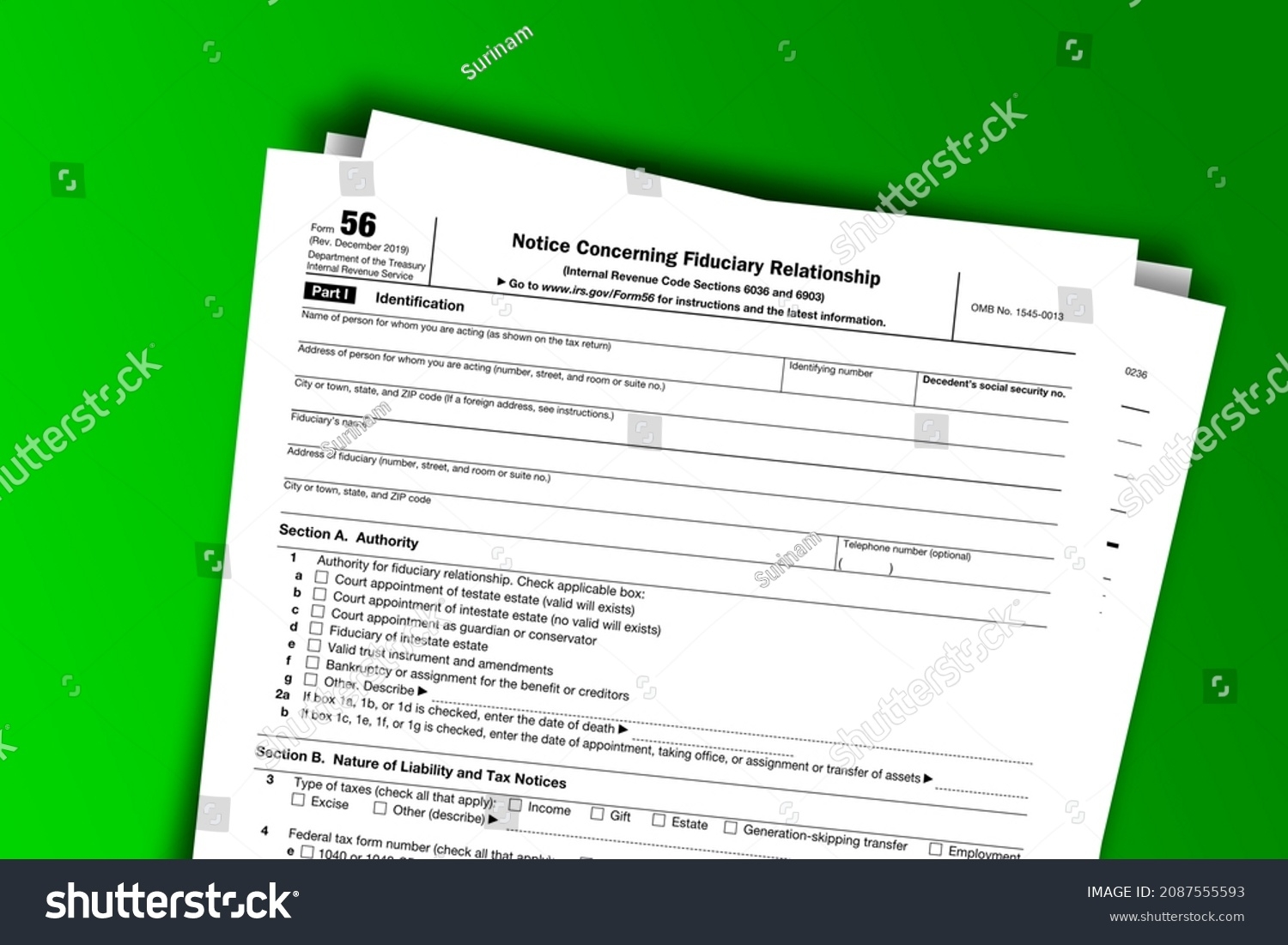

When it comes to IRS forms for 2016, there are a variety of forms available depending on your specific tax situation. Some common forms include Form 1040 for individual tax returns, Form 1099 for reporting income other than wages, and Form 941 for employers to report payroll taxes. These forms are essential for accurately reporting your income and expenses to the IRS.

It’s important to note that the IRS forms for 2016 are not one-size-fits-all. Depending on your individual tax situation, you may need to fill out different forms or additional schedules to accurately report your income and deductions. It’s crucial to carefully review the instructions for each form to ensure that you are filling them out correctly.

By having the IRS forms for 2016 printable and ready to go, you can save time and stress during tax season. Whether you choose to file your taxes online or by mail, having these forms on hand can help streamline the process and ensure that you are accurately reporting your income to the IRS. Be sure to double-check all information before submitting your forms to avoid any errors or delays in processing.

Overall, having the IRS forms for 2016 printable is essential for anyone who needs to file their taxes for that year. By being prepared and having all the necessary forms on hand, you can ensure that you are complying with all tax laws and regulations and avoid any potential penalties or fines. So, make sure to download and print out the necessary IRS forms for 2016 to make the tax-filing process as smooth as possible.