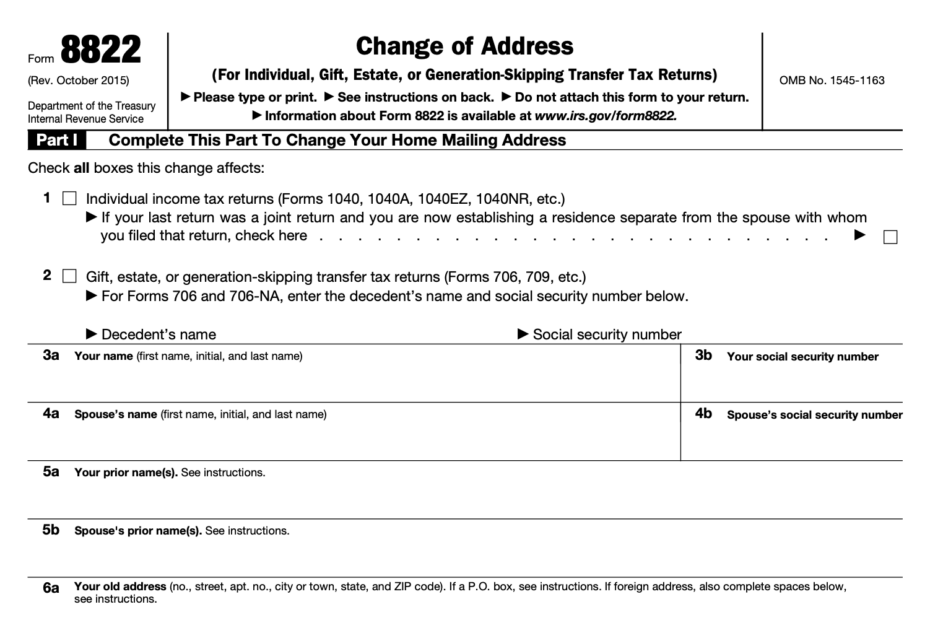

IRS Form 8822 is used to notify the Internal Revenue Service of a change in your address. It is important to keep your address updated with the IRS to ensure that you receive important correspondence and refunds in a timely manner. By filling out Form 8822, you can update your address for both individual and business tax purposes.

It is easy to access IRS Form 8822 online and print it out for your convenience. Whether you have moved recently or need to update your address for any other reason, Form 8822 is a simple way to make sure the IRS has your current contact information.

Quickly Access and Print Irs Form 8822 Printable

Form 8822 B 2024 2025 How To Fill And Edit PDF Guru

Form 8822 B 2024 2025 How To Fill And Edit PDF Guru

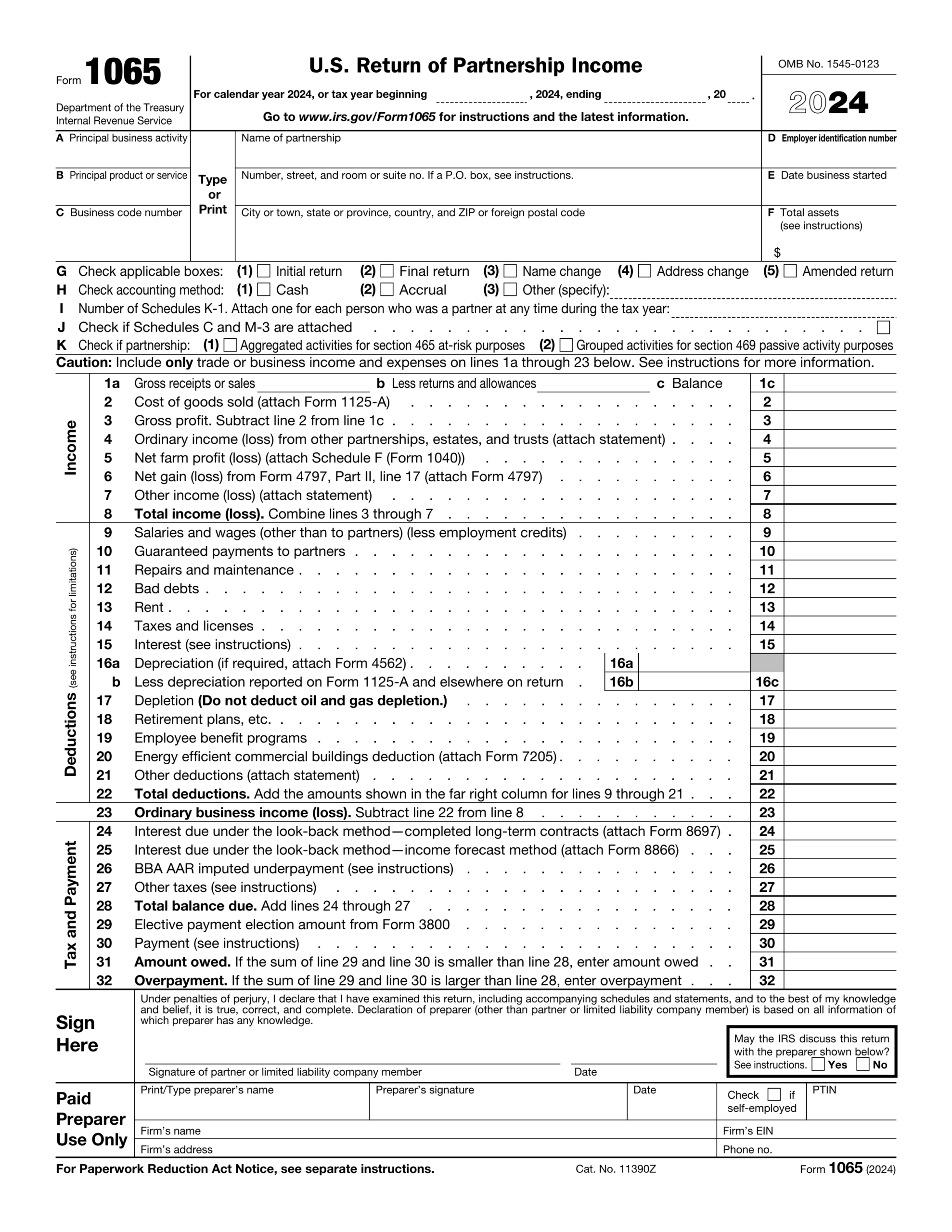

When filling out Form 8822, be sure to include your old address, new address, and your Social Security Number or Employer Identification Number. You can also designate which tax returns the address change applies to, such as individual, partnership, corporation, estate, or trust.

Once you have completed Form 8822, you can mail it to the address provided on the form. It is important to keep a copy of the completed form for your records. The IRS will process your address change and update their records accordingly.

Remember, it is your responsibility to keep your address current with the IRS. Failure to do so can result in missed correspondence, delayed refunds, or other issues with your tax filings. By using Form 8822, you can easily update your address and ensure that the IRS has the correct information on file.

So, if you have recently moved or need to update your address for any reason, be sure to fill out IRS Form 8822. It is a simple and efficient way to keep your contact information current with the IRS and avoid any potential issues with your tax filings.