IRS Form 8300 is a document that businesses and individuals use to report cash payments over $10,000 received in a trade or business. This form is crucial for complying with the IRS regulations and preventing money laundering activities.

By filing Form 8300, businesses help the government track large cash transactions and ensure that taxes are properly reported. It also serves as a deterrent to individuals who may attempt to evade taxes by making large cash payments.

Save and Print Irs Form 8300 Printable

Form 8300 2024 2025 Complete Edit And Download PDF Guru

Form 8300 2024 2025 Complete Edit And Download PDF Guru

What is IRS Form 8300?

IRS Form 8300 requires businesses to report any cash payments received over $10,000 in a single transaction or in multiple related transactions within a 12-month period. The form must be filed within 15 days of receiving the cash payment.

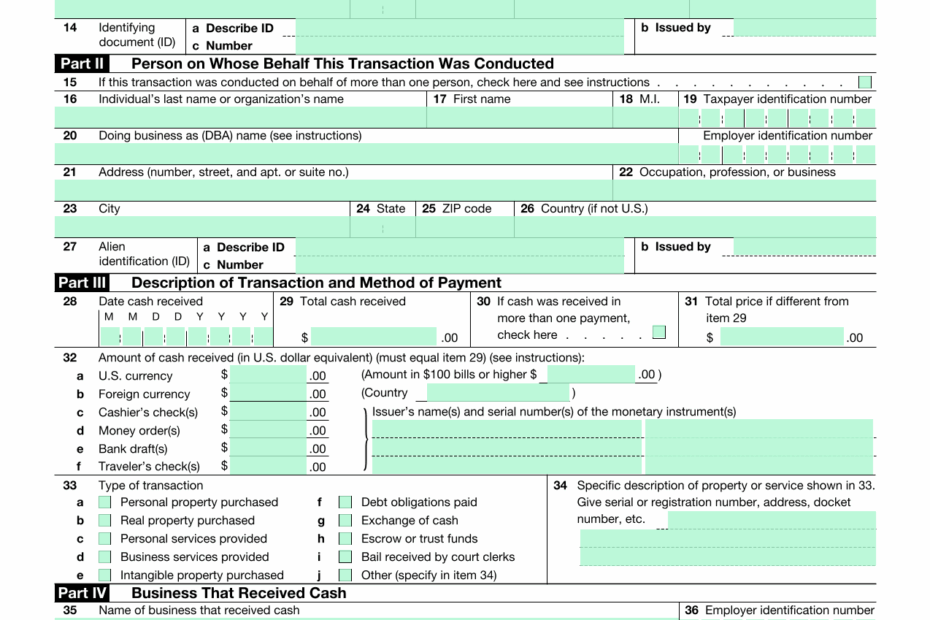

Businesses must provide detailed information about the transaction, including the name and address of the payer, the amount of cash received, the date of the transaction, and the nature of the transaction. Failure to file Form 8300 can result in penalties and fines imposed by the IRS.

Form 8300 is available for download on the IRS website in a printable format. Businesses can easily access the form, fill it out, and submit it to the IRS to comply with the reporting requirements. It is essential for businesses to keep accurate records of cash transactions and file Form 8300 when necessary to avoid penalties.

In conclusion, IRS Form 8300 is a vital tool for businesses to report large cash transactions and comply with IRS regulations. By completing and filing this form, businesses contribute to the fight against money laundering and tax evasion. It is important for businesses to understand the reporting requirements and file Form 8300 in a timely manner to avoid penalties and ensure compliance with the law.