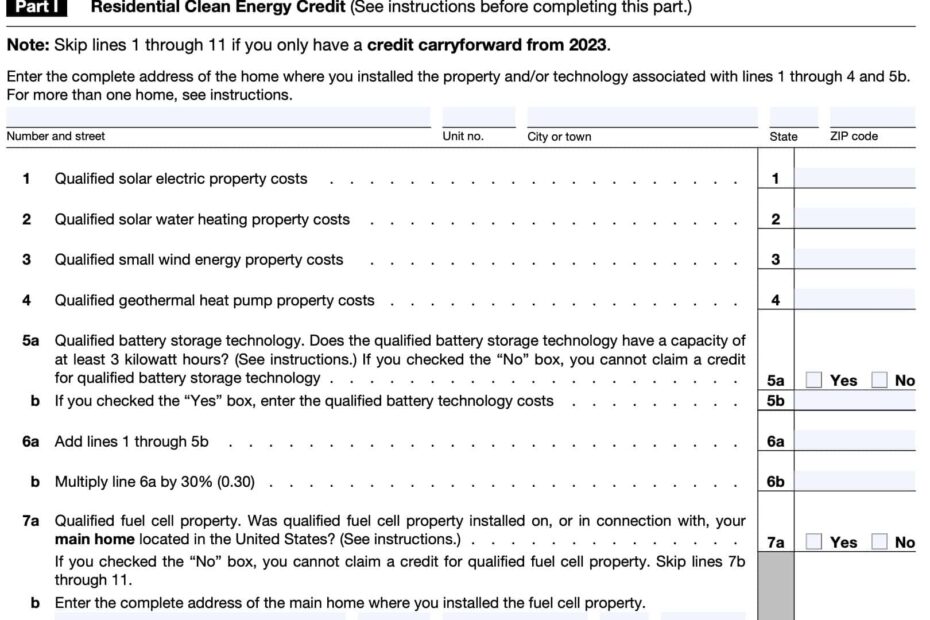

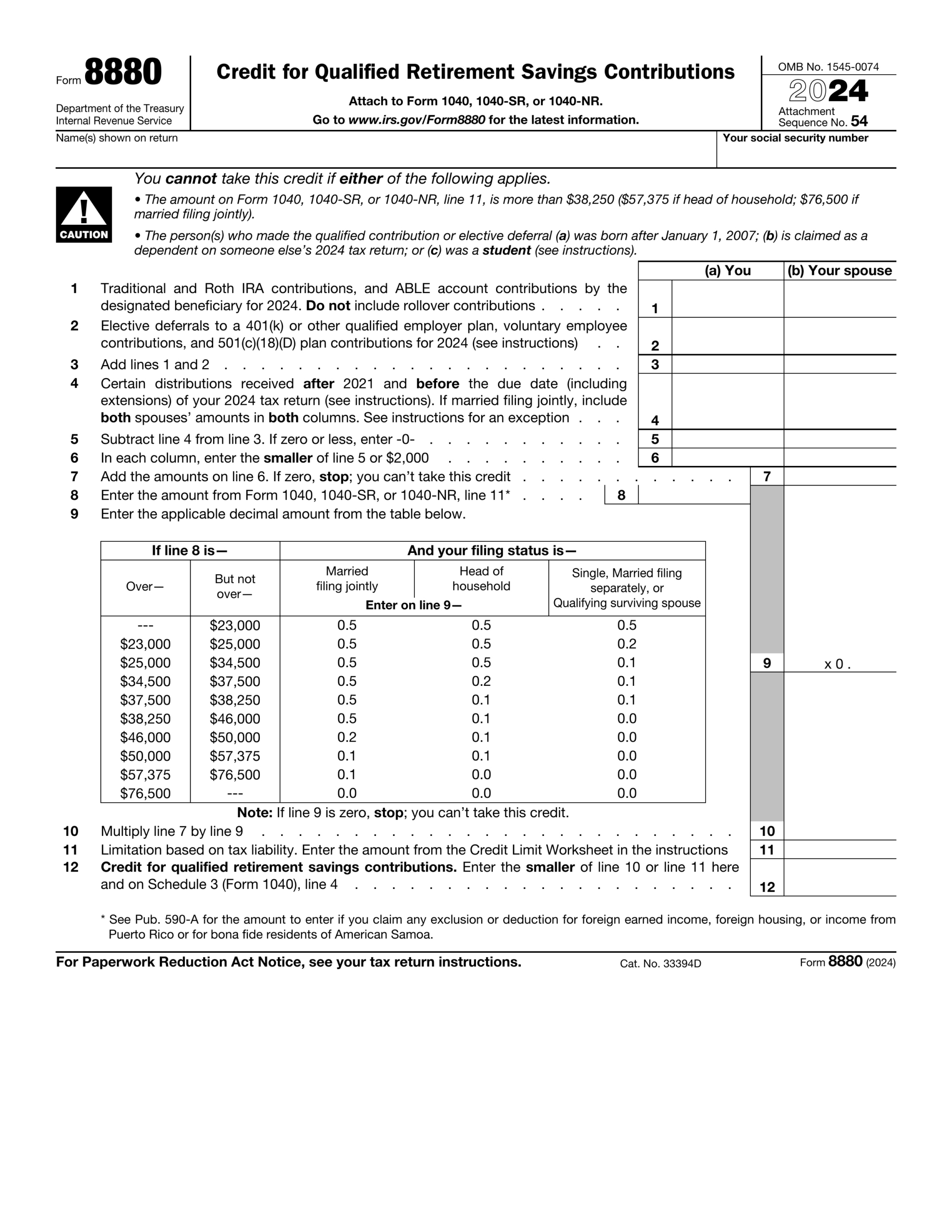

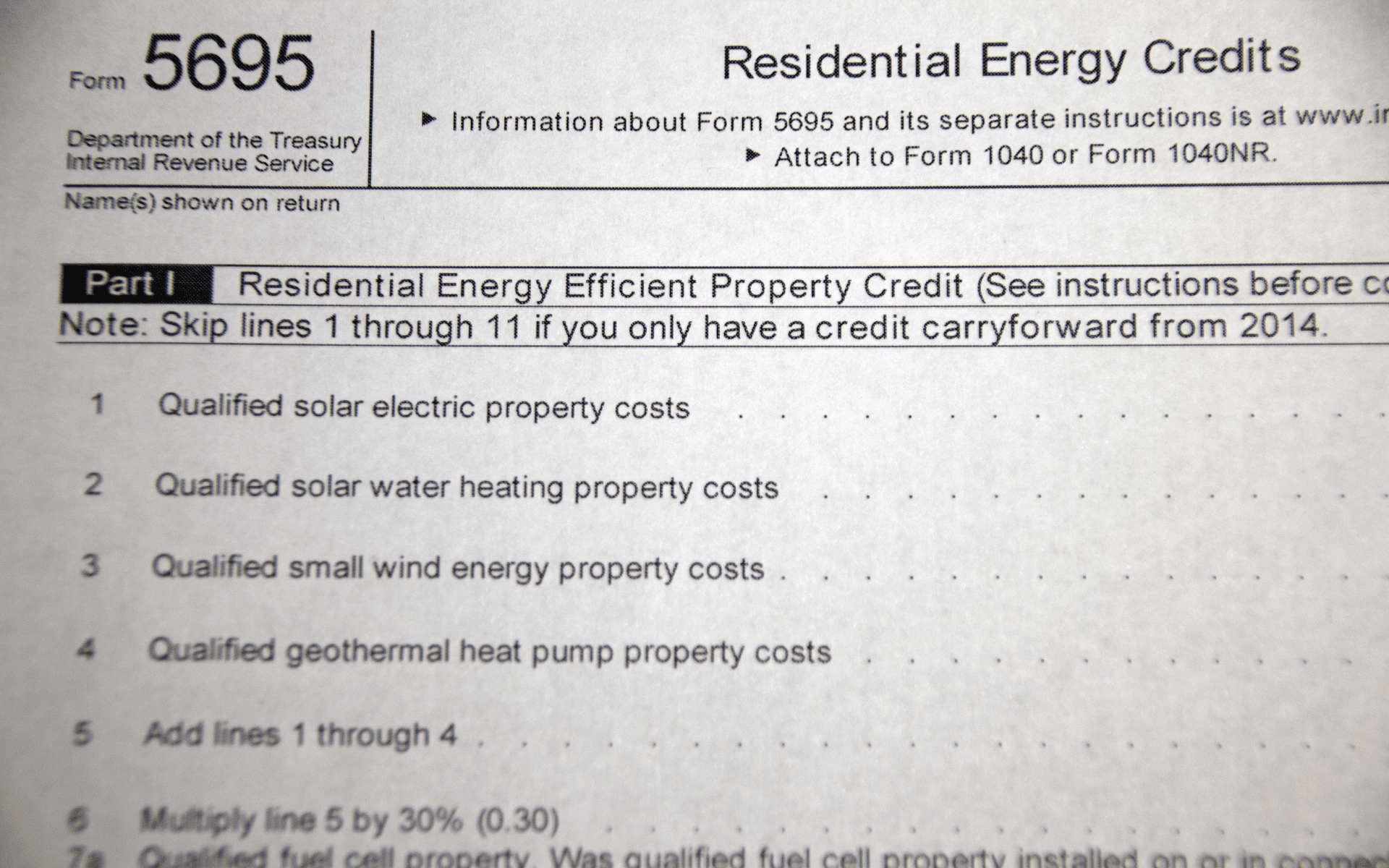

IRS Form 5695 is used to claim residential energy credits for qualified energy efficiency improvements to your home. These credits can help you save money on your taxes while also reducing your energy consumption. It is important to follow the instructions carefully to ensure that you are eligible for these credits and that you are claiming them correctly.

For the year 2025, the IRS has updated the instructions for Form 5695 to reflect any changes in tax laws or credits. It is important to review these instructions carefully before filling out the form to ensure that you are claiming the correct amount and that you have all the necessary documentation to support your claim.

Irs Form 5695 Instructions 2025 Printable

Irs Form 5695 Instructions 2025 Printable

Quickly Access and Print Irs Form 5695 Instructions 2025 Printable

How To Draft Form 5695 Best Guide With Free Template

How To Draft Form 5695 Best Guide With Free Template

IRS Form 5695 Instructions 2025 Printable

When completing Form 5695, you will need to provide information about the energy-efficient improvements you have made to your home, such as installing solar panels or energy-efficient windows. You will also need to calculate the amount of your credit based on the cost of these improvements and any other eligible expenses.

It is important to note that there are limits to the amount of credit you can claim for certain improvements, so be sure to review the instructions carefully to ensure that you are not exceeding these limits. Additionally, you will need to keep records of your expenses and receipts in case the IRS requests documentation to support your claim.

Once you have completed Form 5695, you can submit it along with your tax return to claim the energy credits. Be sure to double-check your calculations and review the instructions one last time before submitting your forms to ensure that everything is accurate and complete.

In conclusion, IRS Form 5695 can help you save money on your taxes while also promoting energy efficiency in your home. By following the instructions carefully and providing accurate information, you can ensure that you are claiming the credits you are eligible for and that you are complying with IRS regulations. Be sure to review the instructions for the year 2025 to stay up to date on any changes and to ensure that you are claiming the correct amount.