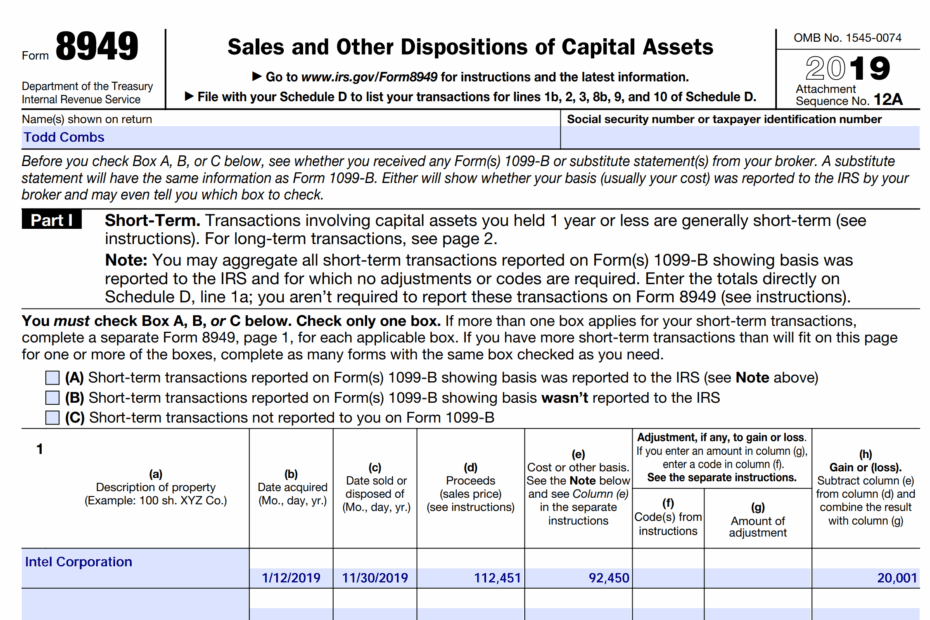

IRS Form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, and real estate, to the Internal Revenue Service. It is an important form that must be filled out accurately to ensure compliance with tax laws. The form is used to report capital gains and losses, which are then reported on Schedule D of Form 1040.

For those who have sold or exchanged capital assets during the tax year, IRS Form 8949 is a necessary document to include with their tax return. It is important to accurately report all transactions to avoid any potential penalties or audits from the IRS.

Download and Print Irs Form 8949 Printable

Form 8949 2024 2025 Fill Edit And Download PDF Guru

Form 8949 2024 2025 Fill Edit And Download PDF Guru

IRS Form 8949 Printable

IRS Form 8949 is available for download on the IRS website in a printable format. Taxpayers can easily access the form and fill it out either by hand or electronically. The form is divided into two parts – Part I for reporting short-term capital gains and losses, and Part II for reporting long-term capital gains and losses.

When filling out IRS Form 8949, taxpayers must provide details of each transaction, including the description of the property, date acquired, date sold, sales price, cost basis, and gain or loss. It is important to accurately report all information to ensure the correct calculation of capital gains and losses.

After completing IRS Form 8949, taxpayers must transfer the totals to Schedule D of Form 1040. The information reported on Form 8949 will be used to calculate the taxpayer’s overall capital gains or losses for the tax year. It is important to keep accurate records of all transactions to support the information reported on the form.

In conclusion, IRS Form 8949 is an essential document for reporting capital gains and losses to the IRS. Taxpayers who have sold or exchanged capital assets during the tax year must accurately fill out the form and include it with their tax return. By following the instructions provided on the form and keeping accurate records of all transactions, taxpayers can ensure compliance with tax laws and avoid any potential issues with the IRS.