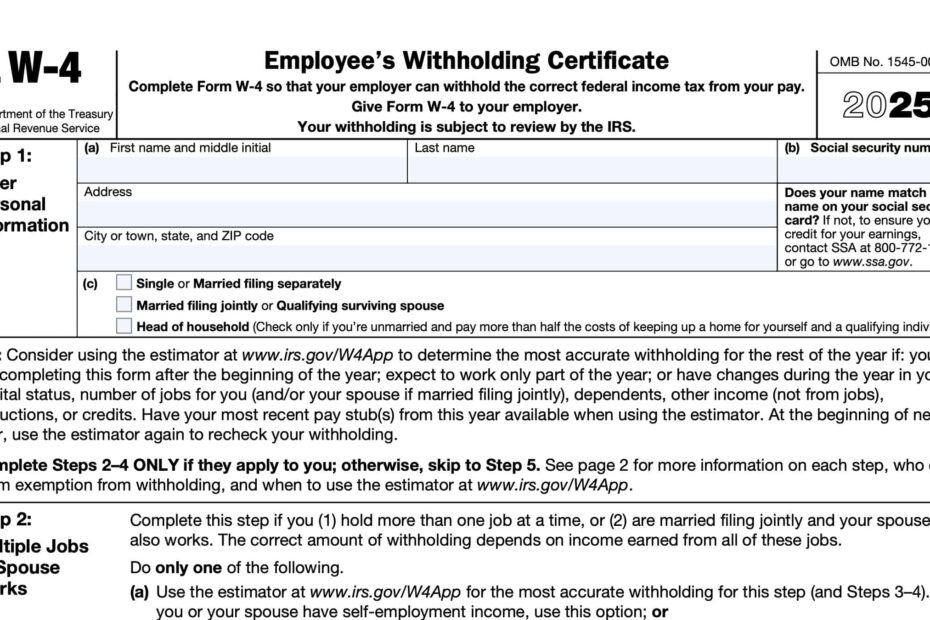

When starting a new job, one of the first things you will need to do is fill out a Form W-4. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form correctly to avoid any surprises come tax season.

Form W-4 can be a bit confusing, but luckily the IRS provides a printable version on their website. This makes it easy for you to fill out the form at your own pace and ensure that all the information is accurate.

