When married couples file their taxes jointly, they are both equally responsible for any taxes owed. However, if one spouse has past-due child support, student loans, or other federal debts, the IRS may withhold the entire tax refund to cover these debts. This can be frustrating for the innocent spouse who may be counting on that refund.

Fortunately, there is a solution in the form of IRS Form 8379. This form, also known as the Injured Spouse Allocation form, allows the innocent spouse to claim their portion of the tax refund. By filing this form, the innocent spouse can protect their share of the refund from being taken to pay off the other spouse’s debts.

Quickly Access and Print Irs Form 8379 Printable

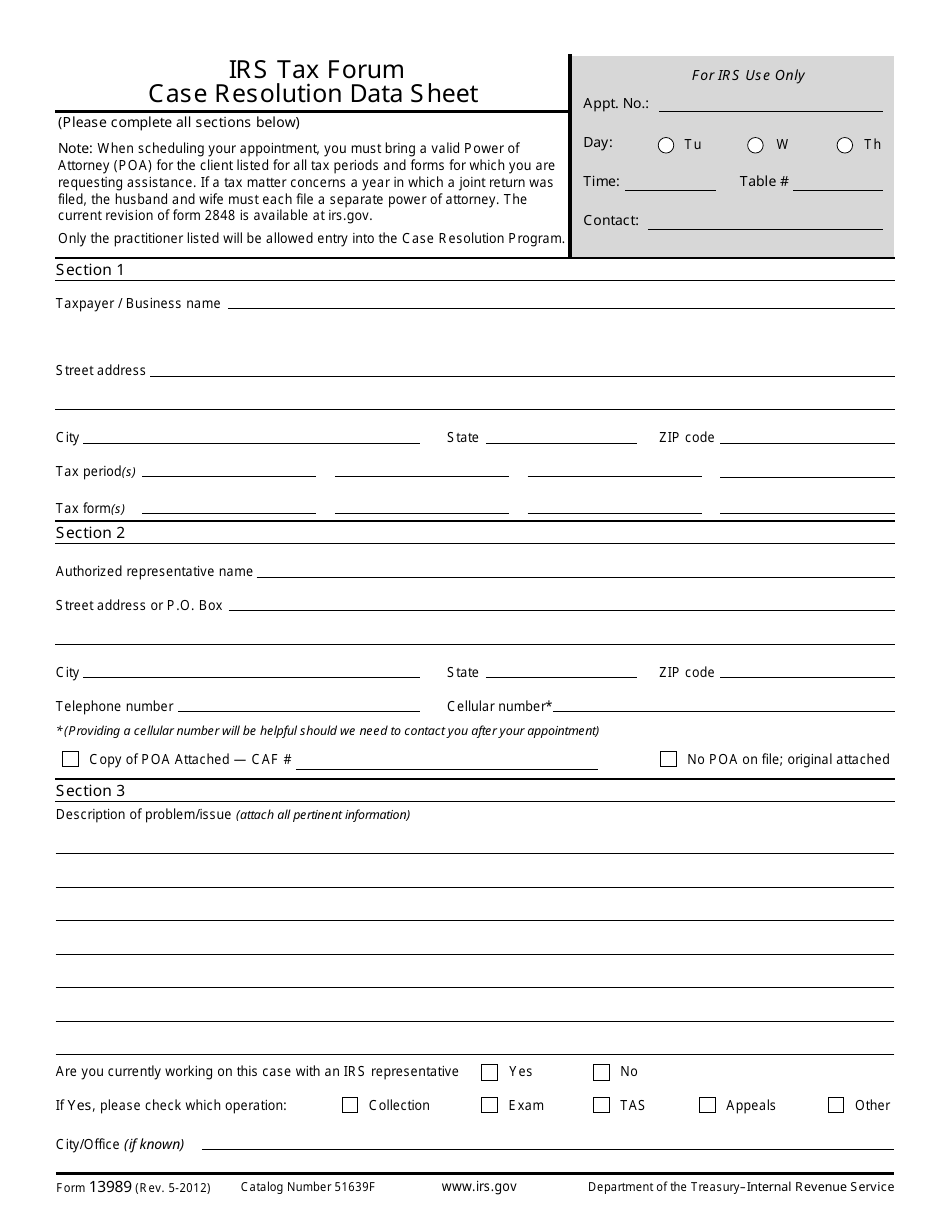

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 13989 Fill Out Sign Online And Download Fillable PDF Templateroller

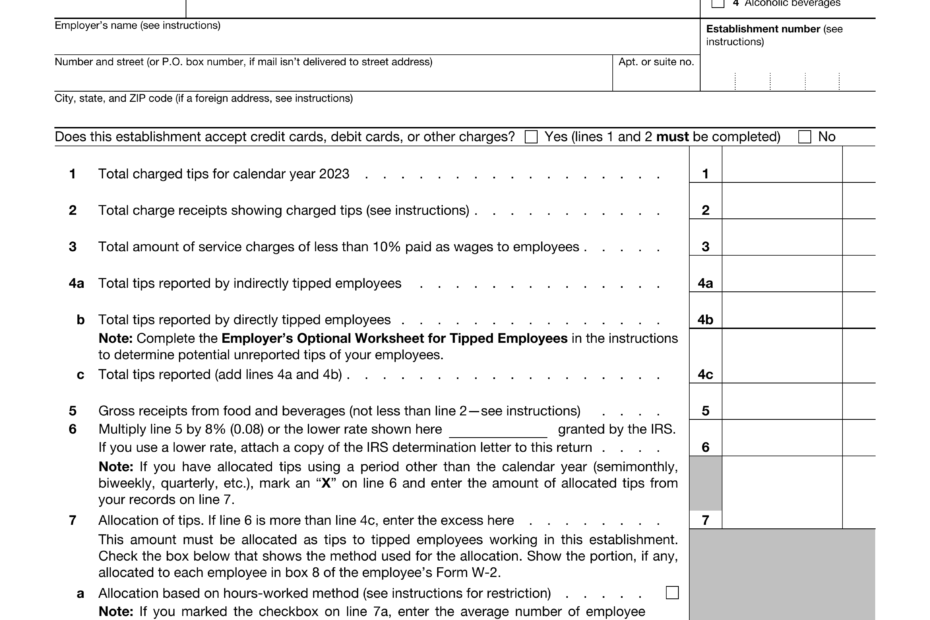

It is important to note that Form 8379 must be filed with the couple’s tax return. The form can be downloaded and printed directly from the IRS website, making it convenient for couples to access and fill out. The form includes sections for both spouses to provide their information and indicate how they want the refund to be allocated.

Once the form is completed, it should be attached to the couple’s tax return and filed with the IRS. It is recommended to file the form as soon as possible to ensure that the innocent spouse’s portion of the refund is protected. The IRS will then review the form and allocate the refund accordingly.

By using IRS Form 8379, innocent spouses can protect their share of the tax refund and avoid having it taken to pay off their partner’s debts. This form provides a fair solution for couples facing financial challenges and allows both spouses to receive their rightful portion of the refund.

In conclusion, IRS Form 8379 is a valuable tool for married couples who want to protect their tax refund from being used to pay off past-due debts. By filing this form, innocent spouses can ensure that they receive their fair share of the refund. It is important for couples to be aware of this form and to take advantage of it when needed.