IRS Form 7004 is a form used by businesses to request an automatic extension of time to file certain business income tax, information, and other returns. This form allows businesses to extend their filing deadline, giving them more time to gather necessary documentation and ensure accurate reporting of their financial information.

It is important for businesses to file IRS Form 7004 if they are unable to meet the original deadline for filing their tax returns. Failure to file on time can result in penalties and interest charges, so it is crucial to request an extension if needed.

Easily Download and Print Irs Form 7004 Printable

Free 7004 Form Generator Fillable 7004 By Jotform

Free 7004 Form Generator Fillable 7004 By Jotform

Irs Form 7004 Printable

IRS Form 7004 can be easily found online in a printable format. By accessing the form online, businesses can quickly fill it out, print it, and submit it to the IRS. This convenient option saves time and ensures that businesses meet the deadline for requesting an extension.

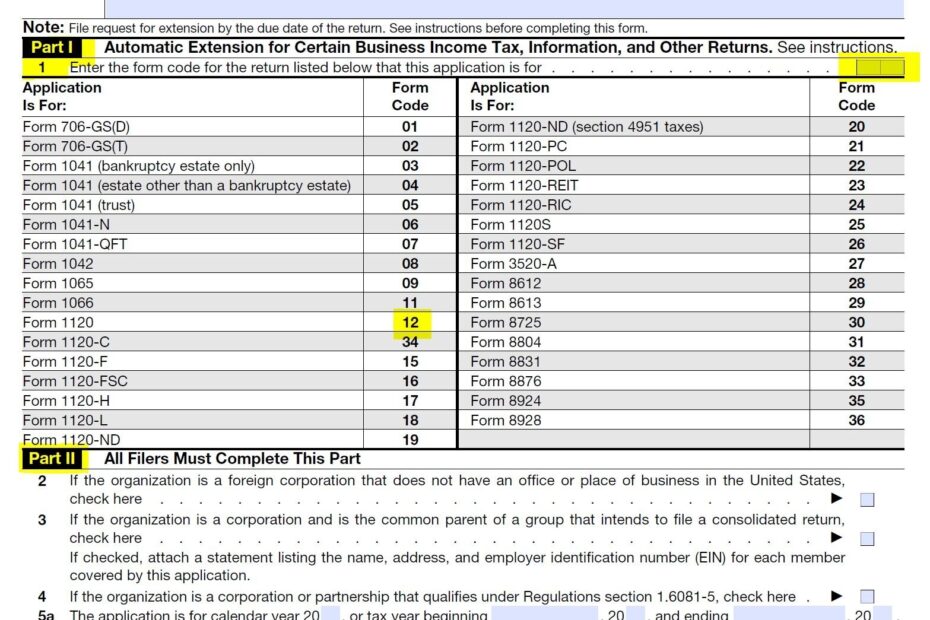

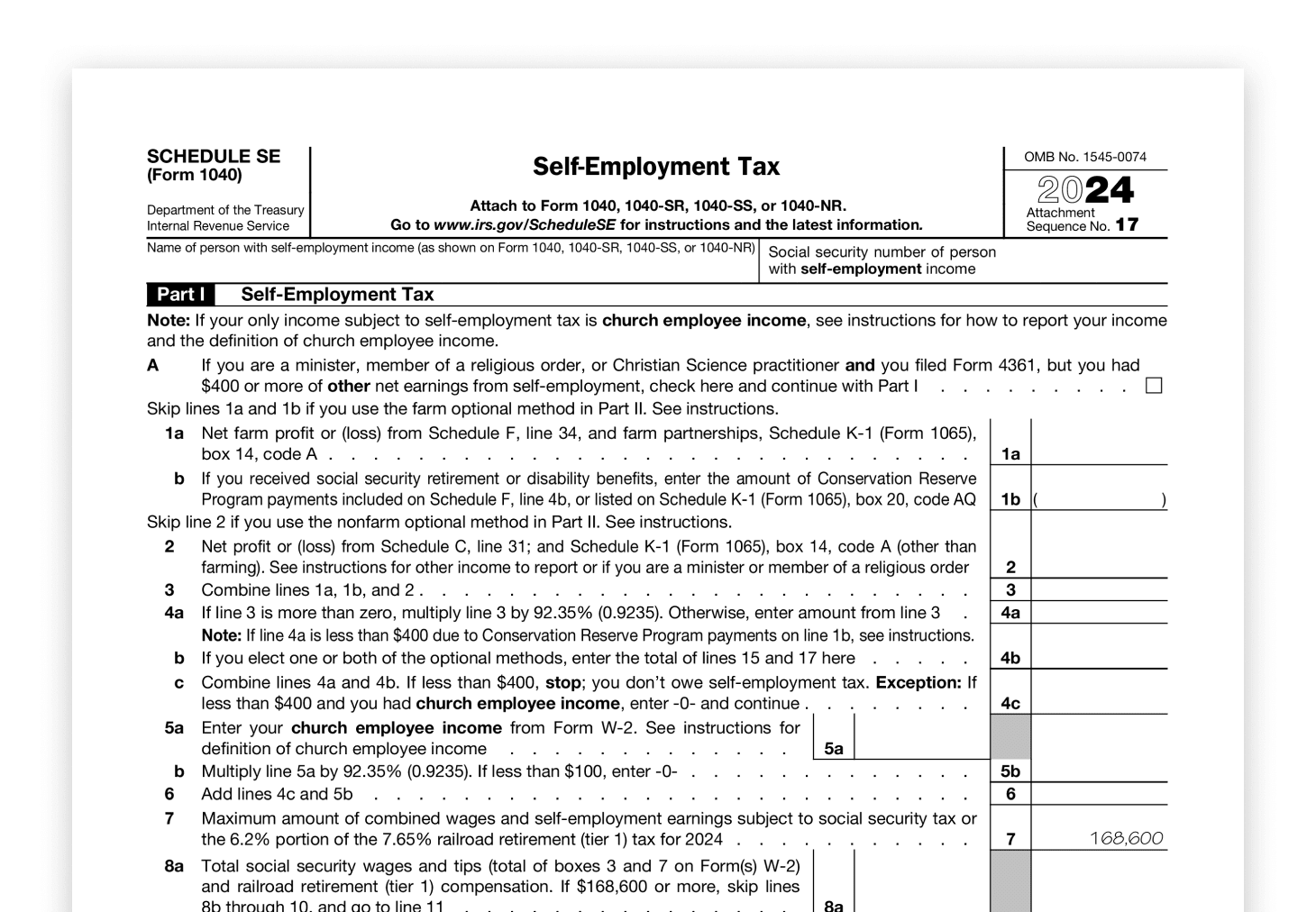

When completing IRS Form 7004, businesses will need to provide basic information such as their name, address, and tax identification number. They will also need to indicate the type of return they are filing for and the reason for requesting an extension. Once the form is filled out, it can be mailed to the IRS along with any required payment.

It is important for businesses to carefully review IRS Form 7004 and follow the instructions provided to ensure that the extension request is processed correctly. Filing for an extension can give businesses peace of mind and help them avoid costly penalties for late filing.

In conclusion, IRS Form 7004 Printable is a valuable tool for businesses seeking an extension of time to file their tax returns. By utilizing this form and submitting it to the IRS on time, businesses can avoid penalties and ensure that their financial information is reported accurately. It is important for businesses to familiarize themselves with the form and follow the instructions provided to successfully request an extension.