Download and Print Irs Form W 4 Printable

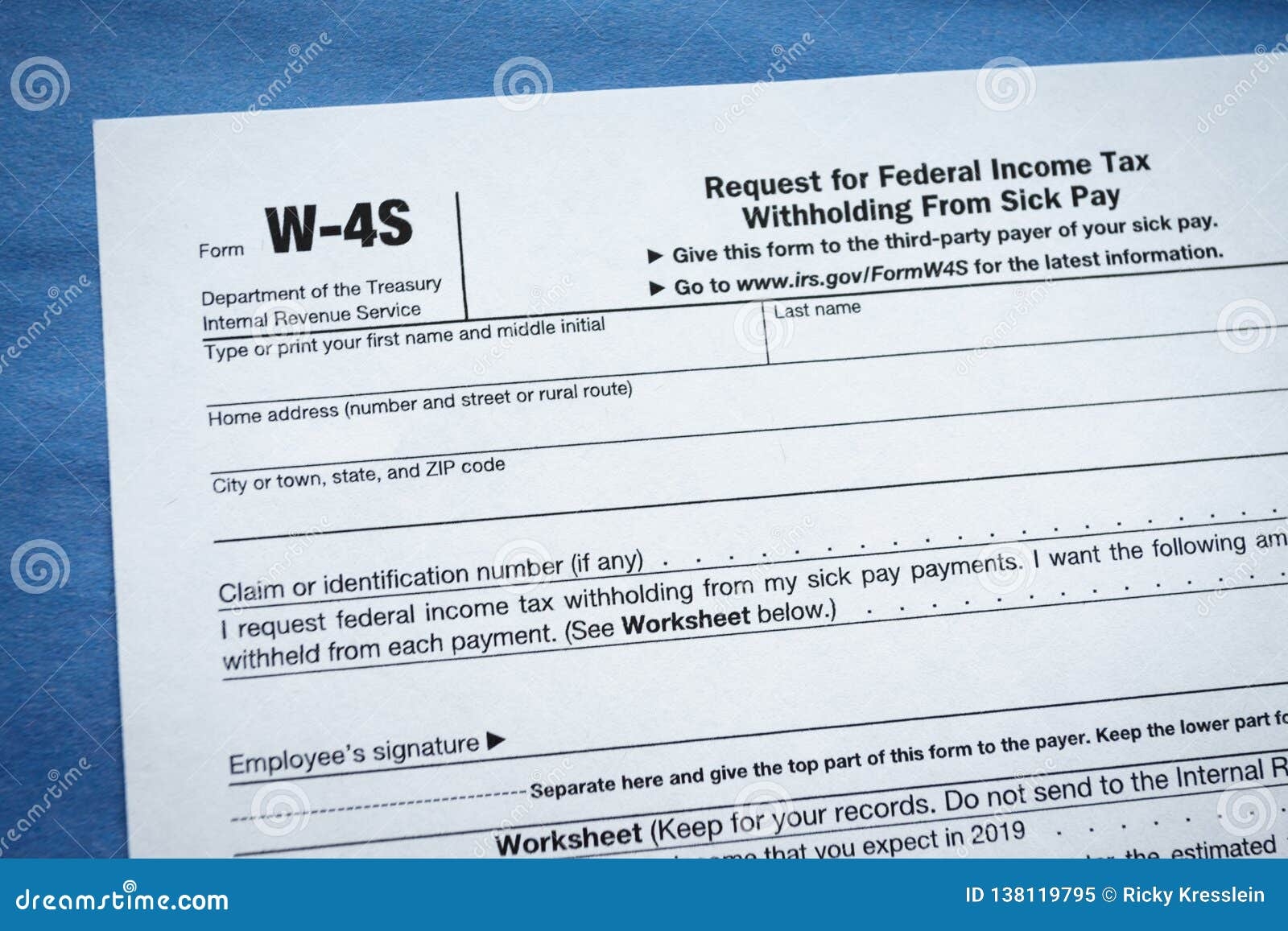

Form W 4S Request For Federal Income Tax Withholding From Sick Pay

Form W 4S Request For Federal Income Tax Withholding From Sick Pay

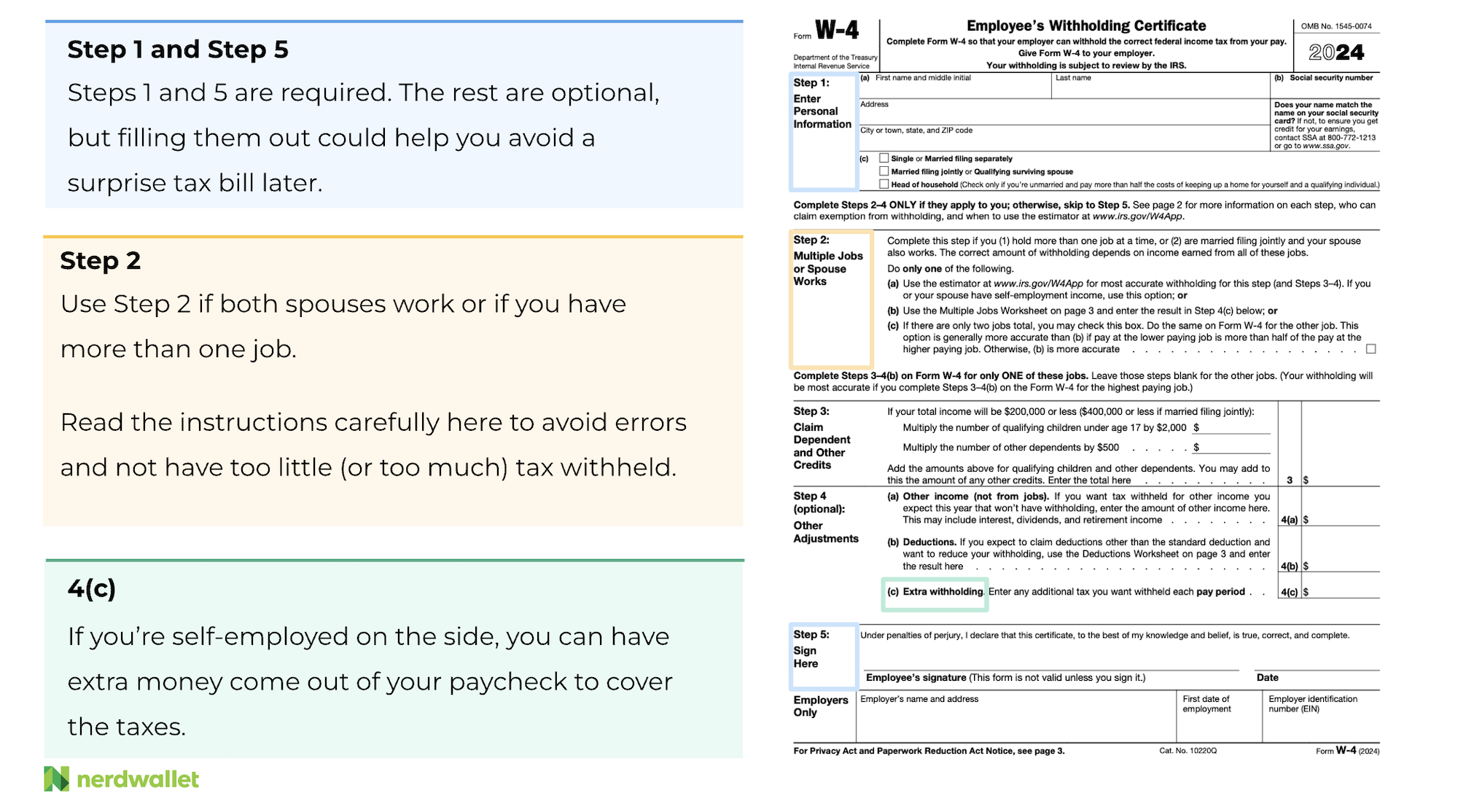

When filling out the Form W-4, you will need to provide information such as your filing status, number of allowances, and any additional amount you want withheld from each paycheck. It’s important to review your withholding periodically and make updates as needed, especially if you experience any life changes such as getting married or having children.

One important thing to note is that the IRS recently updated the Form W-4 for the 2020 tax year. The new form eliminates the concept of allowances and instead asks for more detailed information about your income and deductions. This new format aims to make withholding more accurate and streamlined for taxpayers.

It’s recommended that you review your withholding each year or whenever you experience a significant life change. This will help ensure that you are not overpaying or underpaying your taxes throughout the year. Using the printable Form W-4 provided by the IRS can make this process easier and more convenient for you.

In conclusion, filling out Form W-4 is an important step when starting a new job. By using the printable version provided by the IRS, you can easily provide accurate information to your employer and ensure that your federal income tax withholding is correct. Be sure to review your withholding periodically and make updates as needed to avoid any surprises at tax time.