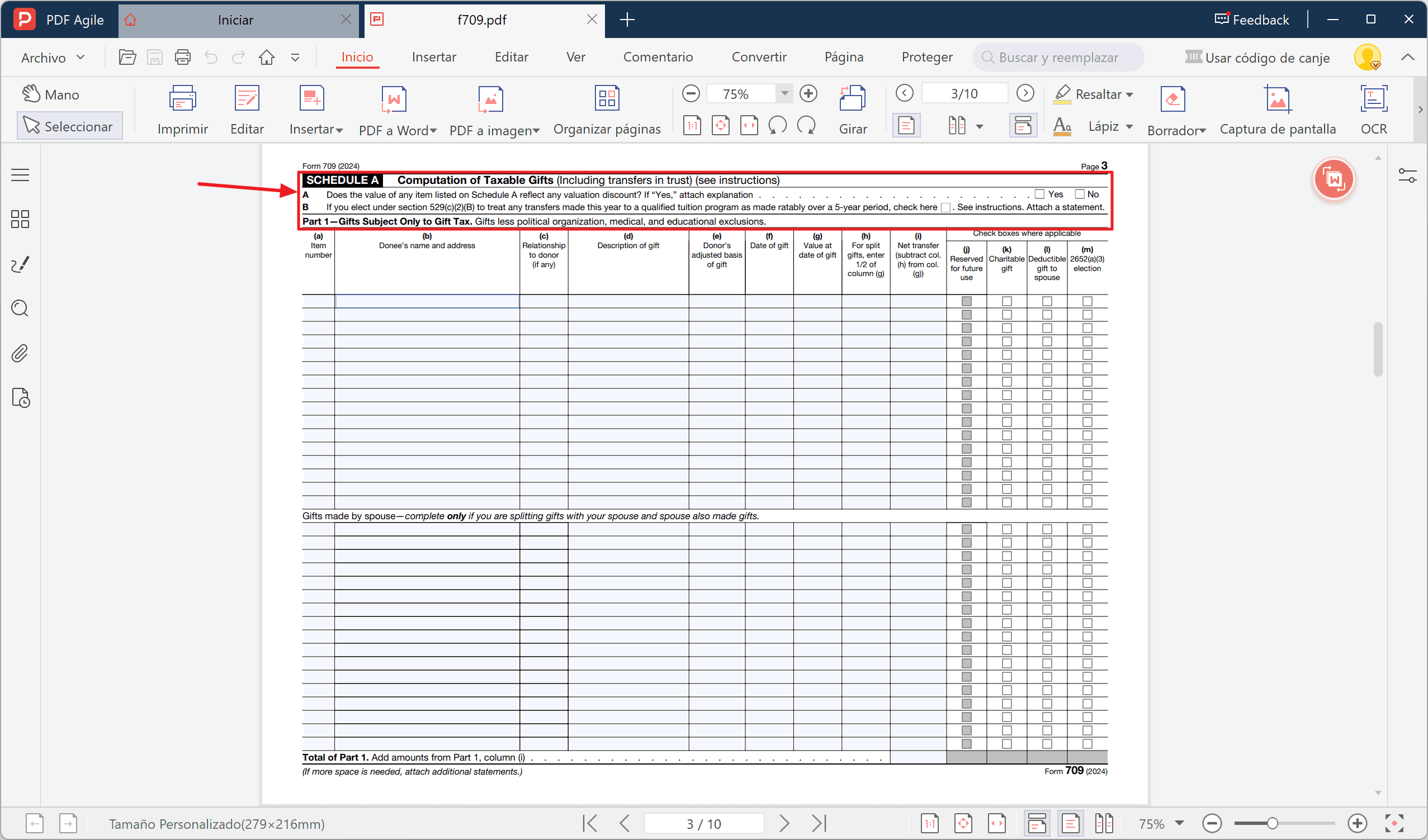

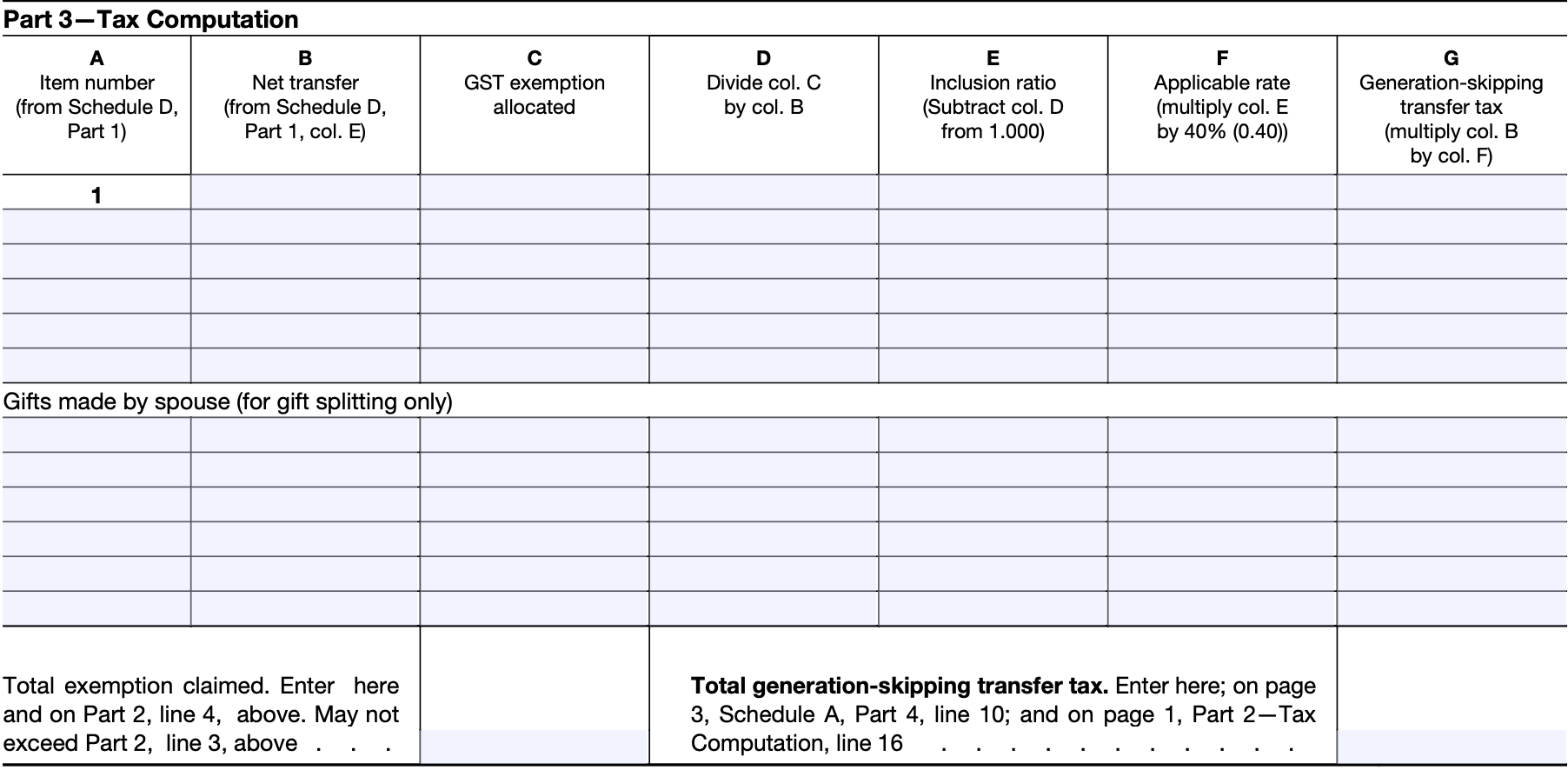

IRS Form 709 is used to report gifts given during the tax year that exceed the annual exclusion amount. For 2025, the annual exclusion amount is $16,000 per recipient. This form is necessary for individuals who have given gifts totaling more than this amount to any one person.

It’s important to note that the donor, not the recipient, is responsible for filing Form 709. This form helps the IRS keep track of gifts that may be subject to gift tax, which is separate from income tax.

Irs Form 709 For 2025 Printable

Irs Form 709 For 2025 Printable

Easily Download and Print Irs Form 709 For 2025 Printable

How To Fill Out Form 709 Nasdaq

How To Fill Out Form 709 Nasdaq

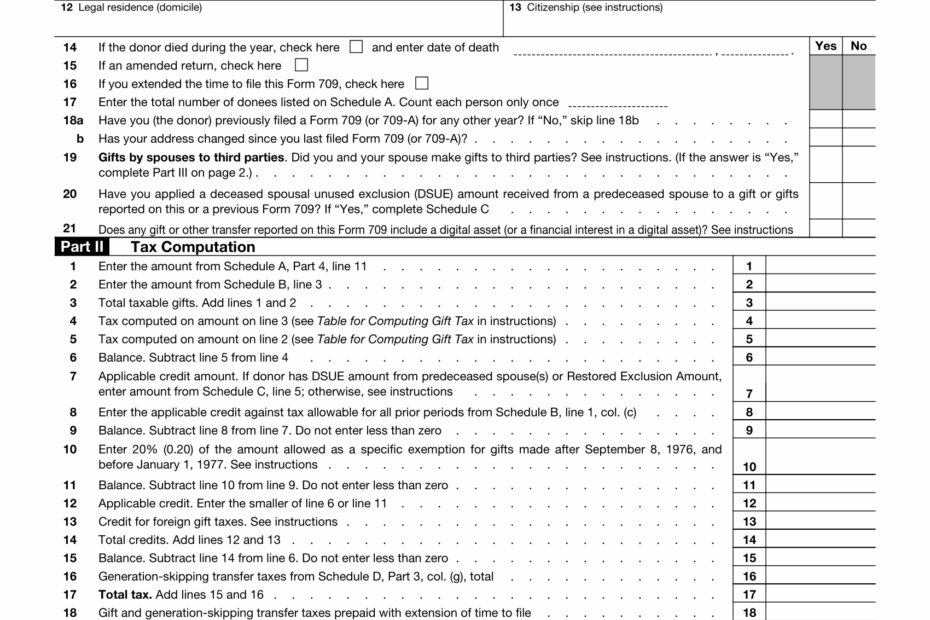

Filing Requirements

When filing Form 709 for gifts given in 2025, the deadline is April 15th of the following year. However, if the donor is granted a filing extension for their income tax return, the deadline for Form 709 is automatically extended as well.

Individuals can gift up to $16,000 per recipient per year without having to report it on Form 709. However, any gifts exceeding this amount must be reported, even if they are not subject to gift tax. This form helps the IRS keep track of lifetime gifts that may eventually be subject to estate tax.

Form 709 requires donors to provide detailed information about each gift, including the recipient’s name, relationship to the donor, the fair market value of the gift, and any deductions claimed. Donors must also include a list of all gifts given during the tax year, as well as any previous gifts made that may impact the current year’s tax liability.

Failure to file Form 709 when required can result in penalties and interest charges. It’s important for individuals who have made gifts exceeding the annual exclusion amount to consult with a tax professional to ensure compliance with IRS regulations.

In conclusion, Form 709 is an essential tool for donors to report gifts given during the tax year that exceed the annual exclusion amount. By understanding the filing requirements and providing accurate information, individuals can avoid potential penalties and ensure compliance with IRS regulations.