IRS Form W-4P is used by retirees to withhold federal income tax from their pension or annuity payments. It allows individuals to specify the amount they want withheld from each payment, helping them avoid a large tax bill at the end of the year. The form can be updated as needed to reflect changes in tax status or financial situation.

For the year 2024, the IRS has released a new version of Form W-4P that retirees can use to ensure the correct amount of tax is withheld from their pension or annuity payments. It is important for retirees to review and update this form annually to avoid under-withholding or over-withholding.

Download and Print Irs Form W 4p 2024 Printable

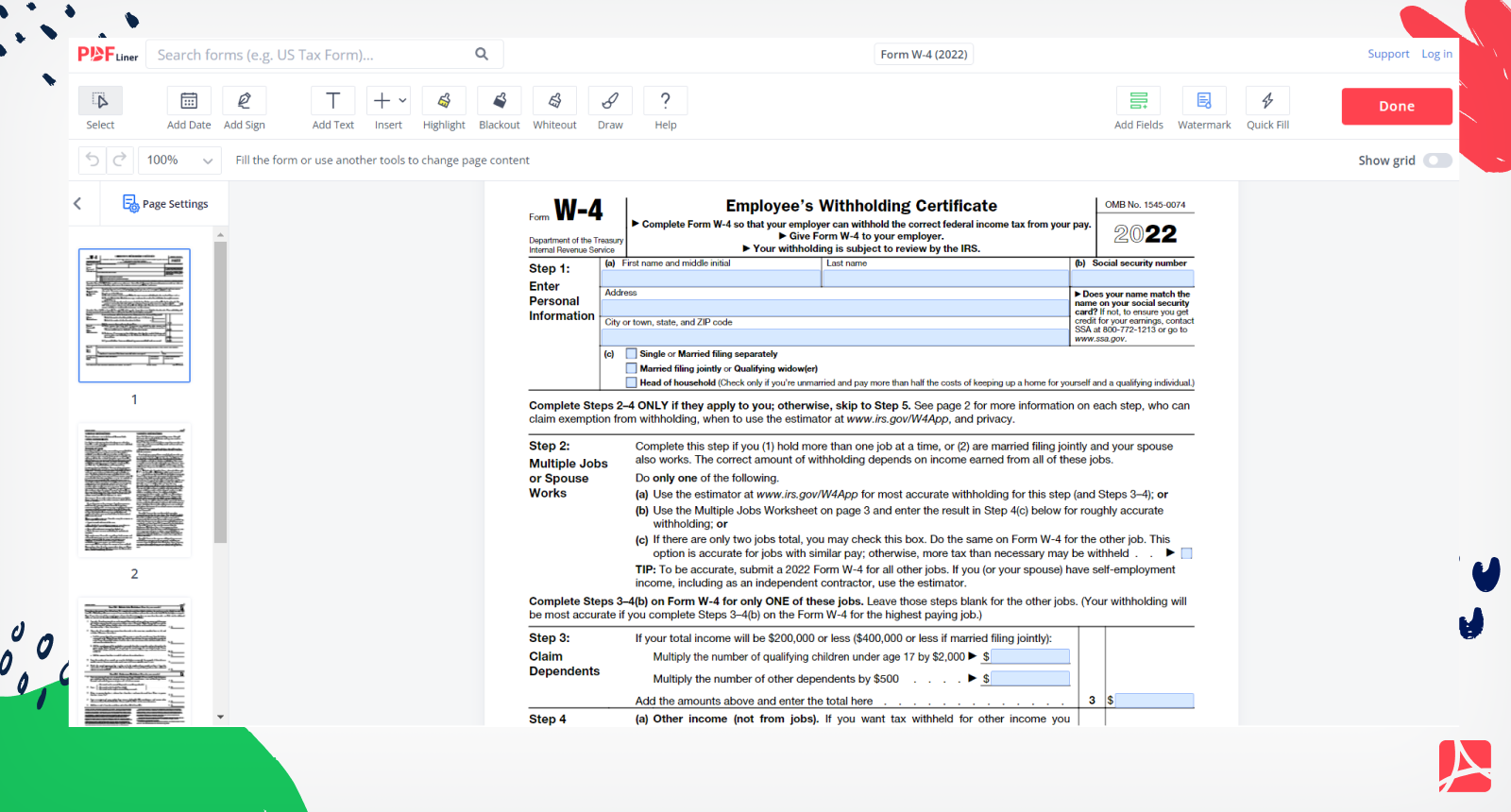

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

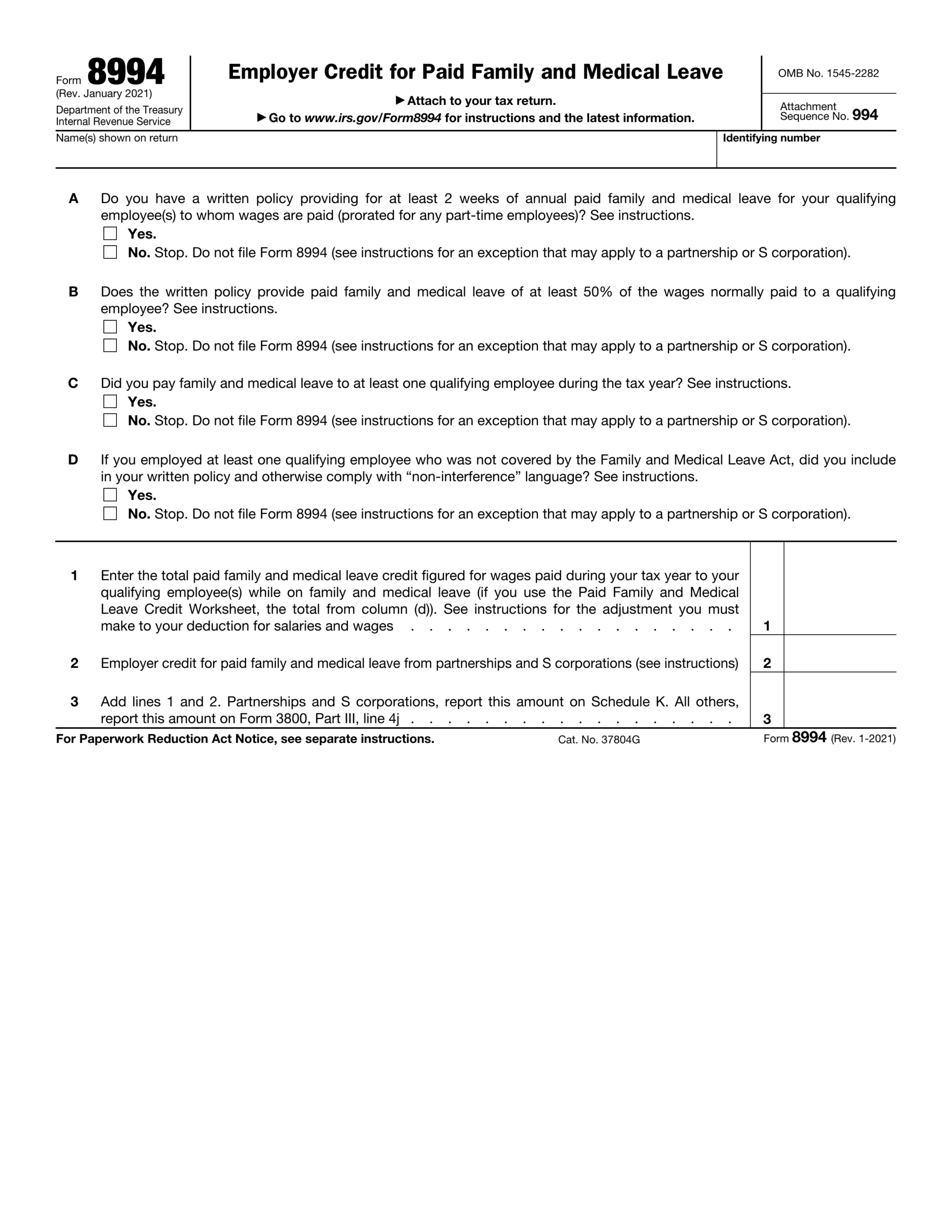

When completing Form W-4P, retirees will need to provide their personal information, including their name, address, and Social Security number. They will also need to indicate the amount they want withheld from each payment, as well as any additional withholding they may want to request. The form includes instructions to help retirees determine the appropriate withholding amount based on their individual circumstances.

Retirees should keep a copy of their completed Form W-4P for their records and provide a copy to the payor of their pension or annuity. It is recommended to review and update this form whenever there are changes in tax laws or personal financial situations that may impact withholding requirements.

By staying informed and proactive about their tax withholding, retirees can avoid surprises at tax time and ensure they are meeting their tax obligations throughout the year. The IRS Form W-4P 2024 Printable makes it easy for retirees to manage their tax withholding and stay compliant with federal tax laws.

Overall, IRS Form W-4P is a valuable tool for retirees to manage their tax withholding from pension or annuity payments. By completing this form accurately and updating it as needed, retirees can maintain control over their tax liabilities and avoid potential issues with under or over-withholding. It is important for retirees to stay informed about changes in tax laws and to review their withholding status regularly to ensure compliance with federal tax regulations.